CATEGORY

Fuel Oil

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for Global Fuel Oil Market

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Fuel Oil.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoFuel Oil Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoFuel Oil Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Fuel Oil category is 8.10%

Payment Terms

(in days)

The industry average payment terms in Fuel Oil category for the current quarter is 46.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

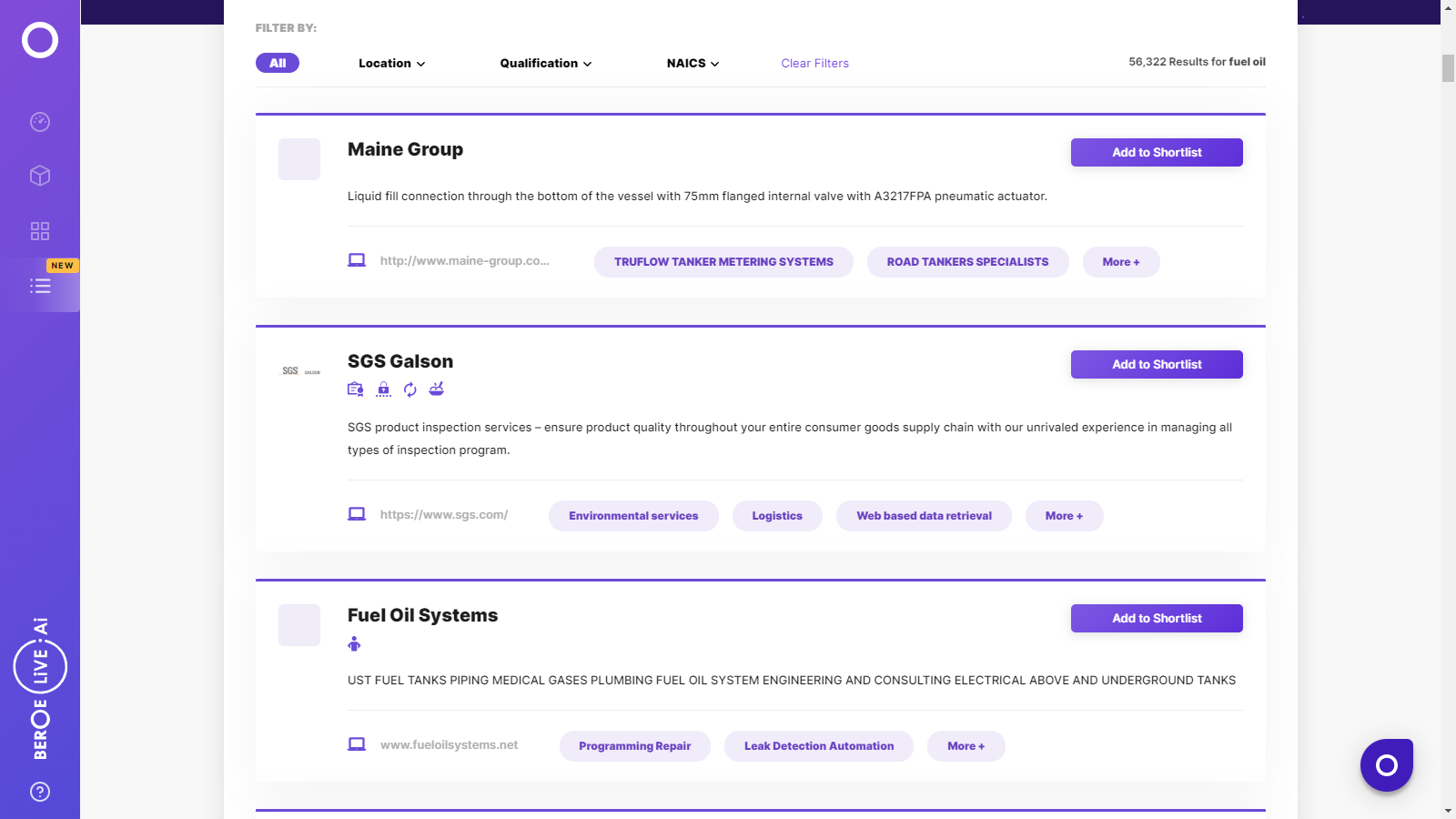

Fuel Oil Suppliers

Find the right-fit fuel oil supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Fuel Oil market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoFuel Oil market frequently asked questions

By 2020, it is expected that the fuel oil market will decline at a CAGR of 4.08 percent. According to the oil market data, new policies and regulations have emerged owing to the health and environmental concerns caused by the high sulfur content of residual fuel oil. This has resulted in significantly low expectations for the future of residual fuel use at the global level.

