CATEGORY

Hydraulic Fracturing Services

Hydraulic fracturing is an unconventional method for the production of natural gas and oil by fracturing the rock formation that stimulate the flow of natural gas or oil, increasing the volumes that can be recovered

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Hydraulic Fracturing Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

New technologies and fracing techniques showcased at SPE Hydraulic Fracturing Technology Conference

February 06, 2023Sunak to restore UK ban on fracking

November 02, 2022UK lifts ban on shale gas fracking

September 15, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Hydraulic Fracturing Services

Schedule a DemoHydraulic Fracturing Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoHydraulic Fracturing Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Hydraulic Fracturing Services category is 16.40%

Payment Terms

(in days)

The industry average payment terms in Hydraulic Fracturing Services category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

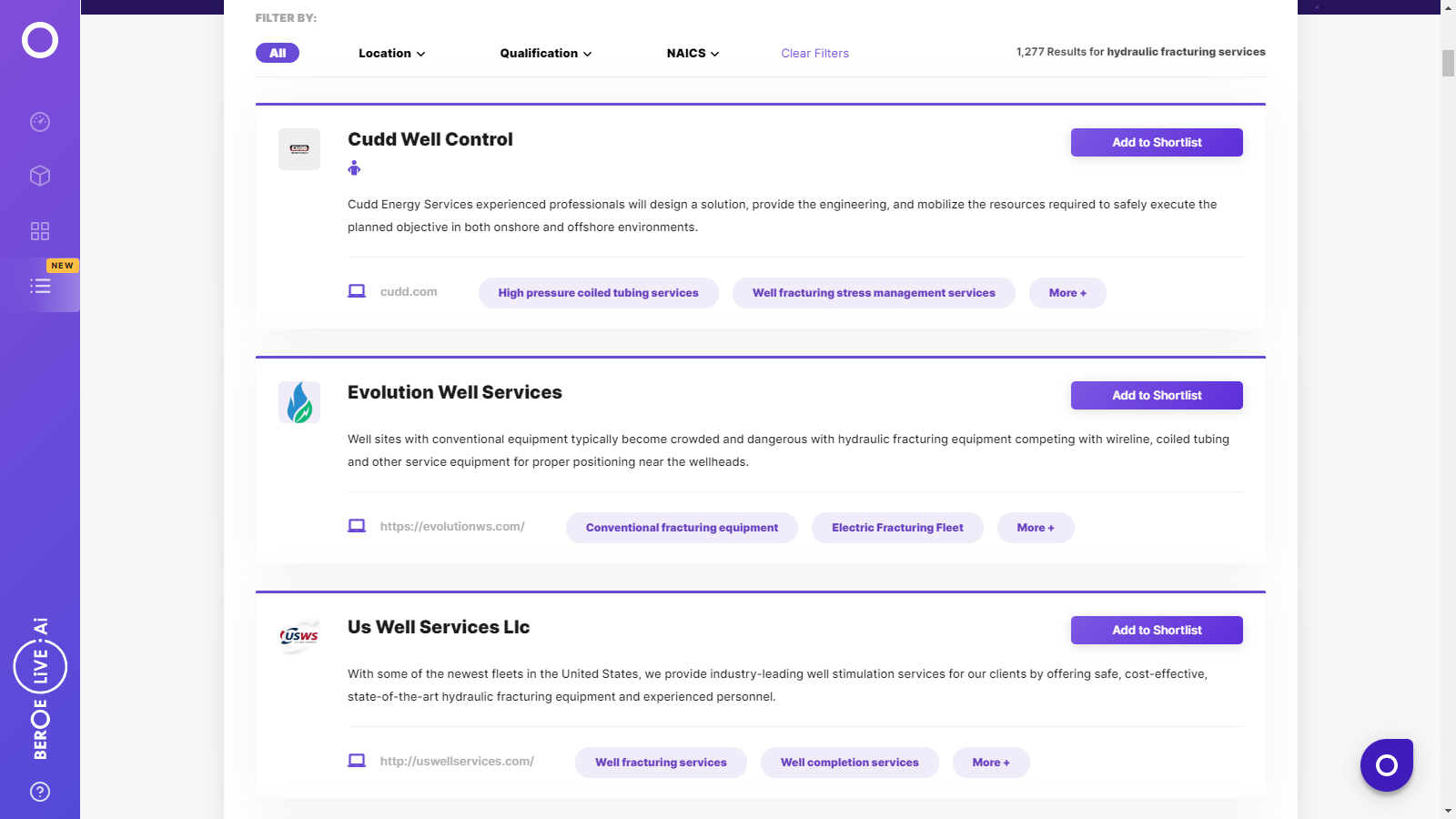

Hydraulic Fracturing Services Suppliers

Find the right-fit hydraulic fracturing services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Hydraulic Fracturing Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoHydraulic Fracturing Services market report transcript

Global Market Outlook on Hydraulic Fracturing Services

-

The global hydraulic fracturing service market is anticipated to be valued at $39.1 billion in 2023, and it is anticipated to reach $44.8 billion by the end of 2026, with a CAGR of 4-6 percent

-

The US is the significant market for hydraulic fracturing services, which accounts for more than 85 percent of the market in North America

Global Hydraulic Fracturing Market Drivers and Constraints

Drivers

-

High crude prices and emerging economies have maintained sustainable, however cautious, CAPEX spend from E&P operators

-

Due to technological optimization in fracturing method, it is more widely adopted in regions like LATAM, Europe and APAC after North America

-

Technical advancements, like slide sleeving, are changing the fracturing method. Many companies are exploring the possibility of using it over the traditional method of plug and perforation

-

The global oil demand for the year and next is forecasted to increase, coupling with ban on Russian output will drive the oil production in the year

-

Resume of oil & gas activities in Libya in are expected to positively impact the fracking market in Africa

-

Colombian court allows allow seven contracts worth $517.4 million to move forward by rejecting a lawsuit to nullify norms regulating commercial exploration and exploitation of non-conventional energy deposits, including fracking

Constraints

-

Stricter policies and environment laws are limiting the scale of fracturing operations in several regions across the globe especially in Europe where France, Germany, Bulgaria, and the Netherlands have banned fracturing activities while United Kingdom's hydraulic fracturing activities have witnessed strong backlash due to environmental impacts of fracturing

-

Governments cite possible contamination to the aquifers a concern in limiting the fracturing activity

-

Water scarcity in parts of the US and China limits the spread of hydraulic fracking

-

According to a study, emissions from the planned US offshore and onshore drilling projects were four times larger than all of the planet-heating gases expelled globally each year, which could tip world to edge of climate disaster

-

Labor shortage in the oil industry is stinging the industry with high costs

Cost Structure of Hydraulic Fracturing Services

-

The cost of consumables, such as fracking proppants, chemical, etc., accounts for the single largest cost component. Hydraulic fracturing companies provide the equipment on rentals with crew or without crew. The crew works on a call-out basis and is charged on day-rate basis. Long-term contracts with an assured number of jobs can provide better cost efficiency to the operator.

Consumables

-

Consumables (frac proppants, chemicals, etc.) account for 45 percent of the total fracturing operation cost.

Equipment Rentals

-

An extensive amount of equipment, such as high-pressure, high-volume fracking pumps; blenders for fracking fluids; and storage tanks for water, sand, chemicals, and wastewater are required.

Labor

-

The typical fracking service crew consists of a frac supervisor, a hydraulic fracture engineer, three senior operators, a well head specialist, a senior lab technician, a data acquisition technician, a senior mechanic, a blender operator and a hydration unit operator. The crew works on a call-out basis and is charged on day-rate basis.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now