CATEGORY

Offshore Aviation Logistics

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Offshore Aviation Logistics.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

NHV group has won 5-year contract for offshore helicopter services in the central North Sea with INEAS FPS

October 17, 2022CITC offshore helicopter company acquires four AW139 helicopter

July 26, 2022Crew Change and SAR Services Will Be Offered by CHC for Equinor's Offshore Platforms in Norway

July 19, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Offshore Aviation Logistics

Schedule a DemoOffshore Aviation Logistics Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Offshore Aviation Logistics category is 16.40%

Payment Terms

(in days)

The industry average payment terms in Offshore Aviation Logistics category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

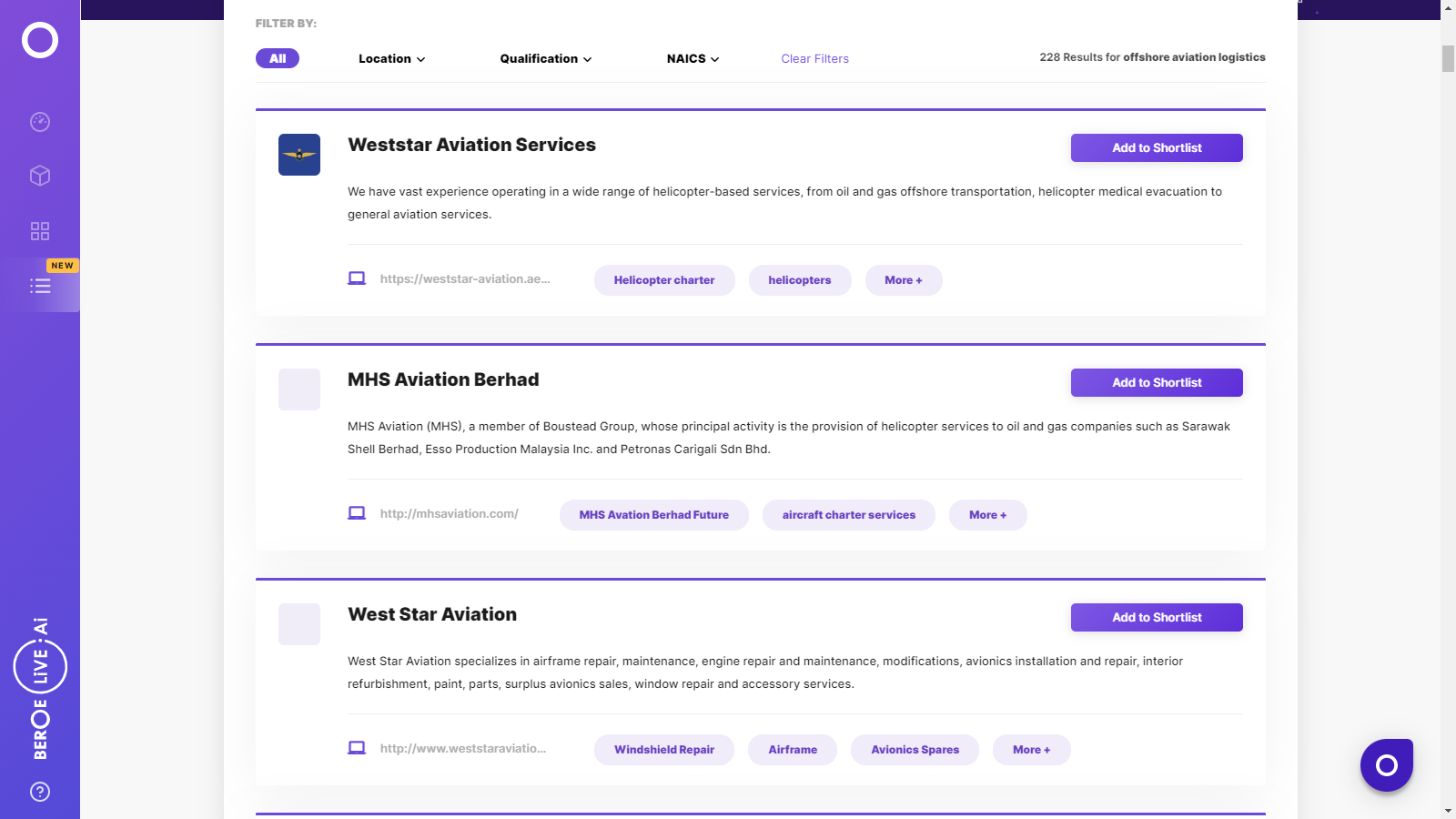

Offshore Aviation Logistics Suppliers

Find the right-fit offshore aviation logistics supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Offshore Aviation Logistics market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOffshore Aviation Logistics market report transcript

Global Market Outlook on Offshore Aviation Logistics

-

The offshore aviation logistics market is estimated at $3.10 billion in 2023 and is expected to grow up to $3.48 billion by 2026, with an estimated CAGR of 3.9 percent

-

The North Sea is the largest offshore market in the world for helicopter operators. Prior to the pandemic, close to 2 million passengers a year were flying offshore from about 16 bases in the U.K., the Netherlands, Denmark and Norway

-

Latin America spend is anticipated to grow strongly, driven by continued offshore activity in Brazil and the emergence of Guyana’s offshore oil and gas market

Offshore Helicopters – Global

The offshore aviation logistics market is estimated at $3.1 billion in 2023 and is expected to grow up to $3.48 billion by 2026, with an estimated CAGR of 3.9 percent.

-

The offshore aviation logistics market is estimated at $3.1 billion in 2023 and is expected to grow up to $3.48 billion by 2026, with an estimated CAGR of 3.9 percent

-

The North Sea is the largest offshore market in the world for helicopter operators. Prior to the pandemic, close to 2 million passengers a year were flying offshore from about 16 bases in the U.K., the Netherlands, Denmark and Norway

-

Offshore wind-related helicopter expenditure is expected to be around $130 million in the forecasted period, with a CAGR of

-

17 percent

-

Brazil has been the largest revenue contributor with 68% of the market share in South American region. The country has been investing in improving its search and rescue (SAR) services.

-

Western Europe remains the largest region by expenditure, accounting for 30 percent of the global spend

-

With the new platforms coming online, Gulf of Mexico oil production is expected to grow substantially in the coming years

-

Latin America is expected to witness a growth of 4.3 percent CAGR, primarily due to greenfield projects in Brazil and Guyana

Offshore Helicopter: Cost Structure Analysis

Owning and operating a helicopter might be difficult, considering the cost and maintenance. Therefore, cost saving is limited to the crew. By having its own roaster of pilot, clients can have better flexibility in operating the helicopters and this can help clients in optimizing the crew cost by 10–15 percent in the crew costs

Cost Analysis

-

Helicopter charter rates cost splits into fixed and variable costs

-

Fixed costs includes crew cost, training cost, insurance, hangar fee and constitutes to 38.1 percent of the total cost

-

Variables cost covers fuel cost, maintenance, and other crew cost like regulatory and testing costs

-

Aircraft maintenance is the key variable cost component with a share of 35 percent in the overall charter cost for helicopter, as it requires to keep them in a safe operating environment

-

Insurance charges are high for offshore helicopters than civilian helicopters, due to the high risk involved in it

-

Scope of cost saving is limited to the crew cost

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now