CATEGORY

Stretch Film Australia Indonesia Malaysia

This report provides an overview of Stretch Films demand across key countries in South Asia and Oceania. Key suppliers operating in these countries were also listed.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Stretch Film Australia Indonesia Malaysia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Stretch Film Australia Indonesia Malaysia Suppliers

Find the right-fit stretch film australia indonesia malaysia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Stretch Film Australia Indonesia Malaysia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoStretch Film Australia Indonesia Malaysia market report transcript

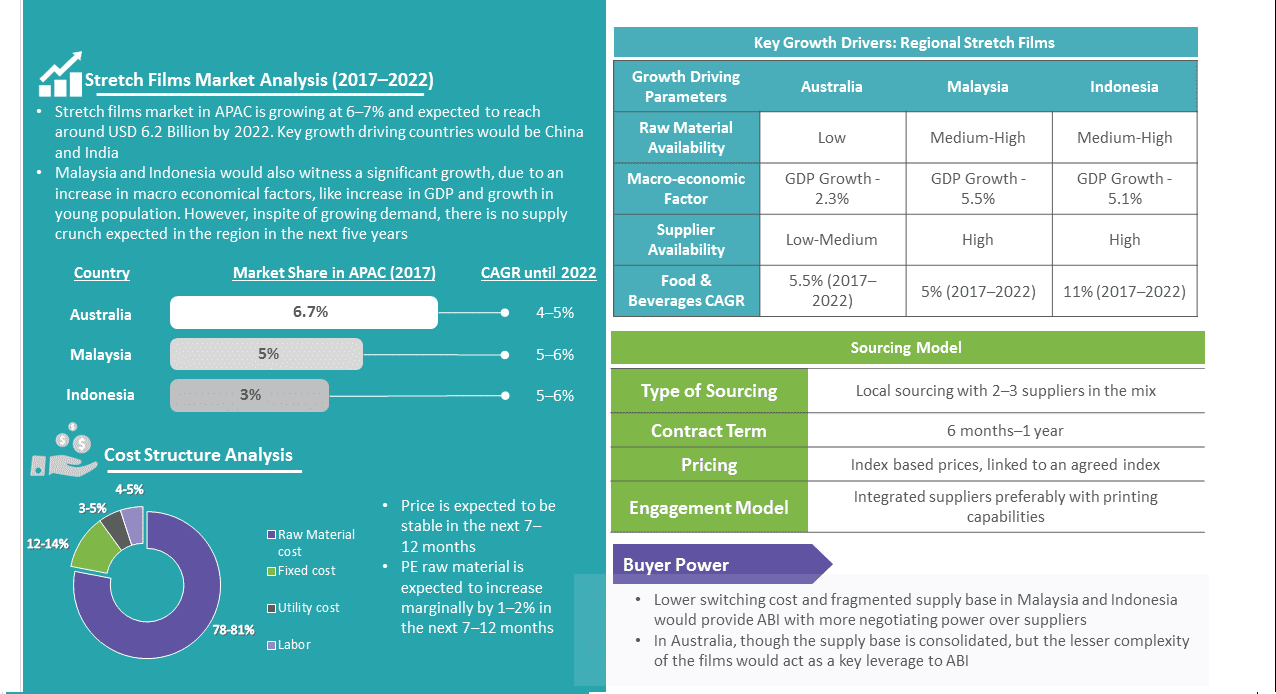

Regional Market Outlook on Stretch Film

The global stretch films market penetration is expected to grow considerably across the globe, due to the presence of strong supply base and increasing demand from end-use sectors, like food, beverage and industrial segment. The APAC is expected to lead the growth.Due to cost containment pressure in APAC and European markets, converters would likely to focus on technical aspects of the films such as down gauging and stretch percentage to enhance competition in the market.

Market Size and Growth: Stretch Films in Indonesia

The market would not face any availability issues in Indonesia, due to the presence of strong supply base, having the capability to meet the fast growing demand of stretch films. However, there could be challenges in finding suitable suppliers with additional capabilities of printing.

Increase in young population, economic growth are the prime reasons for the fast growth of stretch films packaging in this region. New investments in packaged foods, soft drinks, groceries and increase in consumer spending are likely to sustain future growth in Indonesia.