Looking at the oil market trends and forecasts, the market share of the petrochemicals sector is likely to increase from the current 13 percent to 15 percent by 2040.

The fuel oil global market is dominated by top global service providers like BP, Shell, ExxonMobil, Rosneft and Total.

The IMO regulations will encourage consumers to switch from fuel oil to diesel. With the reduction in the use of residual fuel for power generation and space heating, the global demand for fuel oil will also subside. According to the global oil demand forecast, the shift from fuel oil-based heating in ships by 2020 will result in an excess of heavy fuel oil, which will be available at a hefty discount.

While the demand for fuel oil is expected to decrease, Saudi Arabia has been among the few countries that have increased their fuel oil intake realizing that it is uneconomical to use their own crude oil for power. The global standards for oil use and stringent environmental policies are resulting in significant supply and demand risks in the global market. Despite the lower demands of fuel oil globally, new refining capacity is concentrated in locations in APAC where demand seems to be growing.

Fuel Oil market report transcript

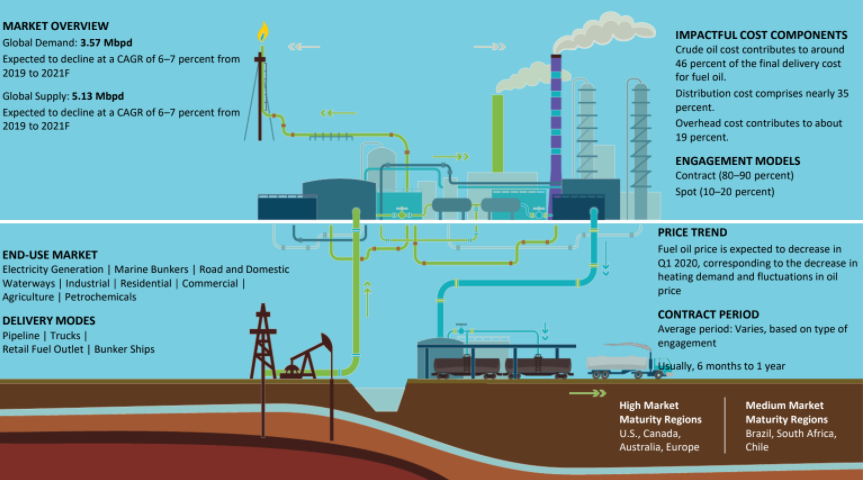

Fuel Oil Global Market Outlook

-

The global demand for liquid fuel (oil) in 2022 was at 99.6 Mbpd, about 2.7 percent higher than in 2021. It is expected to grow by 2-3 percent in 2022 and reach 101.9 Mbpd. The rise of 2.5 million barrels per day (mb/d) in 2022 is supported by strong economic growth in both OECD and non-OECD countries, except for China, which has seen its annual oil requirements fall. The end of China's zero-COVID-19 policy in December 2022, on the other hand, is anticipated to increase the country's oil demand. 2023. Meanwhile, the OECD predicts slightly slower growth in oil demand leading to a 2.3 mb/d increase in global oil demand in 2023.

Fuel Oil Demand Market Outlook

-

2022 is expected to witness increased fuel oil demand with rapid growth in industrial activities. However, the current Russia–Ukraine tension will have an impact for short period.

