CATEGORY

Laminate Films: North America and Europe

Laminate films report covers the demand dynamics in detail along with some of the key developments in laminate structures and printing

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Laminate Films: North America and Europe.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

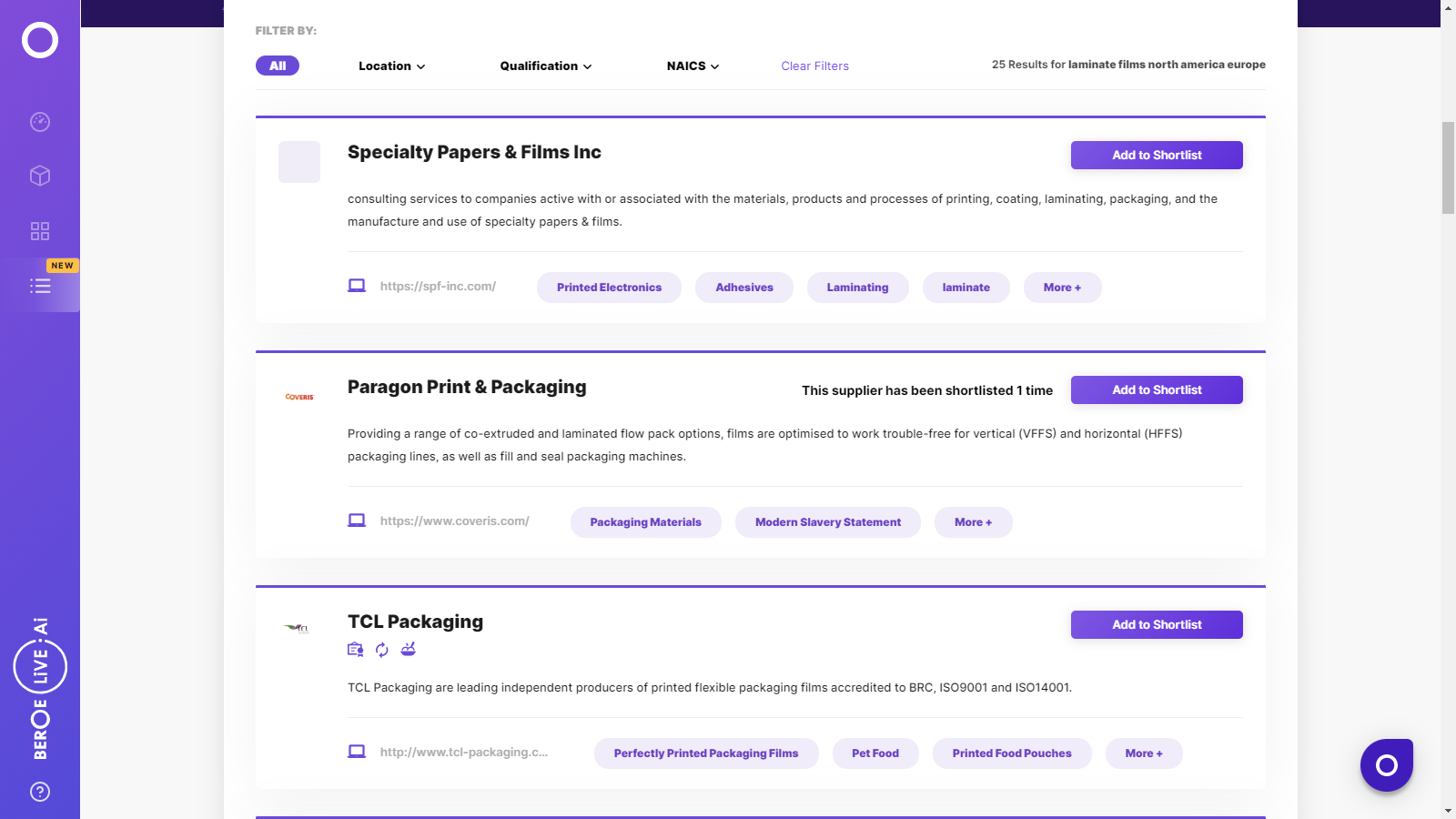

Laminate Films: North America and Europe Suppliers

Find the right-fit laminate films: north america and europe supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Laminate Films: North America and Europe market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLaminate Films: North America and Europe market report transcript

Regional Market Outlook on Laminate Films: North America and Europe

Global market size: $17.8 billion, growing at 6–6.5 percent until 2020.The stand up pouches market, growing at a CAGR of 4.5–5 percent until 2020, due to increasing shift from rigid to flexible packaging format, is the major reason for laminate film market growth.APAC leads the market with share of 38 percent, closely followed by Europe and North America.

- There is a larger trend of packaging shift from rigid to flexible formats across industries. This trend is expected to facilitate multiple innovations across barrier laminates for shelf life and aesthetic pouch designs in the near future.

- Laminate film growth in developing region flourishes by increasing demand from end-use segments with changing life style and

- increasing consumer spend. Mature markets are engaged with producing laminate structures to comply with the regulation demand.

- Global laminate film market is expected to reach $24 billion by 2022, growing at a CAGR of 6-6.5 percent

- Drivers: Rapid increase in demand for high barrier films for extending product's shelf life and shift from rigid to flexible packaging in food and homecare industries

- Supply base: The supply base is fragmented across the globe with the presence of large number of global and regional players in the market

The food and beverage industry holds the major market share of laminate film end use. However, the home care packaging market is expected to grow at a CAGR of 7-8 percent until 2021, due to majority of rigid to flexible packaging shift taking place in the home care industry.PE is one among the majorly opted layers in laminate film structure. PE resin prices are expected to witness a price rise of 2-3 percent in Q2 2018, which is expected to increase the PE film price by 1-2 percent in the same quarter.

- Adoption of flexible packaging for product portfolio extensions and new brand launches from established players in food, beverage and home care chemical industries are significant factors fueling the market growth

- Laminate film demand is increasing year-on-year, especially from pouch segment

- The global home care chemicals market is growing at a steady pace, with a CAGR of 4-5 percent until 2020, owing to rising demand from middle-class population, mass urbanization, and increasing awareness about health & hygiene

- PE is the majorly used film with a market share close to 70 percent, due to its increasing demand from food, pharmaceutical and homecare segments

- About 80-85 percent of laminate film uses layer of PE as a sealant to produce hot/cold sealing between the films

- Laminate film made of PET holds the second largest market share of laminate film market, preceded by PP made laminate film

Trends in Laminate Film

Sustainability is gaining increased importance in the recent times, especially in Europe and North America. Sustainability in material front is likely to be the key impactful development in the next five years. Recycled, bio-based, and bio degradable materials are likely to become more popular with the material availability barrier being overcome gradually.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now