CATEGORY

Cementing Chemicals

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cementing Chemicals.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Oil prices drop on potential recession fears

July 04, 2022Exxon & Imperial to divest Canadian shale assets for $1.5 billion

June 29, 2022Oil prices drop on potential recession fears

July 04, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Cementing Chemicals

Schedule a DemoCementing Chemicals Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCementing Chemicals Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Cementing Chemicals category is 16.40%

Payment Terms

(in days)

The industry average payment terms in Cementing Chemicals category for the current quarter is 30.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

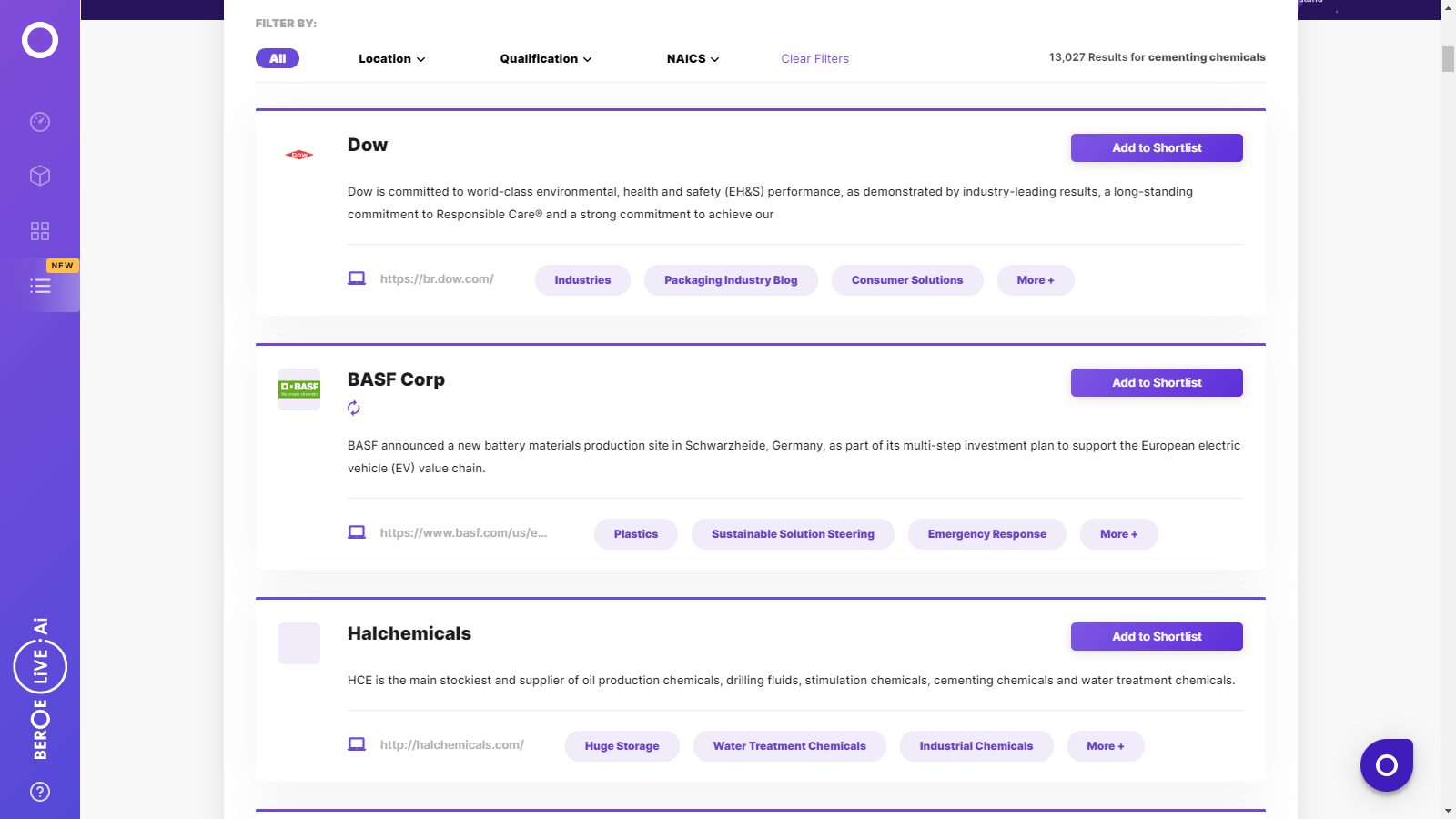

Cementing Chemicals Suppliers

Find the right-fit cementing chemicals supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Cementing Chemicals market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCementing Chemicals market report transcript

