CATEGORY

Directional Drilling Services

Directional drilling is a technique of controlling trajectory and deviation of a wellbore, along a pre-planned path to tap the oil from targeted locations, which otherwise would have been left inaccessible

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Directional Drilling Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

JSG to drill new oil wells in Texas Panhandle

February 06, 2023ADNOC awards IDFS contract to SLB, Halliburton and ADNOC Drilling

November 02, 2022US rig count flat

December 06, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Directional Drilling Services

Schedule a DemoDirectional Drilling Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoDirectional Drilling Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Directional Drilling Services category is 16.40%

Payment Terms

(in days)

The industry average payment terms in Directional Drilling Services category for the current quarter is 30.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Directional Drilling Services Suppliers

Find the right-fit directional drilling services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Directional Drilling Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDirectional Drilling Services market frequently asked questions

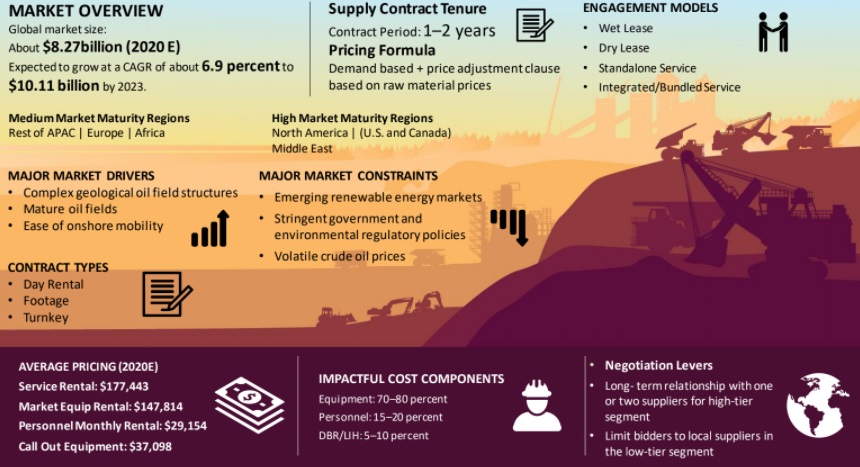

According to Beroe's directional drilling services market report, the market was estimated at $9.01 billion in 2018. By the end of 2021, it is expected to reach $10.77 billion growing at a CAGR of 6.13 percent.

Schlumberger, Baker Hughes, Halliburton, Weatherford, Scientific Drilling are the top global players contributing to more than 60 percent of the total directional drilling services market size. Over the years, Schlumberger has been the market leader with a global share of about 30 percent.

As most of the producing wells have reached their matured stage, North America and the Middle East regions are highly lucrative markets for directional drilling.

The following factors drive the growth of the drilling services market. ' Discovery of new oil fields due to directional drilling ' Complex geological oil field structures and Shale are the key drivers for the market in North America and APAC ' High number of maturing oil fields in onshore and offshore applications ' Ease of onshore mobility allowing multiple usages of directional drilling services ' Recovering crude oil prices

The emerging renewable energy markets and the stringent government and environmental regulatory prices are turning out to be major constraints for the drilling services market.

As per Beroe's drilling services market outlook reports, North America holds the largest market share followed by the Middle East. As more projects come up in the near future, the demand from these regions will dominate the market.

The supplier power is pushed to medium due to the stabilizing crude oil prices although the criticality, complexity, and technology that the services involved are high. Suppliers gain an added advantage because of the high costs involved in the switching and learning curve that limit buyers from switching among the suppliers. Moreover, the horizontal directional drilling market is consolidated by four major players globally.

The first reason is, a majority of the equipment used in directional drilling services is patented to major service providers due to which buyer power is less. Secondly, the equipment and services are quite complex which makes the buyer rely on major suppliers.

After the crude oil price crash, many players downsized their tools and equipment leading to a shortage of availability. Consequently, this might cause a noticeable rise in prices in the future.

