CATEGORY

Glass Bottles in Iberian Peninsula

The repot covers some of the key developments in the glass supply scenario of Iberian peninsula. The report also covers alternative sourcing options for the region

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Glass Bottles in Iberian Peninsula.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

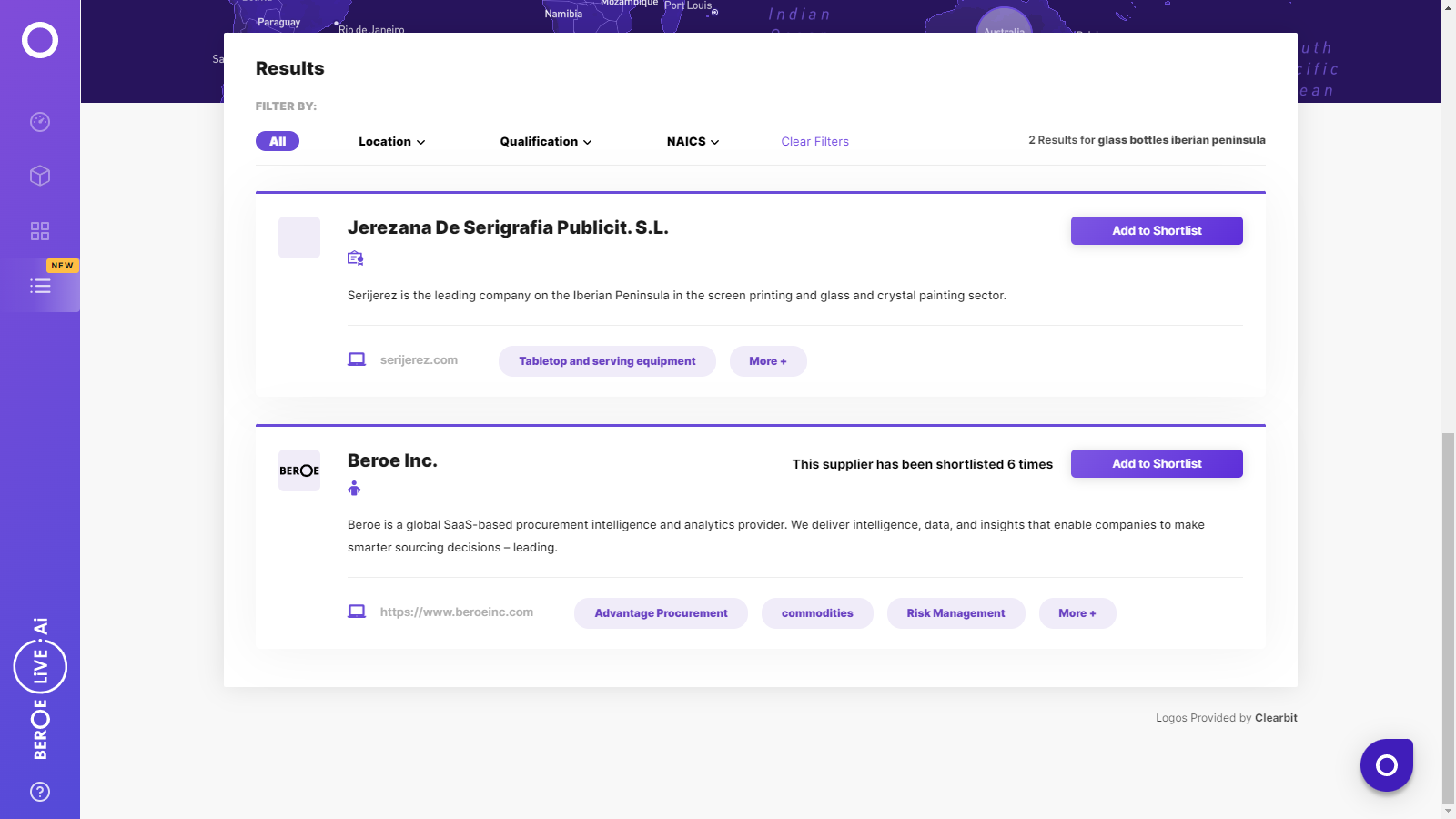

Glass Bottles in Iberian Peninsula Suppliers

Find the right-fit glass bottles in iberian peninsula supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Glass Bottles in Iberian Peninsula market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoGlass Bottles in Iberian Peninsula market report transcript

