CATEGORY

Blow-molded Plastic Packaging in Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Blow-molded Plastic Packaging in Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Blow-molded Plastic Packaging in Australia Suppliers

Find the right-fit blow-molded plastic packaging in australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Blow-molded Plastic Packaging in Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBlow-molded Plastic Packaging in Australia market report transcript

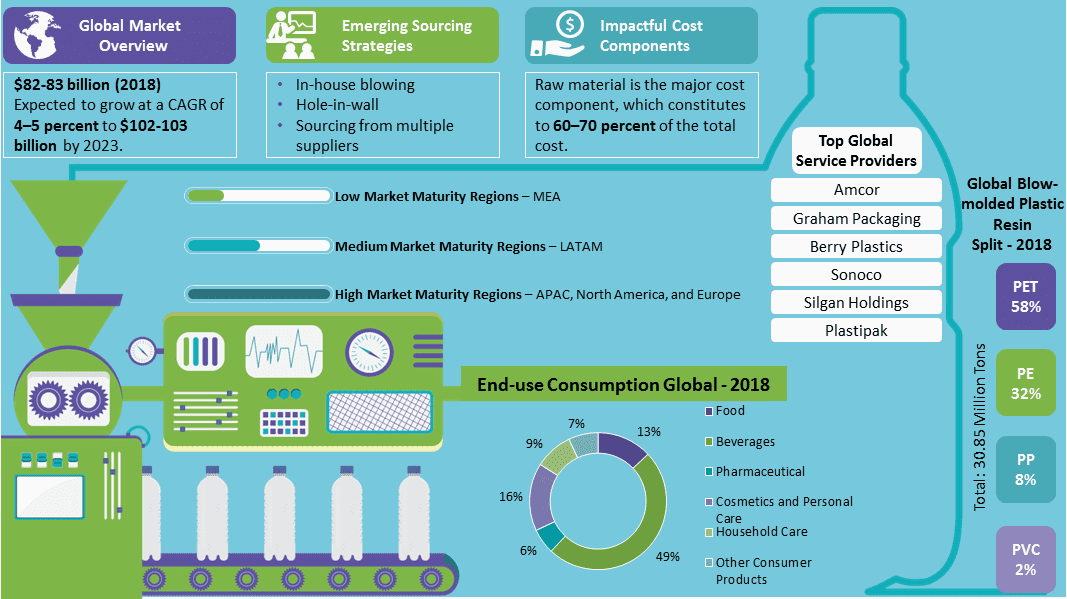

Regional Market Outlook on Blow-molded Plastic Packaging

The Australian blow molded plastics market is forecasted to grow at about 1.5-2 percent CAGR over the next five years driven by increasing demand from food and beverages segments such as bottled water, milk and processed dairy

- The blow molded plastic packaging market in Australia was estimated at about $2 billion in 2018 and accounts for less than 2% of the overall APAC demand

- Slow growth in end use segments such as beverages and personal care owing to the mature nature of the Australian market has led to the slow growth forecasts over the next five years

- Increasing penetration in segments dominated by metal and glass and increasing demand from milk and other dairy, and bottled water are the key factors driving growth, while technology advancements driving down overall weight and increasing cost pressures have moderated value growth in the market

- Buyer preference for more one-stop solutions has led suppliers to sign multiple technology sharing partnerships between major players

Porter's Five Forces Analysis: Australia

Supplier Power

- Major portion of feedstock is imported from China and other Asian markets

- The suppliers are often small to medium sized regional players and the high competitiveness in the market lowers the bargaining power

- The indexed nature of the products commoditized the negotiation power of the buyers

Barriers to New Entrants

- The barriers to setting up of blow molding facilities is quite low as the technological complexity and investment required is low to medium

- Also, many governments offer incentives to set up SMEs, which further facilities new entrants

Intensity of Rivalry

- Owing to the absence of many large integrated players, the market is dominated by smaller companies

- The companies offer similar levels of service and the competition is moderate owing to stagnated market growth

Threat of Substitutes

- Flexible packaging products such as standup pouches have made large inroads into segments dominated by blow molded containers such as beverages, personal care and home care

- Increasing sustainability of such products could potentially result in higher penetration in these segments, driving down demand

Buyer Power

- Large chemical and beverage companies are in a better negotiating position, due to their strong presence and large buying capacity

- In addition, buyers are generally large global customers who have broader reach for bottle sourcing

- Since innovations are driven by suppliers, it balances the power in the industry

Market Drivers and Constraints for HDPE and PET Bottles

Key factors such as increasing preference for flexible packaging options and low growth in purchasing power would moderate the demand growth of plastic blow molded bottles in Australia

Drivers

Penetration into Metal and Glass Containers

- PET and HDPE bottles continue to replace metal and glass containers in many key end segments including personal care and processed food products, owing to lower cost and weight

- Increasing sustainability of plastic bottles owing to developments in bio-based resins and higher recyclability has further helped drive this trend

Growing demand in Milk and Dairy segments

- The diary segment in Australia is forecasted to grow at about 4 percent CAGR over the next five years as a result of growing penetration in the market

- This market is expected to be the key growth driver for plastic bottles over the period

Constraints

Alternative packaging solutions

- New flexible packaging options such as pouches and tetra packs continue to make heavy inroads into rigid plastic packaging owing to higher sustainability and lower transportation costs

Demographic factors

- The population growth rate in Australia is forecasted at about 1.5 percent over the next five years. The population is also almost equally distributed between the ages 10-50

- As a result, there would be no significant increase in the key spending demographics over the next 10 years

Australian Blow-Molded Market Overview

- Australia has few medium sized global suppliers such as PACT Group and VISY packaging. Majority of the market is supplied by small to medium-sized regional players including PB Packaging and PlasPak

- The demand is dominated by global and regional beverage firms who mostly source standard products with low to medium levels of customization

- Major companies manufacturing blow-molded bottles are trying to set up their own manufacturing plants in emerging regions, due to low costs for a bottle, high growth of end-use industries, and low transportation costs

- Regional players in Australia have begun improving the sustainability quotient of their products by adopting bio-based and biodegradable resins and through technology sharing with other converters

- For large volume requirements, it would be beneficial to source from suppliers located near the filling facilities. This would help to reduce high logistics cost and increase efficiency

- The in-house blowing method will be beneficial for large players, which will give them better bargaining power

- For customized designs and large volume purchase, the most preferred model would be hole-in-wall

- Bioplastics are expected to be the focus of development for the next 10 years

- The market for bioplastic packaging is expected to grow at a CAGR of approx. 37–38 per cent and reach 7.5 million metric tons in 2019

- Bioplastics consume lesser energy than petroleum-based plastics. Initiatives, like reducing waste and increased recycling, are catalysts in promoting the use of bioplastic products

- With an increased focus toward environmental protection and sustainability, products with low carbon footprint are increasingly popular

Why You Should Buy This Report

- Information on the Australian blow-molded plastic market size, market maturity, major trends, regional market outlook, etc.

- Porter’s five forces analysis of the Australian blow-molded plastic industry

- Market drivers and constraints

- Supplier analysis, etc.

- Best procurement practices, innovations, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now