CATEGORY

Flexible Packaging Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Flexible Packaging Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Flexible Packaging Australia Suppliers

Find the right-fit flexible packaging australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Flexible Packaging Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoFlexible Packaging Australia market report transcript

Regional Market Outlook on Flexible Packaging

Increasing adoption in key end-use segments, such as food and beverages and personal care and home care as flexible packaging replace plastic containers, will drive growth in the Australian market.

APAC Flexible Packaging Market (2018–2021F)

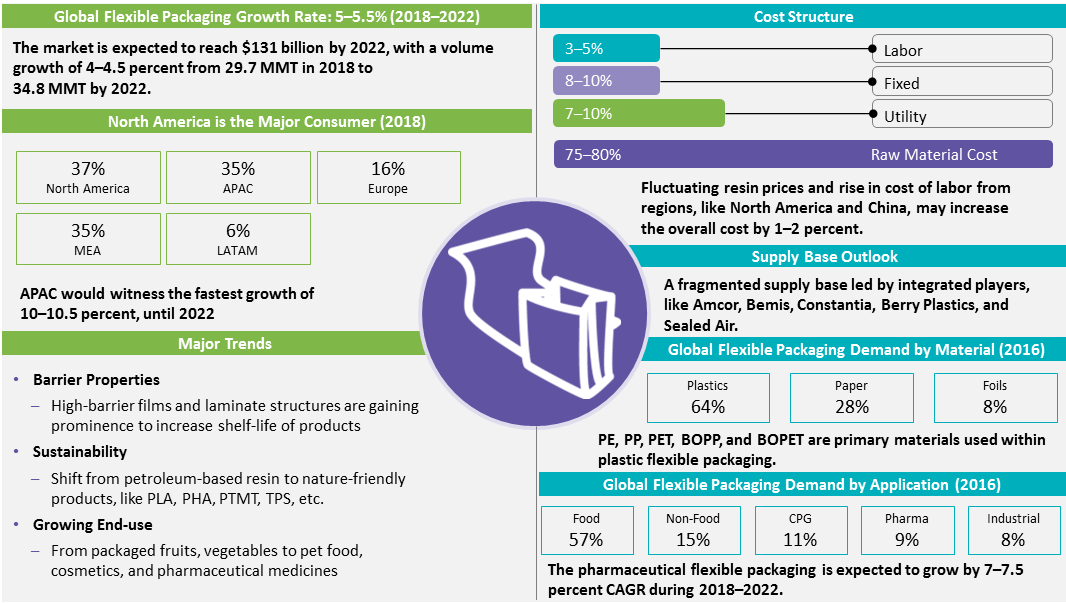

- Market Growth: The market is expected to grow from $2.25 billion in 2018 to $2.5 billion by 2023 at a CAGR of 2–2.5 percent. Australia and New Zealand are fairly mature markets, like the US, where consumers prefer enhanced product packaging with high-performance features

- Drivers: Increased penetration of flexible packaging options, such as stand up pouches and tetra-packs into segments, such as diary, sauces and condiments, beverages, and personal and home care, which were previously dominated by rigid packaging, is driving the growth in the Australia market

- End-use Segments: Food & beverages, personal care and home care are the key end-use markets driving the growth in the region with packaged foods segment forecasted to grow at about 4–5 percent CAGR over the next five years

- Newer products, such as stand up pouches and resealable, easy-to-use, and store packs, have witnessed high penetration in the packaged food segment as a result of increasing trend of on-the-go food consumption

- Trend: There is an increase in demand for BOPA film with major use in packaged food applications, due to the properties, like high tensile strength, broad operating temperature range, and excellent printability. China contributes to ~33 percent of the global BOPA film exports

Industry Drivers – Australia

End-uses Growth

- Being the largest end user, the growth is expected to continue with various countries adopting packaged food as a potential to reduce the food wastage

- Segments in packaged foods, such as condiments, sauces, and beverages, are forecasted to grow at about 5–6 percent CAGR and increasing adoption in these segments would further drive the growth

- Pouches and bags are the most common and preferred format across most of the food and beverage products

- Pouches in Retail-Ready- Packaging (RRP) offer convenience to urban customers who are shifting from rural areas