Directional Drilling Services market report transcript

Global Market Outlook Directional Drilling Services

-

The global directional drilling market is anticipated to be $11.4 billion in 2023, and it is expected to reach $12.9 billion by the end of 2026, with a CAGR of 3–5 percent. In 2021, the directional drilling market across all the regions improved on a yearly basis

-

The directional drilling market is highly consolidated by the top four global suppliers, constituting to more than 60 percent of the market share

-

Matured production wells are likely to drive the directional drilling services market in North America and the Middle East regions

Global Market Overview for Directional Drilling Services

-

The global directional drilling market is anticipated to value at around $11.4 billion by the end of 2023, and it is expected to grow at a CAGR of 3–5 percent during 2023–2026. The rise in the market value is ascribed to the increase in the number of wells to be directionally drilled in the coming years

-

Globally, North America holds the largest market share of more than 40 percent, followed by the Middle East. An increase in oil and gas demand from this region due to ban of Russian oil and gas imports is expected to the increase the directionally drilling services in the forecasted period, as more projects are expected to come up in the future

Market Drivers and Constraints

-

Nearly, 70 percent of the world’s oil & gas production accounts from mature fields

-

Complex geological structures and Shale are the key drivers for directional drilling services

Drivers

-

Directional drilling has helped in new oil field discoveries, which otherwise would have been challenging to tap because of geographical location

-

Complex geological structures and Shale are the key drivers for directional drilling in North America and APAC

-

Nearly, 70 percent of the world’s oil & gas production accounts from mature fields. This high number of maturing fields in onshore and offshore applications would demand directional drilling to tap the maximum reserves, in order to meet the increased demand globally

-

Ease of mobility in onshore regions allows multiple usages of directional drilling. This can save a lot of lost time and cost by making the most efficient use of the equipment

-

The global oil demand for the year and next is forecasted to increase, coupling with ban on Russian output will drive the oil production in the year

-

Resume of oil & gas activities in Libya in are expected to positively impact the directional drilling market in Africa

Constraints

-

Increasing focus on renewable energy, such as solar, wind, etc., globally is a major concern

-

Stringent regulatory policies and environmental concerns might hold back the market

-

Volatility in oil price confines investment into oil & gas activities, which affects the directional drilling market

-

Geopolitical tension in Europe is expected to impact negatively directional drilling market in Europe

-

Russian invasion of Ukraine has led to a decrease in the production activities in the region

-

Labor shortage in the oil industry is stinging the industry with high costs.

Cost Structure of Directional Drilling Services

Equipment cost accounts for the single largest cost component. Directional drilling companies provide the surface equipment on rentals with crew or without crew. Lead Directional Driller and Lead MWD/LWD engineer constitute to majority of the personnel cost.

Equipment Monthly Rental

- The indicative cost structure of directional drilling services includes monthly rentals for equipment and personnel to perform the operation. Equipment rentals account for majority of monthly rental for directional drilling.

Personnel Cost break-up

- Typical directional drilling crew consists of one lead directional and MWD/LWD engineer, one second directional operator and MWD/LWD engineer. Lead Directional Driller and Lead MWD/LWD engineer constitute to majority of the personnel cost.

DBR/LIH

- DBR or LIH are charges in addition to other rates if an equipment or any of its component is not retrieved from the borehole.

Directional Drilling Market Overview

- Stabilizing crude oil price pushes the supplier power to medium, even though criticality, complexity and technology involved in directional drilling services are high.

- High switching and learning curve costs incurred would limit the buyer to switch among the suppliers, giving suppliers an added advantage.

- The horizontal directional drilling market is consolidated by major four players globally, giving an upper hand to the suppliers.

- Majority of equipment used in directional drilling services are patented to major service providers and are limited to certain providers. Hence, buyer power is less.

- Complexity of equipment and service, the value it adds to the buyer in decision making make the buyer to rely on major suppliers.

- Low-tier segments exhibit a power shift toward buyers, but high-tier segments are dominated by the major players in the market.

- Following the crude oil price crash, many players have downsized their tools and equipment, resulting in a shortage of availability, which might cause a noticeable increase in prices in the near future.

- Slumberger is a dominant player, in terms of directional drilling market share (more than 30 percent) and technology advancement.

- The top companies provide lower or breakeven pricing, in order to protect its market share or a particular client.

- Barrier to entry is high, due to huge capital expenditure.

- Nearly, 80 percent of the directional drilling service cost is incurred by the equipment, which makes the entry of new players difficult.

- Manufactures and service companies spend a significant amount of time and money on research and development to meet the challenges and to be competitive in the directional drilling market

Why You Should Buy This Report

- Information about directional drilling services market size, overview, drivers and constraints, etc.

- Porter’s five force analysis of the global directional drilling market.

- Cost analysis and cost breakup.

- directional drilling procurement intelligence, engagement models, contract practices.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now