CATEGORY

Drilling Chemicals

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Drilling Chemicals.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Global upstream capex growth expected around 15%

February 09, 2023US Gulf of Mexico operators shut down operations due to Hurricane Ian

September 28, 2022ADNOC awards a five year drilling services contract to Weatherford

September 13, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Drilling Chemicals

Schedule a DemoDrilling Chemicals Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoDrilling Chemicals Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Drilling Chemicals category is 16.40%

Payment Terms

(in days)

The industry average payment terms in Drilling Chemicals category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

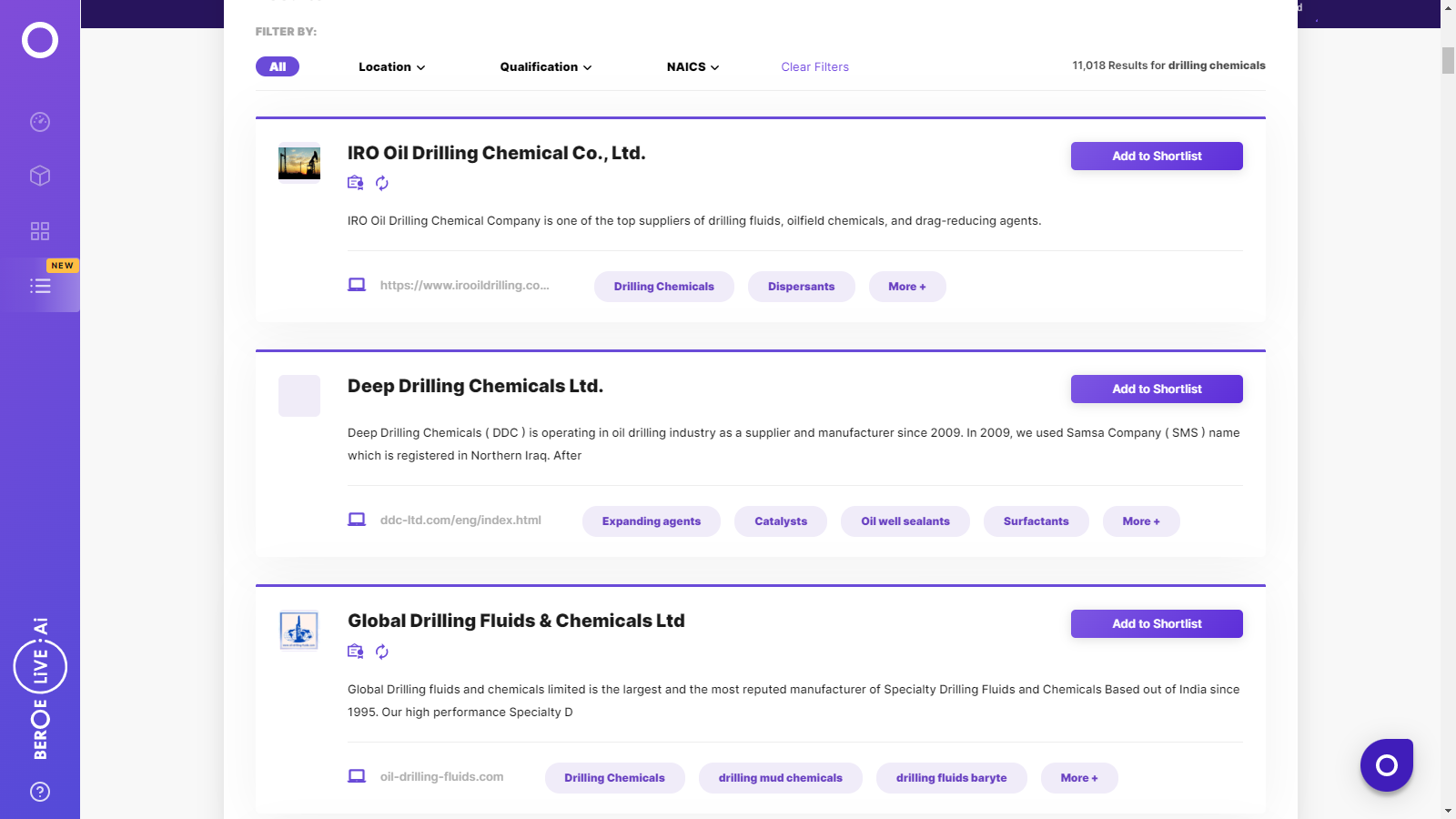

Drilling Chemicals Suppliers

Find the right-fit drilling chemicals supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Drilling Chemicals market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDrilling Chemicals market report transcript

