CATEGORY

Blow Molded Plastic Packaging

The report covers Blow Molded Packaging across food, beverage, personal care and health care segments. The demand dynamics and trends are covered across 4 regions

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Blow Molded Plastic Packaging.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Blow Molded Plastic Packaging Suppliers

Find the right-fit blow molded plastic packaging supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Blow Molded Plastic Packaging market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBlow Molded Plastic Packaging market report transcript

Global Blow-molded Plastic Packaging

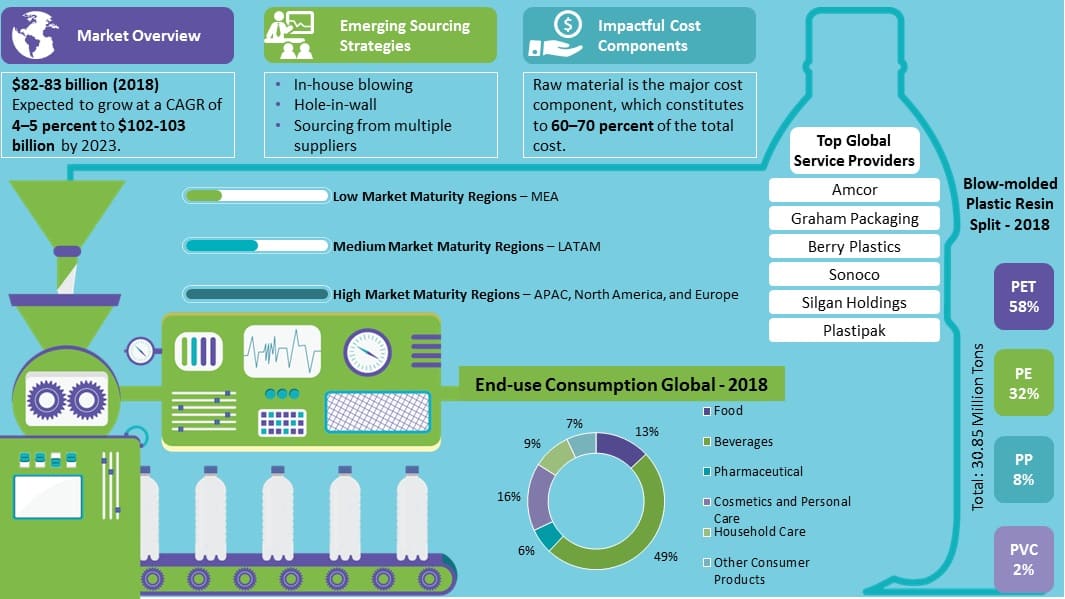

- The global blow-molded plastic market was valued at $82-83 billion in 2018, and it is forecasted to grow at a CAGR of 4–5 percent to reach around $102-103 billion by 2023, mainly driven by the growing consumption of beverages

- The APAC market is forecasted to grow at a CAGR of 7–8 percent during the five-year period until 2023. The North American and Western European markets are matured and expected to grow at 2–3 percent, which is driven by personal care and beverage segments

- Innovation and technical advancements in blow-molded plastic bottle manufacturing process will facilitate a consequent increase in the production of such bottles

- The global blow molded plastics market was $82-83 billion in 2018 and is expected to grow at a CAGR of 4–5 percent to $102-103 billion by 2023.

- Raw material is the major cost component, which constitutes to 60–70 percent of the total cost.

- Top global molded plastic packaging service providers are Amcor, Berry Plastics, Sonoco, Silgan Holdings, and Plastipak.

Major Global Trends in Plastic Bottles - HDPE and PET

Bioplastics

- Bioplastics are expected to be the focus of development for the next 10 years

- The market for bioplastic packaging is expected to grow at a CAGR of approx. 37–38 percent and reach 7.5 million metric tons in 2019

Impact

- Bioplastics consume lesser energy than petroleum-based plastics. Initiatives, like reducing waste and increased recycling, are catalysts in promoting the use of bioplastic products

Sustainable solutions

- With an increased focus toward environmental protection and sustainability, products with low carbon footprint are increasingly popular, which, in turn, has led to many advancements in the bottles sector

Impact

- As the world is shifting toward environmental friendliness and sustainability, eco-sustainable bottles will continue to foster green practices with expected introduction of new regulations relating to environmental sustainability

Multilayered bottles

- Increased preference of multilayered plastic bottles, especially in the cosmetics and personal care segments, owing to better light and gas-barrier properties, result in enhanced shelf life of the product

- Bi-injection and co-injection technology can help to incorporate multiple layers of polymers, which can ensure best-barrier coating and improved product life

Impact

- Multilayered PET bottles are gradually replacing HDPE and PP on grounds of being more durable, transparent, and due to superior barrier properties

Regional Market Outlook

- APAC is expected to witness a significant growth and contribute to approx. 40 percent of the global bottles demand by the end of this decade, majorly driven by the consumption in beverages market, growing at a CAGR of approx. 10 percent from 2018 to 2023

- China is the largest national market in the region, followed by Japan and India

- Cosmetics and personal care segments contribute to approx. 14 percent of blow-molded bottle consumption, and they are expected to grow at a CAGR of 4 percent. This segment is likely to be driven by growing consumption in APAC and also growing innovations in bottle designs across cosmetic segments

- Due to the presence of emerging countries in the region, it remains as a key market. As there are innovation and improvement in technology, buyers are investing more in this market

Blow Molded Plastics Market Overview

- The blow molded plastics market is fragmented, with a very large number of players operating, leading to an intense rivalry.

- With the scope for innovation, suppliers are investing in product differentiations and customization to stay ahead of the competition.

- Large chemical and beverage companies are in a better negotiating position, due to their strong presence and large buying capacity.

- In addition, buyers are generally large global customers who have broader reach for bottle sourcing.

- Since innovations are driven by suppliers, it balances the power in the molded plastic packaging industry.

- Substitutes, like tetra packs and flexible pouches, pose a sense of replacement threat to plastic bottles, especially in home care and personal care space.

- High capital investment, to achieve economies of scale, delays the break-even point for newcomers.

- However, the fragmented nature of the molded plastic packaging industry could allow an easier access for new players with investing capabilities to enter the market.

- Large chemical and beverage companies are in a better negotiating position, due to their strong presence and large buying capacity.

Why You Should Buy This Report

- Information about blow molded plastics market size, maturity, global trends, regional outlook of North America, APAC, LATAM and MEA regions.

- Market drivers and constraints, supply trends and insights, SOWT analysis of major players in the molded plastic packaging market such as Berry Plastics, Graham Packaging, Amcor, etc.

- Cost structure, pricde and profit analysis.

- Sourcing models, innovations, and sustainability trends.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now