CATEGORY

Packaging Tubes Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Packaging Tubes Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Packaging Tubes Australia Suppliers

Find the right-fit packaging tubes australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Packaging Tubes Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPackaging Tubes Australia market report transcript

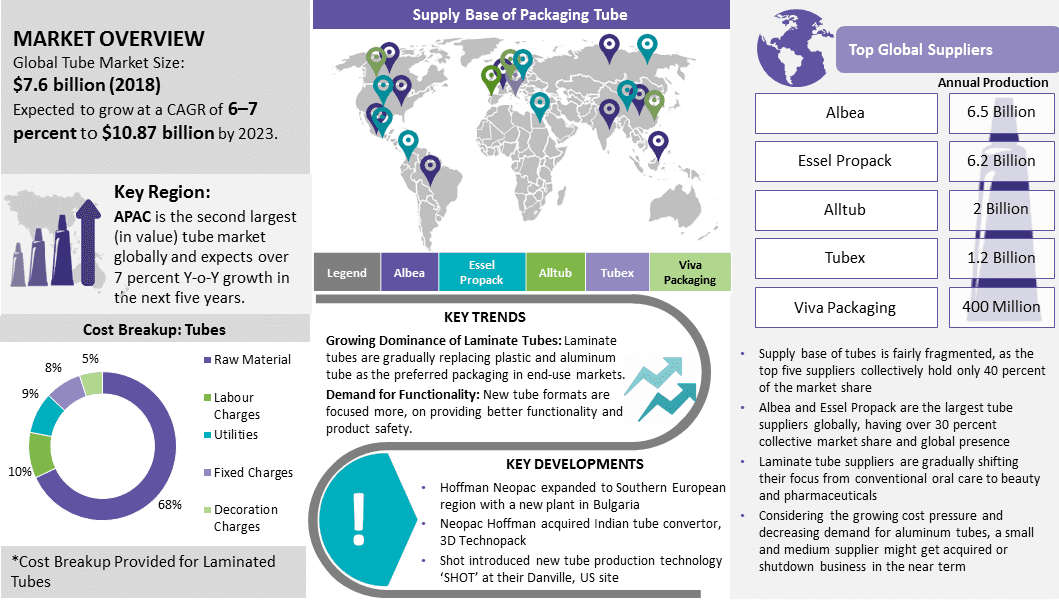

Regional Market Outlook on Packaging Tubes

- The personal care industry would continue to maintain its dominance as the key end-use market for laminated tubes in Australia

- Due to cost-saving opportunities and improved barrier protection & decoration, laminate tubes are expected to gradually replace plastic & aluminum in the cosmetics and pharmaceutical markets in the near future

- The Australian packaging tubes market is valued at around $82 million in 2018, and it is expected to reach around $87 million in 2023. The market is anticipated to have sluggish growth in the next five years, due to the matured nature of the market

- However, demographic factors, like demand from middle-class families, with high disposable income and increasing preference for convenient-sized packaging, would help to sustain the growth, particularly in the personal care and pharmaceutical segments

- High barrier properties in aluminum tubes and enhancements in decorations in laminated tubes would drive the demand in pharma and personal care segments, respectively

- The supply base for packaging tubes in Australia is relatively smaller, with the presence of small to medium-sized players. Amcor is the only global player with a presence in Australia

Global Packaging Tube Drivers and Constraints: Laminated Tubes

Drivers

High Growth in Oral Care Market

-

Oral care is the largest end-use segment for laminate tubes, with over 70 percent of the market share

- Increasing awareness of oral hygiene, especially in the developing markets, like India, China, etc., has triggered almost double-digit growth rate in these regions

Growth Opportunity from Alternative Markets

- Owing to the cost competency, high printability, and barrier properties, laminate tubes are gradually expanding into various end-use markets, especially in cosmetic application

- ABL tubes are gradually replacing aluminum tubes in the pharmaceutical healthcare application and PBL, replacing extruded plastic tubes in the cosmetics segment

Flexibility in Printing and Decoration

- Owing to the increasing preference of esthetics and shelf appeal, tube convertors are gradually switching to lower cost laminate tube packaging format, which can provide excellent printability and decoration flexibility