Drilling Chemicals Global Market Outlook:

-

The global drilling chemicals market is estimated to reach $10.65 billion in 2023, and it is expected to reach $12.92 billion by the end of 2026, with a CAGR of 7.5 percent. Global upstream spending to increase by around 13% in 2023 driven by strong new development and expansion plans in major and developing markets. Cost inflation will add to higher spending in 2023.

-

Oil demand growth for 2023 adjusted to around 2.4%. OPEC set to maintain current production cuts, Norwegian & US supply to increase in the market. By the end of January 2023, the global rig count increased by 3.5 percent on M-o-M and 16.4 percent on Y-o-Y basis.

Global Market Overview for Drilling Chemicals

-

The global market for drilling chemicals is estimated to be at $10.65 billion in 2023. The global upstream activity registered strong growth in January 2023. Oil companies and service providers witnessed cost inflation due to shortage and supply constraints in equipment, material and labor. 2022 registered as the strongest year for oil & gas exploration in the past decade.

-

Global oil and gas drilling chemicals market set to reach $10.65 billion in 2023. The market is forecast to reach $12.92 billion by the end of 2026, with a CAGR of 7.5 percent. Overall upstream spending is expected to increase by 13% in 2023, amounting to around $460 billion. Higher spending is primarily attributed to overall cost inflation for the companies, which is expected to bbl. be around 8-10% for the year. Companies are set to follow strict capital discipline similar to 2022 for continued returns & cash flows. The oil & gas exploration in 2022 generated $33 billion in value and a strong average 22% return, making it the best year in the past decade for exploration and new development.

-

Global oil and gas drilling activities were consistently on the rise and registered an increase of 3.5 percent M-o-M and 16.4 percent Y-o-Y growth by end of January 2023. Operators across the globe, especially in North America, reported higher cost hikes due to supply shortage, and this deterred them from expanding operations. Upstream is set for growth in 2023 but cost inflation will remain key concern. New exploration activities increased in Europe, Latin America, Middle East & Africa. High-cost inflation is leading to lower drilling capacity addition. For 2023, around 8-10 percent cost inflation is expected for the upstream industry

Porter's Analysis on Drilling Chemicals

Supplier Power

-

Drilling chemicals are a mandatory requirement during oilfield drilling operations. Due to the war-led chemicals price hike, suppliers have moderate to high power currently

-

High input costs for suppliers especially in Europe will result in price hikes for products

-

Key chemicals registered severe hike in prices amid supply disruption due to war. These costs are transferred to customers as high prices of production chemicals

Barriers to New Entrants

-

Drilling chemicals are commodity based and can be easily manufactured with right technology. Capex requirement for drilling chemicals manufacturing is low. However, suppliers requires oil and gas expertise for entering into the business

-

The market is highly competitive with many players, acquiring a steady contract would be a challenge for new entrants

-

Therefore, the barriers to new entrants are low to medium

Intensity of Rivalry

-

The market is fragmented with many global and regional suppliers

-

Technology is available to many suppliers. The supplier market is mostly driven by wider service capability, economy of scale, and cost effectiveness of the services

-

Low switching cost. Easy to switch among suppliers with a little product differentiation. The intensity of rivalry is higher

Threat of Substitutes

- There is no substitute available for drilling chemicals. However, internal substitution, such as using of water-based fluids in place of oil-based fluids exists

Buyer Power

- Buyer power currently is medium, as most buyers are invariably exposed to price hikes, as suppliers are transferring their soaring input costs to the customers. Logistics constraints and cost increase are another added factor price hike, which the buyer has limited control

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now