CATEGORY

Oil Country Tubular Goods (OCTG)

Oil country tubular goods (OCTG) is a family of seamless rolled products consisting of drill pipe, casing and tubing subjected to loading conditions according to their specific application. Oil Country Tubular Goods are used both onshore and offshore

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Oil Country Tubular Goods (OCTG).

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Countervailing Duty Orders on OCTG

November 30, 2022Posco outages could result in a 1.7 mt production loss.

September 19, 2022OCTG input cost is down

September 06, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Oil Country Tubular Goods (OCTG)

Schedule a DemoOil Country Tubular Goods (OCTG) Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoOil Country Tubular Goods (OCTG) Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Oil Country Tubular Goods (OCTG) category is 16.40%

Payment Terms

(in days)

The industry average payment terms in Oil Country Tubular Goods (OCTG) category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

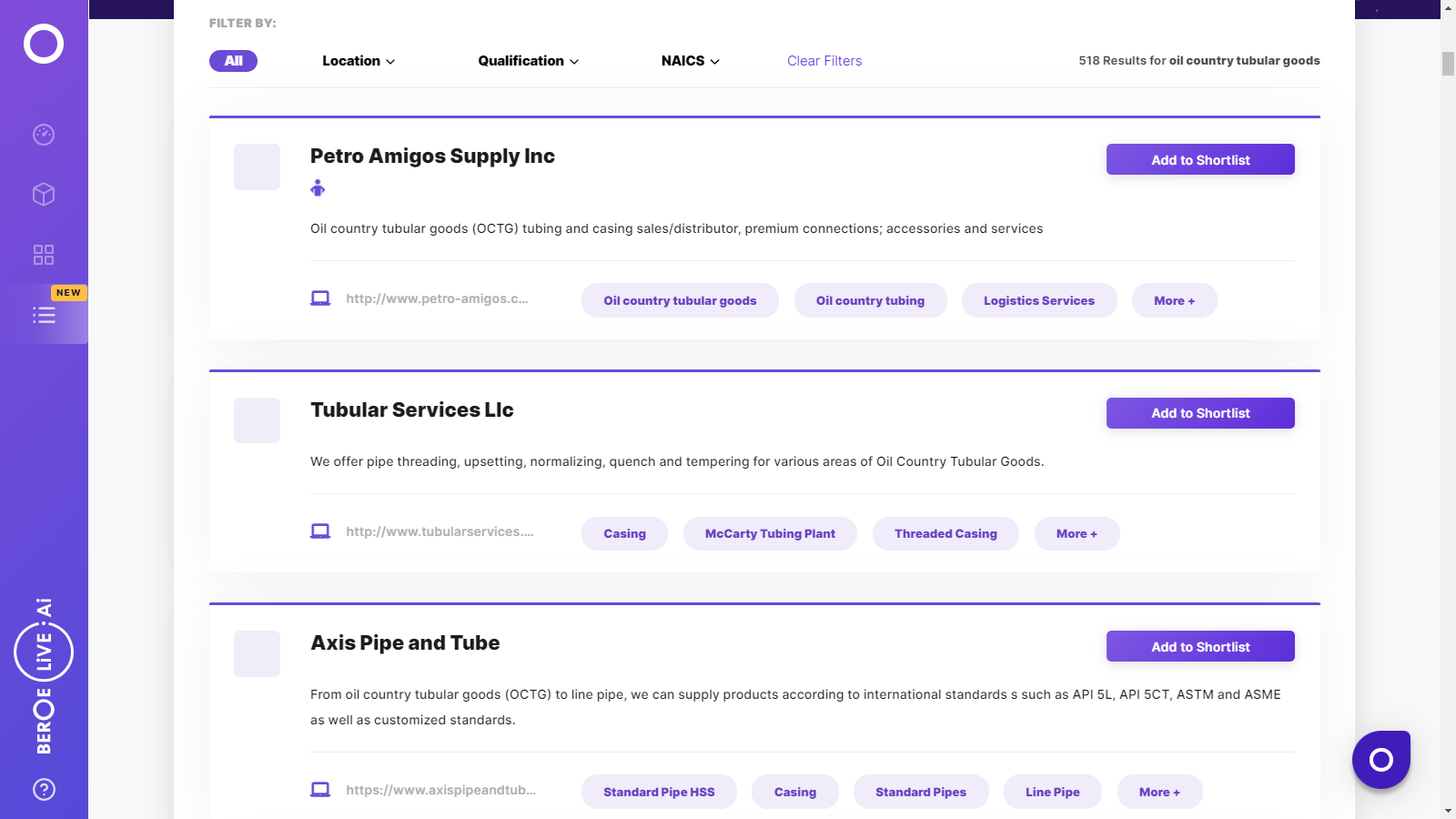

Oil Country Tubular Goods (OCTG) Suppliers

Find the right-fit oil country tubular goods (octg) supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Oil Country Tubular Goods (OCTG) market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOil Country Tubular Goods (OCTG) market report transcript

Oil Country Tubular Goods (OCTG) Market Analysis and Global Outlook

-

The global OCTG market is estimated to be at $13.77 billion by the end of 2023 and is expected to reach $20 billion by 2026, growing at a CAGR of 8.7 percent

