CATEGORY

Offshore Labor

Labor is a worker/ tradesperson employed in the physical construction of the built environment and its infrastructure. Based on the location they work, labor could be named as Onsite and Offshore Labor

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Offshore Labor.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Around1400 offshore employees are demanding a better deal on employment, wages, and conditions

March 20, 2023UK offshore workers are planning to go on a strike due to pay disputes

March 14, 2023There is a vote on strike action for about 70 of TotalEnergies SE's oil and gas employees in the North Sea have voted on strike action

April 17, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Offshore Labor

Schedule a DemoOffshore Labor Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoOffshore Labor Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Offshore Labor category is 16.40%

Payment Terms

(in days)

The industry average payment terms in Offshore Labor category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Offshore Labor Suppliers

Find the right-fit offshore labor supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Offshore Labor market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOffshore Labor market report transcript

Global Market Outlook on Offshore Labor Market

-

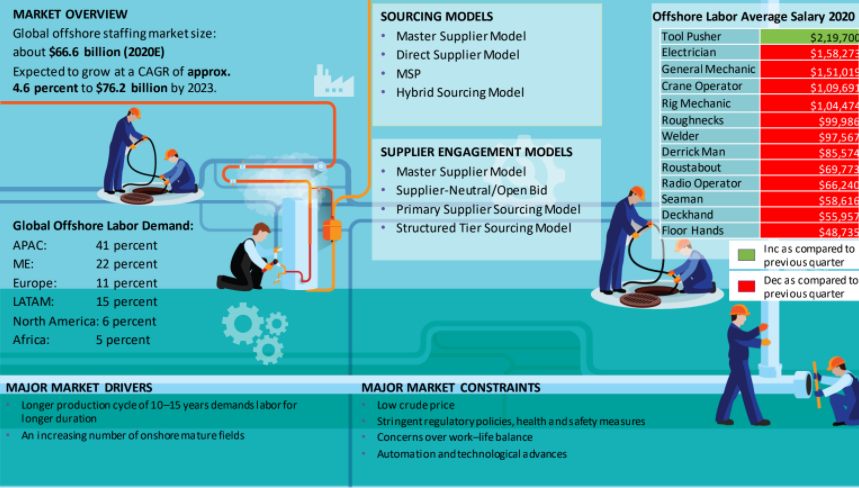

The global offshore labor market is valued at $77.5 billion in 2023. It is expected to grow at a CAGR of 4.5 percent to reach $92.4 billion by the end of 2027. In 2022, the offshore oil and gas market across all the regions improved on yearly basis

-

The demand for offshore labor is driven primarily by E&P activities, majorly in APAC, followed by ME and Europe

-

Discovery of deep-water assets and offshore wind projects are expected to drive the demand in offshore labor job roles

Global Market Overview for Offshore Labor

-

The global oil and gas offshore labor market for 2023 is estimated to be $77.5 billion

-

By 2027, it is expected to reach a market value of $92.4 billion, with a CAGR of 4.51 percent

-

The offshore wind installation is expected to double over the next four years, reaching 1,300 newly commissioned turbines in 2026. The demand is coming from the Northwest Europe market as well as APAC and US regions, which, in turn, triggers the labor demand

-

The recruiters are among the most sought-after professionals right now, which reflects increasing recruitment volume in a context of low candidate availability. When it comes to engineers, overall hiring in the industry has been tempered in recent months. The top required positions are Mechanical Engineers, Design Engineers, Petroleum Engineers, Electrical Engineers, Reservoir Engineers, Pipeline Engineers

-

The primary growth factor behind the steady job gains is the oil price rebound, which is expected to motivate US operators to ramp up investments to more than $90 Billion annually by 2027

-

According to the Global Wind Energy Council, by 2023, almost one-third of the world’s energy requirement would be met through offshore wind generation.

Market Drivers and Constraints : Offshore Labor

The number of offshore labor is directly driven by the demand for offshore E&P activities globally. The E&P activities is set to rise in 2023 due to increase in global upstream spending

Drivers

-

An offshore well continues to produce comparatively same volume of crude for 10–15 years, whereas onshore wells reach approx. 50–60 percent of production in the first year. This would ensure long demand for offshore labor compared to onshore

-

Nearly, 70 percent of the world’s oil & gas production comes from mature fields. This high number of maturing fields would demand production and related activities on offshore, to tap the maximum reserves, in order to meet the increased demand globally

-

New deep-water discoveries are expected to drive the demand for the offshore labor market

-

Offshore developments in wind farms are expected to demand more offshore labor in the near term

Constraints

-

Talent supply in developed economies has been under severe pressure, due to an aging workforce, high youth unemployment, tighter labor markets, an increase in automation, etc.

-

Stringent regulatory policies, health and safety measures to be followed on offshore platform would limit the number of labor on platforms

-

Young graduates are increasingly hesitant to enter the oil and gas industries, preferring to work in renewables instead. According to estimates, the oil and gas sector will require an additional 8,000 petroleum engineers to capitalize on current high oil prices

-

Since labor has to stay in rigs for a longer duration, companies prefer to keep the crew to minimum, in order to bring down the expenses on accommodation, food, etc.

-

Recent developments in drilling, such as increased drilling speed (~100 times), would bring down the drilling time by 50 percent. This would bring down the labor count and requirement

Supply Trends and Insights : Offshore Labor Market

Global/Regional Supplier

-

Geographic Penetration: The top global suppliers operate across the globe

-

Regional Perspective: The market is highly consolidated with few local and regional suppliers.

Engagement Trends

-

Most adopted sourcing models: Hybrid model, master vendor and vendor-neutral MSP

-

Why? The primary reasons for using the regional/local strategy are due to the highly fragmented market, supply variance and the various legal regulations in each country

-

Most adopted pricing model: Percentage of spend and Markup pricing

Supplier Management Trends

-

Organization are engaging with staffing agencies to support employees that were laid-off during the COVID situation.

-

Use of the following supplier management strategies was positively correlated with buyer size: VMS, MSP, programs to encourage the use of diversity/woman/minority staffing suppliers, and trying out new staffing suppliers

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now