Cementing Chemicals Global Market Outlook:

-

The global oil field cementing chemicals market is estimated to be $6.77 billion in 2023, and it is expected to reach $8.16 billion by the end of 2026, with a CAGR of 7.1 percent. New exploration, development, and expansion plans are on the rise across Europe, Latin America, the Middle East, Africa, and Asia. Ban on Russian import is driving the upstream activity in major markets, to replace the deficit for Europe and capitalize on the opportunity. By the end of January 2023, the overall rig count increased by 16 percent on a Y-o-Y basis

-

Cementing is a major part of drilling and completions operation, the increase in the global upstream activity from new developments, and the expected global upstream well services expenditure growth by 13 percent in 2023, set to drive the demand for cementing products

Global Cementing Chemicals: Market Drivers and Constraints

Drivers

-

Cementing chemicals are a mandatory requirement during drilling operations to ensure the integrity of well. Increasing in the number of drilling wells globally will increase the demand for cementing chemicals

-

Ban on Russian imports by major economies, like the US and the EU, operators are pushing to increase production and investing in new operations to replace the Russian supply

-

New oil and gas development projects have increased in Europe, especially gas projects to improve the supply, despite long-term goal of clean energy transition. North Sea is registering the majority of new development and expansion programs. Norway sets to become the region with the second-highest production output hike in 2023

-

The global oil demand for the year is forecasted to increase, coupled with a ban on Russian output, will drive oil production in the year

Constraints

-

Due to the war, the price of key chemicals has soared, due to supply chain disruptions, high input costs for manufacturers, putting string on operators, in terms of high upstream costs. The price of key chemical products surged ranging from 7 percent to 15 percent. For 2023, around 6–9 percent cost inflation is expected for the upstream industry

-

High inflation in major economies across the globe is looming potential threat to the oil and gas industry, which could significantly impact the demand for oil products

-

Labor shortage in the oil industry, especially in the US, is stinging the industry with high costs. The companies are finding it difficult to hire labor impacting operations. This factor, coupled with the fear of recession, poses a significant threat to the industry, which could erode the demand and destabilize the industry

Porter’s Five Forces Analysis: Cementing Chemicals

Supplier Power

-

Cementing chemicals are a mandatory requirement during drilling operations. Due to the war-led chemicals price hike, suppliers have moderate to high power currently

-

High input costs for suppliers, especially in Europe, will result in price hikes for products

-

Key chemicals registered a severe hike in prices, amid supply disruption, due to war. These costs are transferred to customers as high prices of production chemicals

Barriers to New Entrants

-

The existing players have technical expertise, due to experience, and R&D on various cement slurry mix for variety of field applications and specialized tools for the process

-

The market is highly competitive with many players; acquiring a steady contract would be a challenge for new entrants

-

Barriers to new entrants are medium to high

Intensity of Rivalry

-

The market is fragmented with many global and regional suppliers

-

Technology is available with many suppliers. The supplier market is mostly driven by wider service capability, economy of scale, and cost effectiveness of the services

-

The intensity of rivalry is high, since it is easy to switch among suppliers with little product differentiation

Threat of Substitutes

-

There is no substitute available for cementing chemicals

Buyer Power

-

Buyer power currently is medium, as most buyers are invariably exposed to price hikes, as suppliers are transferring their soaring input costs to the customers. Logistics constraints and cost increase are other added factor a price hike, which the buyer has limited control

Cost Breakup

-

Volume of cement required increases with the increase in depth of the well; hence, the cost of cementing services rises

-

The increase in price of cementing services is also due to the rise in prices of additives. For a complex well, additives cost approximately 70 percent of the material cost

-

Cementing services account for 5–7 percent of the overall well cost. The services are priced differently, depending on the well type. The prices of cementing services, on an average, increased by 10 percent in the last eight years. The price increase is due to the rise in additives prices. Additives consumption and utilization are critical in deciding the pricing mechanism of cementing services

-

The indicative cost structure of a typical cementing service is given below. It includes the monthly rentals for equipment and personnel to perform the operation and materials required. Materials, which include cement and additives, account for the majority of cost for cementing services

-

The cementing service costs are high for deep wells, as the volume of cement required increases with depth of the well

-

Cementing equipment day rate would cost up from $8,000 to $10,000

-

Material cost is the largest component for cementing services. Additives play a key role in cementing operation. For a complex well, the additives accomplice for approximately 70 percent of the overall material cost, whereas for a standard well, cement accomplice for 60 percent

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now