Barrier Properties

- Use of multi-laminate structures, coupled with superior functionality, aesthetics, and eco-friendly composition, have given flexibles an edge, over other packaging formats

- High performance films that increase the shelf-life and enhance flavors are on the rise

Sustainability

- Growing consumer awareness for sustainable and environmental-friendly alternatives has bolstered the growth of flexible packaging formats

- There has been a significant increase in the use of bio-degradable material, like corn, starch/potato-based resins to petroleum alternatives, which reduces carbon footprint by 10 percent or more

Market Penetration

- The Australian market has continued to witness increasing levels of penetration of packaged foods

- Products that offering health and wellness, or convenience and practicality are especially preferred by consumers and are forecasted to show above-average growth

- Multiple brands have redesigned their packaging to make it more environmentally friendly, further driving value growth

Cost & Space

- Flexible packaging formats are cheaper compared to rigid alternatives

- Saving is achieved by reducing the material (light-weighting upto 70 percent) and space utilized while transport. One truckload of empty pouches is equivalent to more than 75 truckloads of rigid containers

- Consumers perceive flexible packaging as economical and environment friendly

Porter's Five Forces Analysis – Australia

Supplier Power

- Australia depends on China and other Asian markets for its resin requirements

- The suppliers are often small to medium-sized regional players and the high competitiveness in the market lowers the bargaining power

- The indexed nature of the products commoditized the negotiation power of the buyers

Barriers to New Entrants

- The local market is dominated by small to medium-sized players who cater to mostly regional buyers

- The supplier switching costs in flexible packaging are low, hence it is not difficult to gain inroads into the market by providing cost advantages

- The technological capabilities and investments required for a flexible packaging plant are also low, further lowering barriers to new entrants

Intensity of Rivalry

- The market is highly fragmented, with major differences in production volume and product capabilities

- Price wars and value-added services drive the competition

- With increasing demand for sustainable packaging products from buyers, this has become a major competition point among converters

Threat of Substitutes

- There are no direct threat/substitutes for flexible packaging products, brick liquid cartons have prominence in beverage packaging

- On the resins front, starch (sugarcane)-based resins are gaining popularity over petroleum-based products, owing to functional advantages

- A growing propensity is observed for adapting to these resins at a global level

Buyer Power

- Food and FMCG manufacturers have higher bargaining power over suppliers, as they are the prime users of flexible packaging products

- Other end-users based on volumes negotiate with suppliers

- Their power is offset, when buyers look for customized and innovative services/solutions, where the supplier power increases

Flexible Packaging Australia Market Overview

- Large integrated global and regional suppliers, such as Amcor, Berry, and Integrated Packaging, dominate the market

- Competition is driven by product features, innovation, and service levels.

- Increasing adoption in key end-use segments, such as packaged foods and beverages, personal care, and home care, are some of the key factors driving the growth in flexible packaging products.

- Lack of significant capacity additions by global and regional players would continue to result in high growth in imports of flexible packaging products in Australia.

- Lack of large expansions in the regional supply for flexible packaging products has resulted in Australia, depending on imports to ensure adequate supply

- Exports have grown by about 4 percent CAGR over the last four years, with China and Malaysia accounting for the largest share of about 40 percent of the overall imports

- Malaysia has been the fastest-growing import market, owing to increasing investments by packaging majors in the flexible packaging Australia market

- Australia is a net importer of flexible packaging products with exports accounting for about 21 percent of the overall imports

- Vietnam and New Zealand account for about 45–50 percent of the overall exports of flexible films and packaging over the last four years

- Exports to Vietnam have grown at about 7 percent CAGR over the last four years, as the country has become one of the major trade partners

- Many markets in Australia have sustainable packaging regulations in place to govern the use of plastic food packaging

Why You Should Buy This Report

- Information on the flexible packaging Australia market supply and value chain analysis, demand by application, regional market outlook, trade dynamics, industry drivers and constraints, etc.

- Porter’s five forces analysis of the flexible packaging Australia industry.

- Key industry trends, innovations, and events.

- Supplier portfolio and SWOT analysis of major players like Amcor and Berry Plastics.

- Supplier engagement models.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now