- Indonesian Stretch films packaging market is expected to grow at a CAGR of 5–6% to reach $0.18 billion by 2022, mainly driven by food and beverage and grocery demand

- Soft drinks & alcoholic beverages are expected to grow at a CAGR of 9.5% and 9%, respectively, higher than the food segment growth of around 7–8%

- Rapidly growing young population, rising disposable incomes had led to an increase in consumption of packaged foods in this market

- High GDP growth and low inflation rate has made a major influence in changing the buying patterns of the middle class group in Malaysia

- Increase in growth of modern retailing, like hypermarkets and supermarkets, especially in major cities of Indonesia, like Bekasi, Surabaya, etc., has made a major transformation in the buying formats in Egypt

- The growing supplier capabilities in the fragmented supply base of Indonesia is expected to meet the demand without any supply constraints

Market Size and Growth: Stretch Films in Malaysia

With the growing demand from food and beverage segment, buyers can consider exploring new supplier pools in Malaysia, who have significant capabilities to meet their demand and also can provide new innovative products.Increase in GDP. coupled with low inflation rate. would foster change in buying patterns of the consumers, directly influencing the growth of stretch films.

- Bottled water is expected to grow at a CAGR of 6%, followed by food & beverages segment, which is growing at a CAGR of 5%,

- Increase in population and rise in the disposable income had led to the growth in demand of large family pack sizes for non-alcoholic drinks in Malaysia

- Increase in GDP would facilitate the growth of income of the middle class group and would directly increase the purchasing power of the local consumers

- With reduced inflation rate, packaging converters have entered the market to cater the growing demand of retail consumption and e-commerce

- The fragmented stretch films supply base in Malaysia would meet the growing demand in terms of capacity and capabilities

Market Size and Growth: Stretch Films In Australia

Buyers have cheaper sourcing options from countries, like China, India, Malaysia, Indonesia, etc. However, they could also consider engaging with key local players, like DMI packaging, Maxpack, JMP Holdings, etc., who have significant capabilities to meet their demand.Large growth expected from bottled water and soft drinks are likely to accelerate volume addition and low-cost product advancements in the Australian stretch films packaging market

- The Australian Stretch films packaging market is expected to grow at a CAGR of 4–5% to reach USD 0.38 billion by 2022, mainly driven by baby food, bottled water, sparkling wine, etc.

- Baby food and bottled water, growing at CAGR of 6.6% and 5%, respectively, would likely to be the key growth drivers of stretch films in Australia

- Soft drinks (CAGR-4%) and dairy and soy food segments would be the other major segments demanding the growth

- Australia has lower GDP growth compared to Indonesia and Malaysia. However, lower inflation rate in the country would influence the change in buying patterns in Australia

Growth Drivers and Constraints: Stretch Films in Australia, Indonesia, Malaysia

Drivers

Growing end-use market

- Increase in growth for soft drinks and beverage packaging market is the major driver for stretch films demand

- Growth in retail industries, hyper markets and off license shops in outside the major cities in Australia, Indonesia and Malaysia would foster the growth of stretch films

Consumer buying pattern

- Growing bulk consumption of beverages with the growth of large format retail stores and hypermarkets

- With growing disposable income in Australia, Indonesia and Malaysia consumers are increasingly attracted towards packages like multipacks

Sustainability features

- Stretch films can also be easily recycled, landfilled or incinerated after usage, which contributes a major factor for its increase in demand in beverage packaging in Asia Pacific region

Constraints

Substitutes

- Increase in usage of reusable pallet wraps can act as replacement for stretch films in the Asia-Pacific region

Impact of Taxes

- Increase in talks on levying tax on sugary drinks in major APAC countries like Indonesia, Philippines, etc., might affect the beverage consumption demand in future. Thereby, it might affect a major segment of stretch film application

Trends: Stretch Films

Down-Gauging of Films

- Flexible packaging converters have continually strived to further reduce the stretch film thickness without compromising on the containment strength or using any additional layer of film

- Down gauging can reduce the overall stretch film costs by 20–25%, while maintaining the package security, and also reduce the overall waste to landfill content of the package

Renewable, Decomposable and Recyclable Films

- Sustainability and reducing the carbon footprint has been the prime area of concern for packaging over the last few years. Innovations, like biodegradable PLA and other bio-based resins, have helped to increase the sustainability factor of the stretch films packaging

Improved Printing Capabilities

- Printed stretch films eliminates the need for additional labels to incorporate brand communications. Films provide 360°print space and help brands to explore multiple points of differentiations and create unique products with high shelf-appeal

- Water-based inks are gaining preference among converters, as they are designed for surface printing on films and do not come into contact with the actual product packed inside

Increasing of Stretch Percentage

- Increase of stretch ability of more than 400% has been a major trend followed in stretch films. Suppliers are making major innovation in stretch films by increasing the percentage stretch, without affecting the integrity of packaging andmaintaining the load safety

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now