Strong Raw Material Supply

- Leading polyethylene resin producers, like Dow Chemicals, Sabic, Borealis, etc., run at sizeable production volume, with low to marginal price fluctuation throughout the year

- The strong supply base provides tube converters low risk of supply disruptions and stable pricing

Constraints

Recycling Challenges

- The laminate tube body is manufactured using multiple resins, e.g., LDPE body, HDPE shoulder neck, and PP cap, which makes recycling of these tubes very challenging, and hence, a less sustainable packaging format

Strong Dominance of Plastic Tubes in Cosmetics

- Although, PBL is emerging as a strong alternative to extruded tubes. But, the laminate tube penetration in the cosmetics segment is still low at ~14 percent. Also, plastic tubes, unlike laminate tube, have bounce-back properties, seamless design, and high esthetic value, which makes it a highly preferred option for the beauty segment

Porter's Five Forces Analysis

Supplier Power

- Due to low switching cost and fragmented supply base, suppliers would tend to have low bargaining power

- Recent drop in crude oil price is also expected to bring down the production cost of PE resins, further skewing the power in favor of convertor

Barriers to New Entrants

- Barrier for new entrants will be very high, owing to the presence of large global players, such as Albea, Essel, Alltub, Berry, etc., with long-term supply agreements, with global oral and cosmetic companies, such as Unilever, P&G, Colgate, etc.

- Advancements in the dispensing systems also increase the production complexity and cost, thereby increasing entry barrier

Intensity of Rivalry

- Supply base in the developed market is fragmented, especially in Europe, with presence of multiple large-scale players competing the market

- Local rivalry is further intensified, owing to the growing complexity of tube design, sustainability, and decoration, which is also causing large number of acquisitions in the market

- The supply base is fairly consolidated with large players, like Albea, Essel, Alltub, Visipack, etc., catering to majority of regional cosmetics and pharmaceutical demand

- However, large players, like P&G, Colgate, and L'Oreal, owing to their large contracted volume, can negotiate for volume discounts

Threat of Substitutes

- Innovative injection-molded tube can pose a significant threat to laminate and plastic tubes, owing to better sustainability, printability, and recyclability

Australian Packaging Tubes Market Overview

- Global suppliers across all tube formats, like Albea, Essel, Berry Plastic, Viva Packaging, Alltub, etc., have majority of production facilities set up in the developed markets, hence making the regional supply base strong

- Innovations: In order to cater to the increasing demand for high-end closure/dispensing systems, global players are constantly investing in R&D activities to develop innovative packaging solutions

- Recycled Resins: Owing to the growing need for sustainability of the product and production process, large converters are investing to develop recycled tube formats, with over 50 percent of PCR contribution in the tube production.

- Recycling Challenges: Strict regulations reduce landfill and eco-toxicity in the developed markets have increased challenge, especially for laminate and plastic tube convertors to recover and recycle, as these tubes are produced using multiple resins, hence the recycling becomes a complex process

- Substitution from Alternative Formats: Injection-molded plastic tubes are expected to gain market penetration, especially in cosmetics and pharmaceutical packaging, owing to its better decorative features and low carbon footprint

- Laminate tube convertors are gradually shifting their market focus from their largest end- use segment. Oral care to cosmetics and pharmaceutical segments, as oral care demand is getting matured, especially in the developed regions. Also, laminate tubes are gaining popularity among personal care companies, owing to their low-cost nature and high barrier properties.

- Sustainability is a major concern for plastic tubes, as containers and components are manufactured using different feedstock. Hence, recycling is challenging. Biodegradability, fluctuating resin prices, and energy shortage have pushed the tube manufacturers to incorporate an environment-friendly approach.

Why You Should Buy This Report

- Information on the Australian packaging tubes market including the value chain analysis, cost breakup, global market outlook, drivers and constraints, etc. of plastic, aluminum and laminate tubes.

- Porter’s five forces analysis, SWOT analysis and key industry trends and innovations in the packaging tubes market.

- Supplier analysis

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now