CATEGORY

Vaccine Analytical Testing Services

Labs that evaluate varyig dose formulation of a given Vaccine.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Vaccine Analytical Testing Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

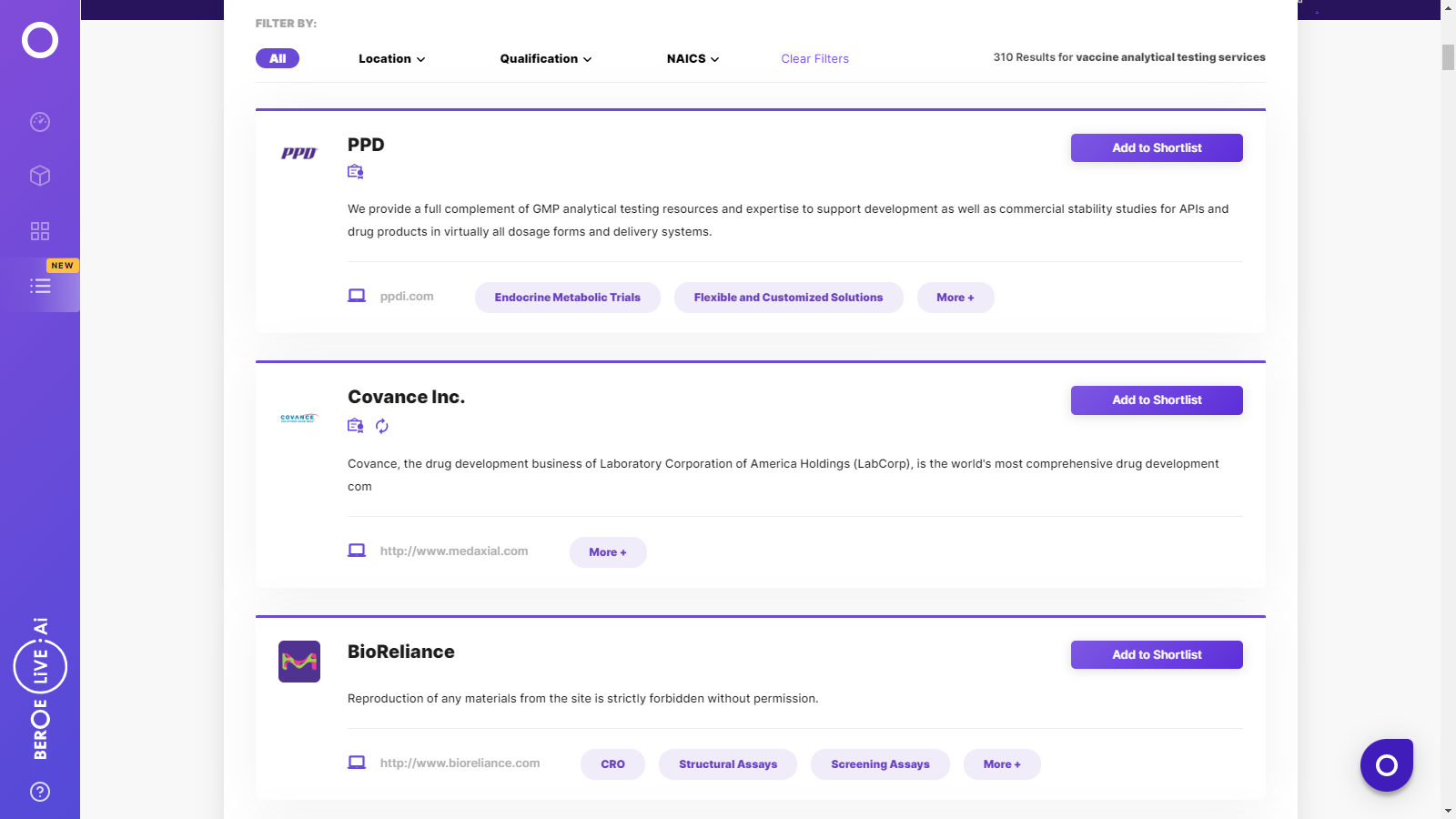

Vaccine Analytical Testing Services Suppliers

Find the right-fit vaccine analytical testing services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Vaccine Analytical Testing Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoVaccine Analytical Testing Services market report transcript