Global Market Size - Fuel Oil

-

The market size is expected to decline at a CAGR of -7.15 percent from 2020 to 2023F

-

Fuel oil is the only petroleum product, whose demand is expected to fall in the long term

-

Health and environmental concerns related to the high sulfur content of residual fuel oil have led to new policies and regulations that have significantly lowered expectations for future residual fuel oil use globally

Fuel Oil Global Demand by Application

-

Demand for light products and middle distillate is expected to grow, but residual fuel is set to decline

-

Bunker gasoil and low Sulfur fuel oil to replace high Sulfur fuel oil, due to IMO specifications for Sulfur content

-

IMO regulations call for global standards for Sulfur content in marine fuel to be tightened to 0.5 percent from 3.5 percent

Downstream Demand Outlook

-

Share of the petrochemicals sector is forecast to increase by 26 percent from 2020 to 2040

-

Residual fuel, as an energy source, is expected to lose weight, as it is expected to be replaced by natural gas as an alternative source of energy

-

Continued switching away from fuel oil in the electricity sector is expected to add downward pressure on the use of fuel oil

-

Transportation sector plays a major role in demand for oil, which shares almost 54 percent of the entire demand share

-

IMO regulations, usage of electric and natural gas-powered vehicles, coupled with usage of cleaner fuel for heating purpose, are expected to reduce the demand for fuel oil moving forward

-

The shift from fuel oil-based heating in ships by 2020 is estimated to leave a vast amount of excess heavy fuel oil, which will be available, most likely at a hefty discount

-

The recent outbreak of COVID-19 and slowing global economy are expected to bring oil demand further down in 2020

Supply Trends and Insights : Fuel Oil

Oil Demand Outlook

-

Oil Demand: The prediction for the increase in global oil consumption in 2022 has been reduced by 0.1 mb/d, and it now stands at 2.5 mb/d. The OECD is expected to have an increase in oil demand of around 1.3 mb/d, while the non-OECD is expected to see an increase of about 1.3 mb/d. The second quarter of this year was slightly revised upward, due to higher-than-expected oil demand in the major OECD oil-consuming nations. However, due to China's zero-COVID-19 policy, continuous geopolitical unrest, and decreased economic activity, oil demand in Q3 2022 and Q4 2022 is revised lower

-

Outlook: The growth is largely constrained, considering ongoing geopolitical changes in Eastern Europe, as well as COVID-19 pandemic restrictions, are projected to have an impact on demand

Trends

-

Capacity Drops and Closures: The refinery sector is likely to witness a significant impact, in terms of capacity closures and idling. About 2.5 mbpd of capacity is expected to go offline by 2025, and by 2045, an additional 6 mbpd would go offline. This trend is expected to bring out a balance between demand and supply, and to bring back a healthy utilization rate, which is about 80 percent from the current 73 percent

-

Capacity Additions: The capacity additions in the coming 1–4 years are about 2 mbpd, although some delay could be expected from the COVID impact. However, considering the growth of alternate fuels, capacity addition may be impacted

Engagement Trends

-

Most Adopted Model Globally: Engage with OMC or dealer

-

Why: Engaging with OMC directly would help in avoiding additional dealer costs and more likely help in stabilizing the prices, as OMCs are usually backward integrated up to refining or even exploration stages

-

Contract Length: 1 year

Fuel Oil Cost Structure Analysis

Chances of new suppliers coming up are less because of a consolidated supplier market, increased investment level and the presence of state level players.

-

Product costs include raw material cost (crude oil)

-

The product costs also include refining costs that can be broken into equipment, maintenance, labor cost, etc.

-

Overhead costs include marketing cost, utility cost, employee cost, and profit margin

-

Other costs are taxes and regulatory compliance costs

-

Distribution costs include transportation and inventory carrying costs

-

Transportation costs are subject to increase with an increase in distance

-

Inventory costs keep increasing until the goods are sold

Why You Should Buy This Report

The report on the fuel oil market provides an extensive analysis of the key price drivers, supply-demand trends and trade dynamics of global manufacturers in North America, Europe, APAC, LATAM, Africa and the Middle East. It further discusses Porter's Five Forces Analysis and presents a fuel oil price forecast trends analysis in the pre-set regions. The report includes an in-depth study of the fuel oil companies such as ExxonMobil, Royal Dutch Shell, and British Petroleum along with their SWOT analysis.

Beroe gathers intelligence through primary sources that include industry experts, researchers, and consultants, as well as current suppliers, producers and distributors. Secondary sources include business journals, newsletters, magazines, market research data, company sources, and industry associations. Following data collation, analysis, and strategic review, the Final Research Report is published on Beroe LiVE.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now