-

The US, China, and Russia are the most important global markets, due to the high consumption of OCTG

Regional Market Outlook - North America

-

North America is poised to be one of the leading OCTG markets, with drilling being expected to increase by 13 percent in 2023 compared to 2022

-

The US Rig count is at an average of 750 now, which was at 670 a year ago

-

US banned all imports of Russian oil and gas and energy, about 8 percent of US oil and refined product comes from Russia

-

High activity in the region is due to various factors, such as the push to increase domestic oil production by the US government post the Russia–Ukraine war, producers trying to maximize profit due to high oil prices, declining crude inventories, and drilled but uncompleted (DUC) wells in the US

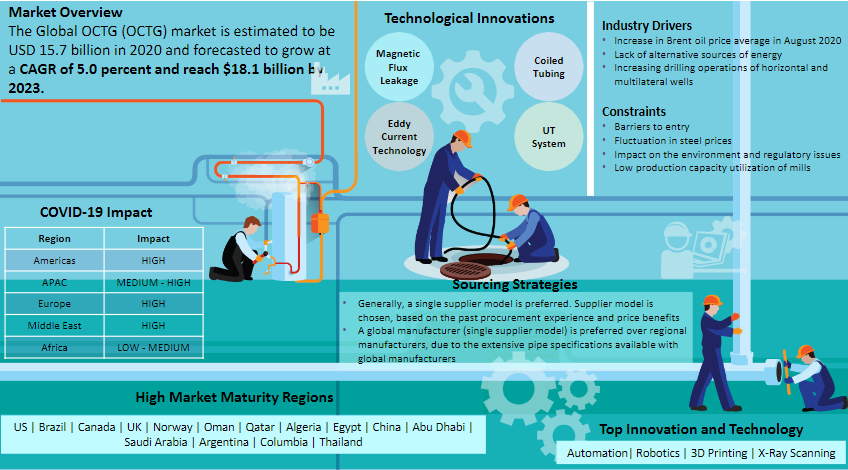

Market Drivers and Constraints : Oil Country Tubular Goods (OCTG)

The recent reduction in oil production activities reduced the demand for OCTG, and the supply can meet the existing demand.

Drivers

-

The international rig counts increased from 813 to 915 in Q1 2023 as compared to that of Q1 2022 hence accelerating the demand over the past year and this is expected to continue in the long run

-

Following an 80 kb/d contraction in 4Q22, world oil demand growth is set to accelerate sharply over the course of 2023, from 710 kb/d in 1Q23 to 2.6 mb/d in 4Q23 which is expected to drive the OCTG demand in the long run

-

Increasing energy demand and a surge in North Sea exploration activity have increased the appetite for OCTG in the North Sea market, particularly in Norway.