Regional Market Outlook on Glass Bottles

With premiumisation driving growth in beer market, Buyers can consider engaging with innovative and decorative suppliers in the market to introduce premium bottled products in this region.

Large global players housed in this region ensure continued supply over concerns of supply tightness. Beverages demand is expected to be around 4-5% through this year.

- Rising energy cost and weak downstream consumption, especially in beverages has lead to sluggish growth of glass containers market in Europe. The key alcoholic beverages like: Spirits (CAGR 1-2%), Wine (CAGR 1-2%) and Beer (CAGR 0-1%) are expected to have a sluggish growth in the next 3-5 years. Also, other smaller segments like Cider, Packaged Water & RTD are estimated to growth at a CAGR of only 1-2% from 2017–2022

- Germany, France and Italy are the production hubs in Europe and contributes around 45% of total production volumes. Poland (7.4%), Turkey (14.8%) & South East Europe (2.9%) have marked the highest percentage production growth rates in the three years

- Glass manufacturing in Europe is growing through a series of developments in terms of reconstruction of old furnaces or installing high end inspection system, mold heaters, automatic gas lehrs, etc. to reduce energy consumption and carbon footprint

Iberian Peninsula Trade Outlook – Glass Containers

Net Exporter during 2017

Portugal was the second largest exporter for glass containers within Europe second to Germany. It had a Trade Surplus of USD 298 million.

Trade Outlook

- BA Vidro is the largest manufacturer (~30% market share) of glass containers within Portugal with 25% of its sales volumes from exports

- Export quantities have increased steadily over the past 5 years growing at 3-4%

Drivers

- Spike in beer consumption is a primary reason for the production and export of glass bottles from this country

- Suppliers improving their export warehouses providing on-time delivery are complimentary factors for Portugal being the net exporter

Net Importer during 2017

Spain was the second largest importer for glass containers within Europe second to France. It had a Trade Deficit of USD 205 million.

Trade Outlook

- Import quantities have grown steadily at 9-10% with seismic increase in imports from France (32-33%) and Italy (25-26%) over the past 4 years

- Last year, imports from France increased by 15% clearly indicating the country's sourcing preference compared to Portugal

Drivers

- Spain leads Europe with 1,600% growth in craft beer industry which has increased the demand for specialty bottles

- This has resulted in the growth of imports from France and Italy where supply base for manufacturing specialty bottles is more compared to Spain

Glass bottles trade between Spain and Portugal are primarily due to geographical proximity. Importing glass bottles from Germany or Belgium would increase transportation cost by 5 times.

France has grown to be a viable sourcing destination within Iberia and is expected to progress in the future.

Iberian Peninsula – Beverage Glass Containers Market

- Per capita beer consumption within Spain was 68 lts/yr/person during 2017 and is expected to increase in the next 2-3 years with craft beer and healthier beer varieties gaining ground in this market.

- Along with this, the per capita consumption of wine in Portugal was 55 lts/yr/person during 2017 and is expected to post moderate growth with increasing tourism and growing myriad of niche wines that require specific packaging formats like glass containers

- In Spain, demand grew by 4-5% during 2017as opposed to the 2-3% growth. This growth was primarily due to a lot of MNC's investing in craft breweries.

- Beer consumption in Portugal grew 10% Y-o-Y during 2017 which was a primary factor for the growth of amber glass bottles in this region.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now