CATEGORY

Onshore Drilling Rigs

Onshore drilling rigs are also known as land rigs; and are used in petroleum industry to drill deep holes under the earth’s surface for oil and gas extraction.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Onshore Drilling Rigs.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Biden backs scaled-down drilling plan for Alaska oil project

February 06, 2023Neptune Energy commences drilling at Adorf

February 01, 2023SLB to acquire Gyrodata Incorporated

November 02, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Onshore Drilling Rigs

Schedule a DemoOnshore Drilling Rigs Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoOnshore Drilling Rigs Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Onshore Drilling Rigs category is 16.40%

Payment Terms

(in days)

The industry average payment terms in Onshore Drilling Rigs category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Onshore Drilling Rigs Suppliers

Find the right-fit onshore drilling rigs supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Onshore Drilling Rigs market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOnshore Drilling Rigs market report transcript

Onshore Drilling Rigs Global Market Outlook

-

The global onshore rig count was around 1,635 in Q4 2022, and it is anticipated to increase by 4-6 percent in Q1 2023 compared to Q4 2022. In Q4 2022, the onshore rig count improved across North America, LATAM, APAC, and the Middle East compared to the previous quarter

Onshore Drilling (Global): Market Analysis

-

High crude oil and gas prices and increasing demand for oil & gas, as global economies aim to recover, amid recession threats, exploration and production activities are expected to improve, while oil and gas companies maintain a conservative approach in 2023

-

North America and the Middle East are the major oil producing region with the highest onshore rig counts

-

The global onshore rig count increased by around 7 percent in Q4 2022 compared to Q3 2022. Canada’s rig count decreased significantly in 2022, due to the producers stuck to plans for limited production growth and change of seasons, which is now increased to the normal number of rig counts. Africa witnessed a marginal increase in rig count compared to other regions, due to the ease in Libya’s political tension. However, the Middle East, LATAM, and APAC witnessed an increase in onshore rig count during the same period

-

Regions, on the basis of active land rig count, as of December 2022, are as follows:

–North America (949)

–Middle East (278)

–APAC (119)

–Europe (74)

–LATAM (148)

–Africa (68)

-

The global crude oil price significantly increased in Q4 2022, upstream suppliers and investors remain cautious globally

-

Global onshore rig count is expected to increase by around 3-5 percent in Q1 2023 compared to Q4 2022, due to high oil prices, resulting from increasing oil and gas demand globally in 2023

-

North America and the Middle East are expected to witness an increase in rig count, due to increasing O&G demand from the European region

-

Increased drilling efficiencies from high-spec rigs and multi-well pad drilling would play important roles in tempering the extent of future rig count growth globally

Onshore Drilling (North America): Market Analysis

-

Exploration and production companies are expected to increase investments in 2023, due to high crude oil prices and increasing demand for oil & gas

-

Shale gas boom has pushed ahead the utilization rate of onshore rigs in the region

-

Explorers and producers are expected to increase investments in the region, due to high oil prices and increasing demand for oil & gas, to meet the demand from the European countries due to ban of Russian oil & gas

-

In Q1 2023, the demand for rigs is expected to increase from Q4 2022 rig demand. Moreover, active land rigs are expected to increase in H1 2023, with investments and high oil prices driving the upstream activities

-

High West Texas Intermediate (WTI) oil prices, due to energy supply shortage and the Russia–Ukraine war disruptions in Q4 2022, have resulted in the utilization of the existing US resources by the upstream suppliers in the region. Upstream suppliers have maintained a strict disciplined approach on new investments

-

In 2023, utilization of land rig in North America is estimated to increase year-on-year and reach pre-pandemic levels moving into 2023, as the utilization of land rigs in North America drastically decreased to below 25 percent in 2020, due to the COVID-19 pandemic

-

Companies are shifting to pad drilling and other high-efficiency operations, which eliminate the need of a high number of rigs

-

Increased drilling efficiencies from high-spec rigs and multi-well pad drilling would play important roles in tempering the extent of future rig count growth in North America

Onshore Drilling Market Overview: North America

-

The Permian Basin in the US and Alberta in Canada have been the key regions for oil exploration in North America

-

Based on the drilling activity, the US had 764 active land rigs by December 2022

-

The top states in the US, on the basis of active land rig count, are as follows:

–Texas (375)

–New Mexico (102)

–Louisiana (54)

–Oklahoma (69)

–North Dakota (39)

–Pennsylvania (22)

-

More than two-thirds of land rigs are active in four states primarily, due to ‘Big Three’ shale basins namely Bakken, Permian Basin, and Eagle Ford, which has the highest number of shale wells

-

The Permian basin in the US, specifically Bone Spring and Wolfcamp, plays a vital role in the US oil production

-

Canada had an average of 155 onshore rigs by December 2022

-

Canada’s rig count decreased significantly in mid of Q2 2022, due to the producer’s stuck to plans for limited production growth and change of seasons, which is now increased to the normal number of rig counts

-

High oil prices and increasing demand have resulted in the resumption of drilling activities in the region

-

Alberta, followed by Saskatchewan and British Columbia with 17 and 15 active onshore rigs, respectively, remains the oil exploration region in Canada, with 155 active onshore rigs by December 2022

Onshore Drilling Market Overview: APAC

-

Companies are expected to increase investments in exploration activities in the APAC region, while oil & gas demand increases, ease of COVID-19 restrictions.

