CATEGORY

Oil and Gas Surface Rental Equipment

Oil and Gas surface rental equipment offers the offshore and onshore industry with various surface equipment for well test and well clean-up operations. These equipment are usually maintained and prepared by well experienced technicians.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Oil and Gas Surface Rental Equipment.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoOil and Gas Surface Rental Equipment Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoOil and Gas Surface Rental Equipment Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Oil and Gas Surface Rental Equipment category is 16.40%

Payment Terms

(in days)

The industry average payment terms in Oil and Gas Surface Rental Equipment category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Oil and Gas Surface Rental Equipment Suppliers

Find the right-fit oil and gas surface rental equipment supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Oil and Gas Surface Rental Equipment market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOil and Gas Surface Rental Equipment market report transcript

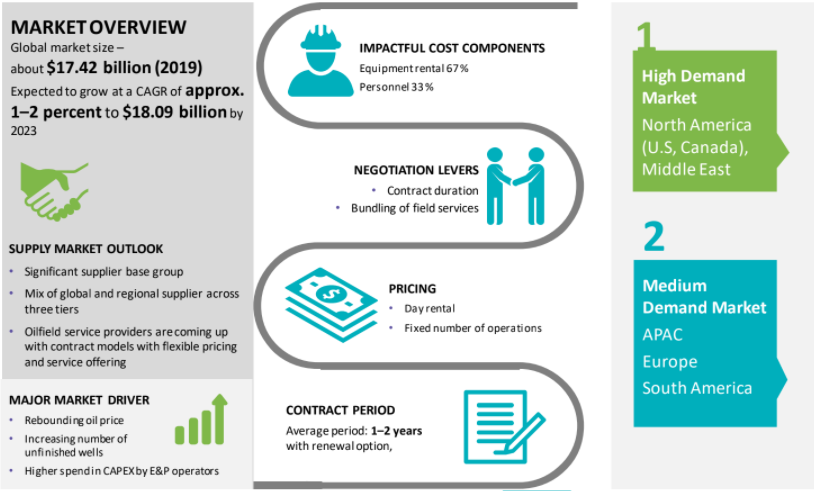

Market Overview for Oil & Gas - Surface Rental Equipment

-

The global market for surface rental equipment is estimated to be $5.34 billion in 2022

-

By 2026, it is expected to reach $7.2 billion, with a CAGR of 10.3 percent from 2023

Global Oil & Gas Rental Equipment - Market Drivers and Constraints

Drivers

-

Advancement in technologies related to surface equipment helps E&P operators optimize operations like well testing, DST, well control, etc.

-

Increase in oil production and increased rig count are driving the surface rental equipment market in 2023

-

Increased upstream investments, owing to high oil price is a driving factor, which induces confidence in the industry and acts as a driver of the surface rental equipment market

Constraints

-

Stringent environment & emission regulations are making the E&P/well completion & intervention activities costlier across several countries

-

Inflation in the North American and European regions is of great concern

-

Global disruption in oil and gas supply due to the Russia-Ukraine war affected not only the prices of these commodities but also every economic activity reliant on hydrocarbons

-

Shortage of skilled labor is an existing constraint in the market

-

Shortage in supply of equipment is another major constraint

Oil & Gas Rental Equipment - Regional Market Outlook - North America

-

The drilling operations are expected to increase over ~15 percent during 2023 in the region

-

US banned all imports of Russian oil and gas and energy, about 8 percent of US oil and the refined product comes from Russia.

-

The US government is tiring to boost domestic oil production owing to its ban on Russian oil, as well as efforts by producers to optimize profits in light of high oil prices

-

In July 2022, the amount of crude stockpiled in the Strategic Petroleum Reserve (SPR) fell to 469.9 million barrels, a 37-year low

-

The US government has decided not to levy anti-dumping tariffs on steel goods

-

Oil and gas activities in the Permian basin region continue to rise and the outputs are expected to hit highs by Q3 2023

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now