CATEGORY

Aluminium Aerosol Can Price Drivers

The report covers Key price drivers and their short term price forecasts.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Aluminium Aerosol Can Price Drivers.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Aluminium Aerosol Can Price Drivers Suppliers

Find the right-fit aluminium aerosol can price drivers supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Aluminium Aerosol Can Price Drivers market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAluminium Aerosol Can Price Drivers market report transcript

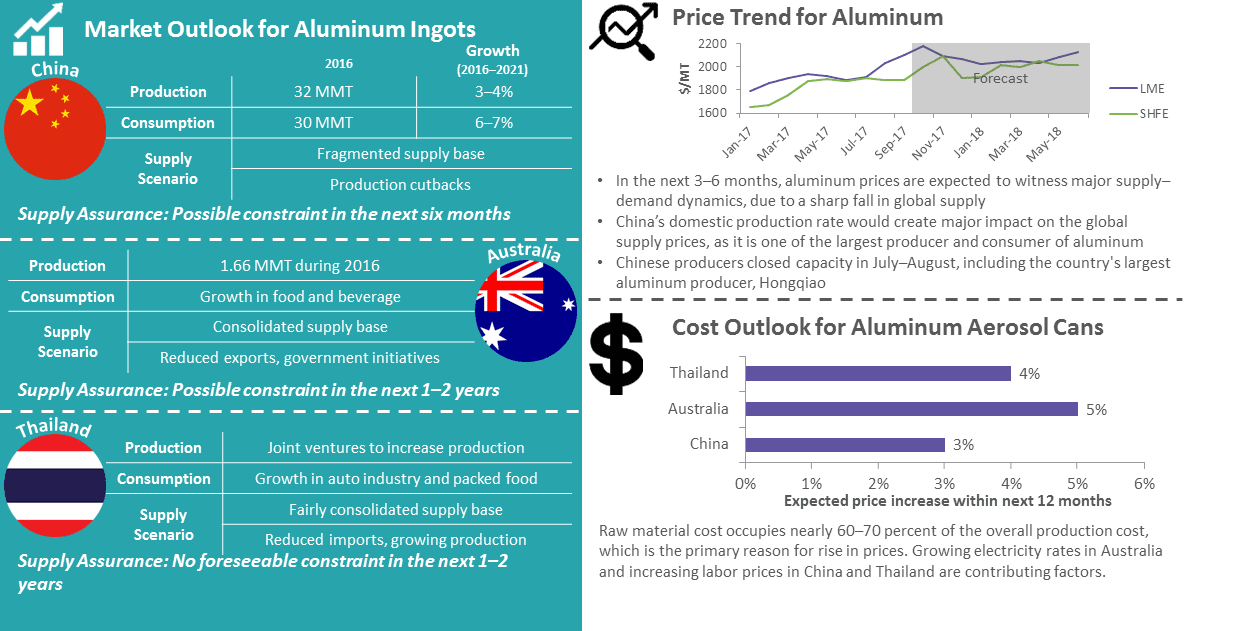

Aluminum Ingots Production and Consumption Outlook: China

Decreasing alumina stockpiles and reducing imports from Australia and Indonesia are contributing factors to supply constraints.

Domestic aluminum ingot inventories have increased steadily from start of this year, due to commissioning of new capacity. Growing operating rates from 55 percent to 60 percent during 2014–2015 to more than 65 percent from 2016 indicates a positive trend for aluminum ingot supply within this region.

End-Use Market Growth (2016–2021)

End-Use Market Growth (2016–2021)

- Aluminum demand from the packaging sector was up by 20 percent during January–September this year, marked by a spike in food and beverage consumption

- Packaging occupies 17 percent of aluminum consumption in China during 2016

- Food and beverage accounted for nearly half of the demand within packaging, followed by pharmaceutical and personal care

- Demand from construction, transportation, and electrical grew only by 8 percent during the aforementioned period

- Growth in secondary aluminum alloy (ingot) was primarily due to growing transportation industry, especially automotive and aircraft industry

- Once monsoon season ends by Q2 2018 in Australia and Indonesia, alumina supply will stabilize. Expected production increase will witness China as a net trader of aluminum ingots in Asia within 1–2 years.

Aluminum Ingots Trade and Supply Market Overview: China

In 2016, China maintained a trade surplus for aluminum ingots, despite capacity curtailments and stringent regulations from governing bodies globally. China will resurge in the market over a year and remain the prime exporter of primary aluminum and aluminum semis (ingots) within Asia.

Aluminum Ingots Trade Market - 2017

- Exports have reduced by ~13 percent from 2015 to 2016 with almost 45–50 percent reduction of exports to Korea

- Despite stringent regulations and intervention from global bodies, China remains the largest exporter of aluminum to the US, which increased by ~14 percent from 2015

- Imports have reduced by ~25 percent from 2015 to 2016 with nearly 42 percent decrease in imports from Korea

- There has been a stagnation in the construction and transportation sectors, which has resulted in the local production being consumed

Supply Scenario for Aluminum Ingots in Australia

Industry can consider multi-sourcing from other countries within Asia to ensure assurance of supply for the next year. Increasing electricity prices and shortage in alumina supply are factors to be considered while engaging with a supplier in this market.

Though government initiatives look to curb exports and improve the capacity of aluminum smelters and converters, rising electricity prices pose a major hindrance for growth of aluminum ingots.

Aluminum Production and Consumption Forecast

- Currently, there are four smelters operating out of Australia who have produced 1.66 million tons during 2016

- Producers, like Alcoa and Rio Tinto, have slashed production by 10 percent or more due to record low electricity generation and prevailing energy crisis

End-Use Market Growth (2016–2021)

- Growing consumer appliances demand and shift towards multi-functional devices are the primary drivers for increased demand from electronics and electrical industry for aluminum ingots

- Food and beverage remain the largest consumers of aluminum within the packaging sector

Aluminum Ingots Trade Market - 2017

- Exports in Australia have reduced nearly 95 percent from 2014, due to Rio Tinto exiting the Australian market

- The market is mainly an import-oriented market with imports increasing ~14 percent from 2015 to 2016

- Trade deficit indicates a limited supply, but this is expected to change with Rio Tinto, announcing its entry back to Australia

Supply Market in Australia

- Supply Base – Consolidated

- Top Suppliers – Alcoa, Rio Tinto, CSR Limited

- Supplier trends – Rio Tinto cut 14 percent output in their Gladstone facility

- Alcoa restored production in their Portland facility, post government intervention

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now