CATEGORY

Packaging Tubes

The report covers Aluminum, Laminate and Plastic Tubes. Demand trends are covered for each of the tube types

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Packaging Tubes.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Packaging Tubes Suppliers

Find the right-fit packaging tubes supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Packaging Tubes market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPackaging Tubes market report transcript

Global Market Outlook on Packaging Tubes

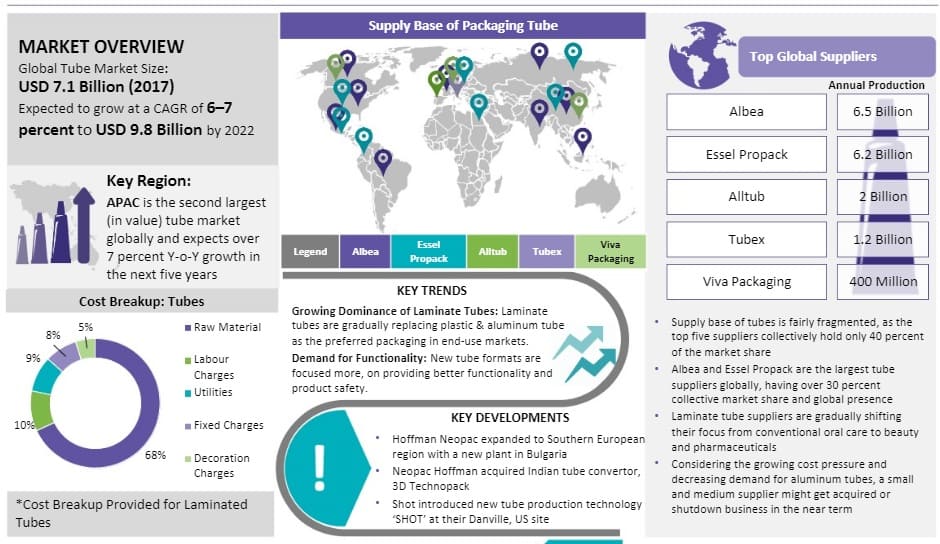

- APAC, LATAM, and the Middle East expect the highest consumption growth in the next 3–5 years, owing to increased disposable income, urbanization, and increasing spend on beauty and healthcare products

- Cosmetics and oral care products will continue to lead the tubes consumption with over 55 percent of share

- Laminated tubes will witness the fastest growth, especially in the emerging markets, owing to its low cost of production, coupled with high demand, from the toothpaste and beauty care segments

- APAC is the second largest (in value) packaging tube market globally and expects over 7 percent Y-o-Y growth in the next five years.

- The top global suppliers in the tube market are: Albea - 6.5 Billion, Essel Propack - 6.2 Billion, Alltub - 2 billion, Tubex - 1.2 Billion, Viva Packaging - 400 Million.

- Key trends in the packaging tube market: Growing Dominance of Laminate Tubes: Laminate tubes are gradually replacing plastic & aluminum packaging tubes as the preferred packaging in end-use markets.

- Demand for functionality: New tube formats are focused more, on providing better functionality and product safety.

- The cost breakup of the tube packaging market: Raw Material - 68%, Labor Charges - 10%, Utilities - 9%, Fixed Charges - 8%, Decoration Charges - 5%.

Regional Demand Overview

Global tube market is gradually moving toward consolidation, as suggested by the recent M&A activities globally. Tube manufactures are attempting to increase the production capacity, at the same time deliver high aesthetic value products, to tap the growing demand of premium products, especially from the cosmetics market

Global Market Outlook of Tubes

- The tube market is likely to experience a strong growth in the next five years, driven by the rapidly growing consumption of personal care products in APAC and LATAM

- Growing concerns over package sustainability and costs are also likely to facilitate substitution of bottles by tubes

- The global tube market expects a significant growth of CAGR 6–7 percent from 2017 to 2022, owing to the increasing use of flexible packaging formats in nearly all key downstream segments, especially cosmetics and personal care. Oral care market is a major driver, with a CAGR of 5 percent in the forecast period

- APAC is expected to drive growth in the next five years, with over 8 percent CAGR in 2017–2022, owing to the rising per capita income in the key markets, like India, China, Malaysia, Thailand, etc., coupled with the growing rate of urbanization, fostering increased consumption of FMCG products

- APAC is the largest manufacturer of tubes, with around 13.3 billion units of the annual produce in 2017, closely followed by Europe and North America. Both Europe and North America are expected to witness a 3–4 percent Y-o-Y growth rate in the next 3–5 years, driven by growing penetration of tubes in food, personal care, and industrial segments

- Concerns over sustainability and growing preference of innovative packaging over traditional formats, like glass, metal, and plastic containers, have lead to the preference of tubes in personal care, pharma/healthcare, and oral care market globally

- In the next five years, squeeze tubes are expected to have the strongest growth with the growing demand from the skin and oral care segments

- Sustainable and cost-efficient tubes, with better barrier properties, would be the focus of brand owners in the near future

- The European aluminum packaging tube market is estimated to have a sub-par growth rate till 2023, majorly due to a sluggish economic growth, weak demand from key downstream segments, and a gradual shift in the preference of laminate tubes.

- Plastic tubes are ~50 percent lighter than bottles and are recyclable, which is likely to make it a preferred packaging format by the personal care brand owners

- Strong growth in the cosmetics market in APAC and LATAM is expected to fuel plastic tube growth in the next five years.

- Laminate tubes are the largest tube segment (~50 percent volume share) globally, and also, they expect the fastest growth in the near future

- In the next five years, extruded tubes are also likely to be substituted by laminate tubes, especially in the skin care and pharma/healthcare segments.

Why You Should Buy This Report

The report gives analysis on the global, European, LATAM and North American tube market for aluminum, plastic and laminate tube packaging. It gives Porter’s five force and SWOT analysis of emerging and developed markets. The report lists out the key trends and innovations in the tube market and does a cost breakup and analysis. The report does a SWOT analysis for key players in the tube packaging market like Albea, Essel Propack, Berry Plastics, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now