Constraints

-

Fluctuation in steel prices, impact on the environment, global oil and natural gas market instability, increased cost of production, due to devaluation of the currency in some regions, regulatory issues, etc., are the key challenges faced by the OCTG industry

-

The Russian invasion made oil and gas drilling more expensive because of potential shortages of oil country tubular goods steel along with supply chain discrepancies

-

Lithium prices are also comparatively higher

Cost Structure of Oil Country Tubular Goods

Raw material cost contributes the maximum of 41–46 percent of the overall price majorly constitutes cost of iron ore (Fe), steel scrap, molybdenum (Mo), chromium (Cr), nickel (Ni), silicon (Si) and manganese (Mn). The overhead cost constitutes around 10–19 percent, and are based on industry analysis, average numbers, and accounting principles. Shipping constitutes around 5–10 percent due to the volumes of both raw inputs and finished product shipping costs can place significant pressure on OCTG pricing.

Price Drivers

Raw Materials Cost:

-

The price indices of stainless and carbon were fluctuating but are now stabilized, thereby bringing low variations to the price index of OCTG

-

Lithium prices continue to stay at the highs and is a cost driver for OCTG

Adapted Supplier Base:

-

OCTG market is highly fragmented with a high number of suppliers. Buyer power is high, as there is an increase in bankruptcies. This tends to decrease the OCTG prices in the market

Fossil Fuel Demand

-

Rise in the oil demand, coupled with a crude deficit, is expected to keep the oil prices high, thus affecting the cost of OCTG

Supply Trends and Insights : Oil Country Tubular Goods (OCTG)

Global/regional supplier

Consolidated market

-

The global OCTG market is consolidated with supply meeting the demand

-

The industry is consolidated in all the regions, except Asia -Pacific

-

Chinese companies have been the largest suppliers of OCTG in the Middle East, with more than 70 percent of the market share. Russian and Brazilian companies are the closest competitors to Chinese companies, due to the availability of all raw materials, cheap energy, and competitive manpower costs

-

Major suppliers have strong links to primary steel producers

High on technology implementation

-

Technology implementation is high in the industry, due to vigorous competition among top suppliers

-

Magnetic flux leakage, coiled tubing, high-speed ultrasonic technology, Eddy current technology, etc., are the few latest technologies

Tier-2/local supplier

-

The quality of locally produced pipes is believed to be still insufficient for drilling in high-pressure environment

-

Suppliers are expanding operations organically, via joint ventures or acquisitions, to compete with big suppliers

-

Big multinational OCTG suppliers are setting up finishing facilities in few regions to help meet the local content requirements

-

Local content requirements, trade restrictions, and requirements for high-grade OCTG plays a major role in maintaining regional and country-level market balances

Market Overview

- According to the oil country tubular goods industry overview, the growing presence of domestic mills in the region enables buyers to deal directly with the oil country tubular goods distributors.

- The growing presence of International Oil Companies (IOCs), to a degree, shuts the distributors out of the market, allowing manufacturers of OCTG to directly interface with buyers.

- Oil country tubular goods distributors tend to move away from supplying OCTG on a pure commodity basis by developing threading capabilities and offering secondary services, such as threading repair, OCTG maintenance, and premium connections.

- No substitutes can be available if drilling is to take place.

Why You Should Buy This Report

This report provides information on the global oil country tubular goods market size, trends, importers, oil country tubular goods industry overview, etc. It gives a regional market outlook of tubular goods in the North America, Europe, Latin America, Europe, Asia-Pacific, MEA regions. It does a Porter’s five force analysis on the global oil country tubular goods market, gives key supply trends and insights and does a SWOT analysis on major oil country tubular goods distributors like Teneris, Vallourec, TMK, etc. It lists out the cost and price drivers and gives the cost structure

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now