Global Market outlook on Vaccine Analytical Testing Services

- Healthcare analytical services are expected to witness a CAGR of 11.3% from 2016 to 2021 to reach $4.18–4.22 billion by 2021

- Asia Pacific is growing at the highest CAGR, due to low cost and large pool of skilled professionals in Asia Pacific

- Buyers can leverage low-cost labor advantage by engaging with suppliers that have a global presence

- Most of the outsourcing is managed at the regional level, due to differences in regulatory standards in different countries and reduced turnaround time

- Stability testing it is being earlier outsourced to CROs in North America mostly, now large pharma companies are developing partnership with CRO in India and China, e.g., Gilead – Wuxi App Tec partnership for stability testing

Regional Analysis

- Currently, North America is still the leader in analytical testing outsourcing, as most analytical scientists and CROs are based in the US and Canada

- Pharmaceutical companies in North America and Europe have also been outsourcing analytical testing to a significant degree since the late 1980s. Most of the supply also came up in these locations, as local sourcing has been the norm, due to requirement for quick turnaround

Drivers and Constraints

Drivers

- Large pharma expenditure: Huge R&D investment by key players in the life sciences industry, thus increasing the number of new drug and vaccine launches in the market. These factors are increasing the demand for high-quality analytical services from the pharmaceutical and biotechnology companies

- Demand: The increase in the number of vaccine clinical trials (year 2000=87 studies, year 2016=156 studies) will drive the testing services

- Flexibility: Service providers have become flexible in adopting the methodologies and are developing customized assays required by the Big Pharma. This has led to strategic partnerships between pharma and service providers for long-term, transferring huge volume of work

- Funding from non-profit organizations: Roles played by non-governmental organizations in funding the development of vaccines, example, GAVI alliance, Sabin Vaccine Institute-a non-profit organization dedicated to developing new vaccines (recently developed a typhoid conjugate vaccine)

- Increasing outsourcing of Analytical testing services: in order to reduce the cost and time of the manufacturing process, there is an increasing trend of outsourcing analytical testing services to CRO

Constraints

- Regulations: Many regulations are in place to control the testing laboratory CAP, CLIA (US), ISO 15189 (EU), GCP, and GLP, but does not clearly define the laboratory practices control for testing clinical trial samples

- Capital intensive: Lab facility, equipment, and reagents contribute to more than 50% of the cost component

- Update technological innovation: The constant need for updating the laboratory with latest technological and medical innovations is another major challenge face by CROs providing analytical testing services

Market Trends

Consolidation, Investments, and Expansions:

- Rising demand for specialized testing services is driving the need for the smarter technology to achieve productivity and reliability. To increase the technology portfolio, regional presence, customer reach, and to sustain in highly competitive landscape companies are investing in technology and expanding theirs services by acquisitions

Impact: Suppliers are providing One-Stop-Shop solution by providing a wide range of analytical services, and Pharma are engaging with CDMO strategically by bundling up their services.

Tax Reforms

- China has implemented a new tax system, VAT on May 1, 2016 that reduces complexity and compliance costs for business. The inclusion of services into the new VAT regime should aid in China's efforts to transition from a labor-intensive economy to a service-orientated one

- The positive effect of the B2V reform results from the inclusion of the entire services sector in the VAT system

Impact: It is expected to eliminate double or multiple taxation under the prior indirect tax regime and further support the growth of the service sector. The State Council is now accelerating plans to optimize and integrate the various VAT rules.

Continuous Innovation

- Numerous new formulations are being discovered and developed into medicines through extensive research to increase the bioavailability of drugs. These new classes of formulations are difficult to analyze. E.g., Patient-specific cancer vaccines

Impact: Continuous development of new products to meet the ever-changing customer need and to provide better and innovative testing services is driving industry towards adopting new technologies.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now