CATEGORY

Bulk Drums

The report covers Plastic and Metal Drums and the demand dynamics across 4 regions

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Bulk Drums.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Mauser Packaging has set to open a new production facility in China.

March 14, 2023Mauser Packaging Solutions expands its production capabilities in China

March 09, 2023Sch?tz UK to expand its portfolio of eco-friendly packaging products in the Worksop site in UK.

February 20, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Bulk Drums

Schedule a DemoBulk Drums Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Bulk Drums category is 5.40%

Payment Terms

(in days)

The industry average payment terms in Bulk Drums category for the current quarter is 84.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Bulk Drums Suppliers

Find the right-fit bulk drums supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Bulk Drums market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBulk Drums market frequently asked questions

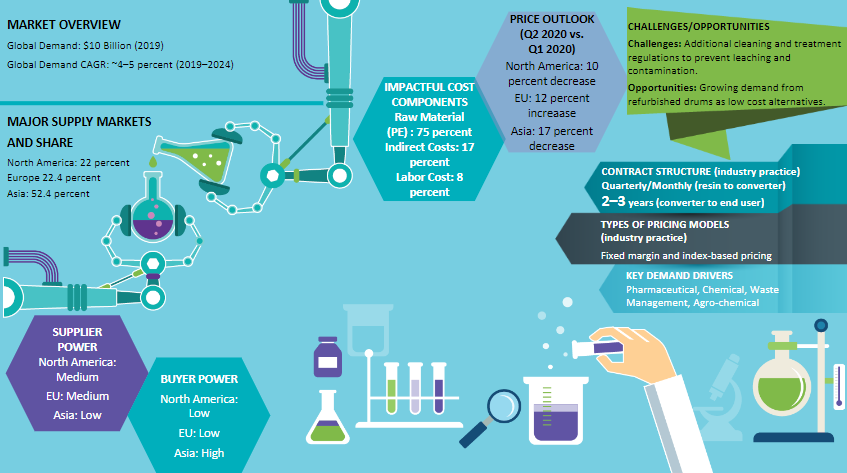

As per Beroe's analysis, the drums market is expected to grow at a rate of 4 ' 5 percent between 2017 to 2023 and will likely touch down a valuation of $11.9 billion.

Following the data from Beroe's report, it's evident that: Steel drums get 67% market share Plastic drums share 19% of the market Fiber drums get a 14% share of the market The same report also indicates that plastic drums will showcase the fastest growth of 6 ' 7 percent by 2021.

The key players of the drum market that capture the entire supply base are: Greif Mauser Schutz Time Technoplast

As per Beroe's report, the major trends that affect the industrial drums market are: Solventless coating An innovative drum valve system Drum reconditioning Two-layer plastic drums

As per Beroe's report, the best practices that are prevalent within the drums market include: Regional sourcing is given more preference due to low transportation cost and lead times Engaging with global suppliers having a regional presence is considered more beneficial All major global players are taking key initiatives in providing reconditioning of drums through their subsidiaries

According to Beroe's report, for steel drums, the cost components share is segregated as: Profit margin - 7 ' 10% Labor - 9 ' 10% Utility - 15 ' 16% Fixed - 16 ' 20% And, in the case of bulk plastic drums, the contribution is: Profit margin - 5 ' 8% Labor - 5 ' 7% Utility - 5 ' 10% Fixed - 10 ' 15%

The contribution of raw materials in costing for steel drums is 60 ' 65%, while in the case of plastic drums, it's 75 ' 80%.

As per Beroe's analysis, drum demand in the developing regions of APAC and LATAM will grow at a rate of 6 ' 7 percent and 5 ' 6 percent by 2022. It's primarily because of the growth in the end-use industries.

According to the fiber drums market trends report generated by Beroe, fiber drums are 10 ' 15 percent lighter and 20 ' 25 percent cheaper than plastic/steel drums and have better recycling options boosting their popularity. The same report also indicates that the market is matured and almost stagnant in the developed regions.

Bulk Drums market report transcript

Global Bulk Drums Market Outlook

- The global market for drums was valued at $ 10.0 billion in 2019 and is expected to grow at the rate of approximately 4-5 percent until 2024, reaching $ 12.74 billion. Steel drum, currently contributes to 67 percent of the global demand. However, demand for plastic drums is expected to have the fastest growth, of 6-7 percent, increasing its market share from 19 percent in 2019 to 20 percent in 2024

- Pharmaceutical and Food segment is expected to take away majority of the market share which was led by Chemicals industry owing to high demand from manufacturing of new vaccines for COVID and high demand from food production

.

Demand Market Outlook

Chemicals, agro-chemicals, and food and beverage industries are the major end-use segments driving the demand for industrial drums. APAC is witnessing the highest growth rate, around 6-7 percent

Global Market Size –Bulk Drums

- Steel drums will continue to dominate the market with a market share of more than 68 percent; whereas plastic drums are expected to reach 22 percent in 2022

- Drum demand in the developing regions of APAC and LATAM are expected to grow at 6-7 percent and 5-6 percent until 2022 due to the growth in end-use industries

- The global drum demand is expected to grow at 4-5 percent from 2017-2022 and reach approximately $ 11.5 billion by 2022

- Plastic drums contributed around 18 percent of the global demand for drums, and is experiencing strong growth owing to its cost and logistic advantages over its steel counterpart. However, steel drums will continue to dominate the market

- Fiber drums are 10-15 percent lighter and 20-25 percent cheaper than plastic/steel drums, and has better recycling options. However, the market is very matured and almost stagnant in the developed regions

Global Capacity –Demand Analysis of Bulk Drums

- The Global drums market is expected to grow at a CAGR of around 4.5-5 percent from 2017 to reach a value of $ 11.4 billion in 2022. This is due to the high end-use demand from chemicals, pharmaceutical and, the food and beverage sector

- Globally, the drums industry has an average utilization rate of 65-70 percent and the manufacturers are able to meet the demand without any supply constraints

Market Overview

Electricity generated from natural gas has been on the rise over the past 2–3 years in the U.S., which increased the drums price. In the developed markets, all the major drum manufacturers are involved in acquisitions, thereby creating intensive competition among suppliers. Ex: Mauser acquired Daniels Healthcare in the UK to increase its expertise in the medical waste industry. In the developing markets all the major players are involved in acquisition to consolidate market position. For example, Mauser acquired Greifs in Brazil and VIP Steel and National Packaging in Australia. In APAC apart from the global players there are many local manufacturers available who can cater to buyers demand which increases the buyer power.

Why You Should Buy This Report

The report gives details on the industrial drums market size, demand and supply outlook, major trends & innovation and industrial developments, supply chain analysis, global trade dynamics, import, export, etc. It gives the cost structure analysis and plastic drum price forecast for U.S., EU, Asia, LATAM, MEA. The report performs the SWOT analysis on major plastic drum supplier like Greif, Mauser, Schutz Gmbh, etc. It lists out the industry drivers and constraints, key trends, technological innovations, etc. and gives the Porter’s five force analysis of the developed and emerging regions.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now