-

Based on the drilling activity, the APAC has 197 active rigs, of which, 116 are land rigs (excluding activities in China) as of December 2022.

-

In APAC, India, Australia, and Indonesia have 63, 18, and 26 active land rigs, respectively, as of December 2022

-

Cautious and marginal increase in investments are expected to be witnessed in the region in the near future, with higher oil prices and increasing oil and gas demand

-

Drilling activities have continued at an average pace, amid high crude oil prices in Q4 2022

-

Rig utilization in India, Australia, and Indonesia is expected to marginally increase in H1 2023 compared to H4 2022. Rig utilization in India has witnessed an increasing trend in Q1 2023

-

Ambitious energy plans of the countries and rising domestic demand would also drive the onshore rig market

-

Capex spend by global oil companies in the APAC region to boost the demand for onshore rigs

-

Potential changes in the China’s Covid policy has led to increase in oil prices

Industry Best Practices : Onshore Drilling

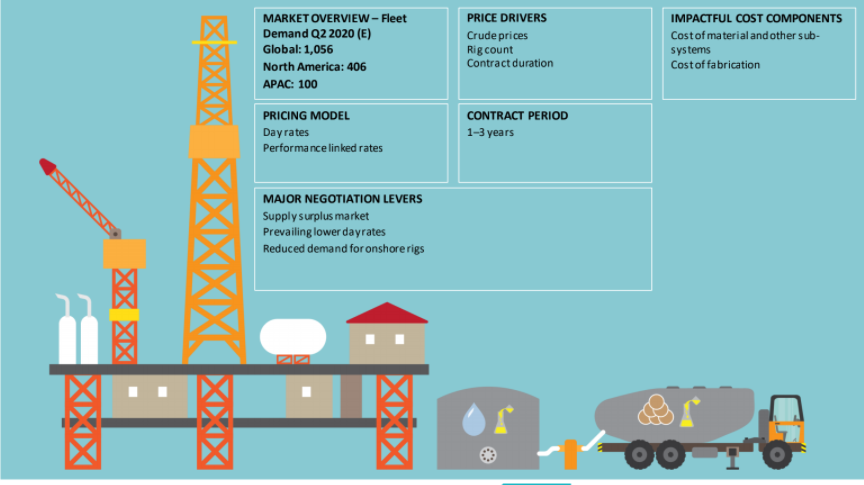

The widely used contract model is Term Contract with rig lease extending for multiple years on predetermined day rates.

Engagement Models

- The common type of engagement is term contract, in which rig services are leased for a fixed term based on day rates

–It is more suitable for long duration contracts, which is more attractive for drilling contractors

- In Fix Well Contracts, rig services are leased for drilling a predetermined number of wells

–It is more suitable for short duration contracts with less uncertainties. This type of contract is not preferred for drilling contractors, as it exposes them to great operational risks

Cost Structure of Onshore Rigs

Labor cost accounts for the largest cost component for onshore rigs services. While, Material cost covers 63 percent of the entire rig and with the demand for rigs with deep drilling capacity, the cost is expected to increase

Labor

- Personnel costs are inclusive of the salaries as well as all other incidentals such as accommodation, mobilizations, and training costs.

Capex Maintenance

- Onshore rigs require regular maintenance to sustain the operation of the various pieces of equipment on board. This may include specialist technical support, spare parts and consumables depending on the inspection requirements that are highly regulated by various industry bodies

Fabrication

- Fabrication cost is the sum of all rent of the facility/yard, wages paid to employees, transportation cost, as well as the employee benefits cost.

Material & Other Costs

- Other costs include cost of major raw materials such as stainless steel, copper, aluminum, nickel, etc., consumables & tools, sub-systems, and OEM equipment such as valves, pumps, drives, etc.

Why You Should Buy This Report

The report gives the market overview, supply trends and market analysis of the North American and APAC on shore drilling rig market. It lists out the global demand drivers for the drilling rig industry. It provides the cost breakup and key cost drivers of the onshore drilling industry. The report details the supplier landscape and SWOT analysis of the North American Oil and APAC rig market and shares the profile of major players like Helmerich & Payne, Precision Drilling Corporation, John Energy, India, SVOGL Oil Gas & Energy Ltd., India, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now