CATEGORY

Wireline Services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Wireline Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Halliburton introduces HalVue? service for real-time wireline data visualisation

October 18, 2022Schlumberger launches Digital Platform Partner Program

September 21, 2022Oilfield jobs approaches near to pre-pandemic levels

September 06, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Wireline Services

Schedule a DemoWireline Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoWireline Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Wireline Services category is 16.40%

Payment Terms

(in days)

The industry average payment terms in Wireline Services category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Wireline Services Suppliers

Find the right-fit wireline services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Wireline Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoWireline Services market report transcript

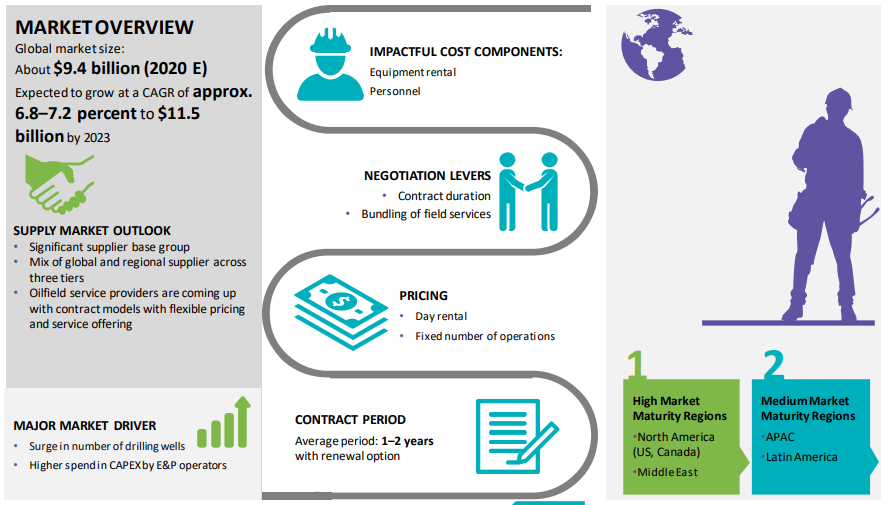

Global Market Overview for Wireline Services

-

Wireline services contribute to around 4–5 percent of the overall global oilfield market. The wireline services market is estimated to be $12.3 billion in 2023 and is expected to reach $15.1 billion by the end of 2026, with a CAGR of 7–8 percent

-

The wireline services market in the North America region is highly matured and LATAM is the fastest growing region. The Latin America region is expected to be the fastest growing region, due to the surge in oil & gas activities

-

In terms of value, the global wireline services market stood is estimated to be $12.3 billion in 2023. The market is forecasted to reach $15.1 billion by the end of 2026, with a CAGR of 7-8 percent

-

Segment wise, cased hole wireline services is expected to account for around 59.4 percent of the overall wireline services market in 2023

-

Open hole wireline services are majorly applicable for new wells, which constituted to around $4.99 billion in 2023. The open hole wireline services market is expected to increase its market share by the end of 2024, due to upcoming surge in wells

Global Wireline Services- Market Drivers and Constraints

Drivers

-

The total rig count in March 2023 is around ~1,879, which is ~13.1 percent increase from the total rig count in March 2022 (~1,661), signifying the surge in upstream E&P activities, consequently driving the market for wireline services

-

Completion and drilling activities are expected to further improve in 2023, amid higher oil prices and increasing demand

-

CAPEX spend by key market layers witnessed a growth from around $321 billion in 2021 to nearly $385 billion in 2022, and the trend is expected to prevail in 2023. This development is expected to drive the wireline services market

-

Wireline services are required during well construction, completion and production. Increasing in number of drilling wells globally is increasing demand for wireline services

Constraints

-

Barriers to entry, geopolitical tensions, fluctuation in steel prices, impact on the environment, global oil and natural gas market instability, increased cost of production, due to devaluation of currency in some regions, regulatory issues, etc., are the key challenges faced by the wireline services industry

-

Major oil & gas assets in Australian Offshore, Gulf of Mexico, Canada are located in environmentally sensitive areas require state-of-art technology, which comes with higher cost

-

Geopolitical tension in Europe is expected to impact negatively wireline services market in Europe

-

Russian invasion of Ukraine has led to a decrease in the production activities in the region

-

Labor shortage in the oil industry is stinging the industry with high costs

Wireline Services: US Market Outlook

-

The US, the largest market for oil & gas wireline services, contributed to about 38 percent of the global wireline services demand. With an urge to increase production, the demand for oil & gas wireline services witnessed a significant increase in Q4 2022. The market is highly matured in the region

-

Open holed wireline services held a share of 26 percent, whereas cased hole wireline services held 74 percent of the overall US market

-

In December 2022, 4,577 DUCs have been recorded as the E&P companies are utilizing current well inventories and are focusing on well completions as compared to new drilled wells in second half of 2022, resulting in the decline in drilled but uncompleted wells (DUCs) in the US

-

Oil production is expected to increase in March 2023 and the trend is expected to continue through 2023, amid growing demand and higher oil prices. Moreover, increasing investments in offshore oil production is also expected to drive the market in near future

Cost Structure of Wireline Services

The indicative cost structure of wireline services includes monthly rentals for equipment and personnel to perform the operation and mobilization/demobilization charges to setup the operation location. Operations/standby charges, which include equipment operation, account for the majority of cost for wireline services

Mobilization/Demobilization

-

Mobilization/demobilization cost includes all activities related to costs for transportation of personnel, equipment, and supplies. It also include disassembly, removal, and site cleanup as well.

Operating/Standby charges

-

Operations/standby charges, which include equipment operation, equipment rentals, etc. Operations accounts for majority of the cost in wireline services.

Personnel

-

Typical wireline service crew consists of one wireline specialist, two wireline assistants, two data acquisition technicians, and a truck operator.

-

Crew works on a 28/28 rotation and are charged on day rate basis.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now