CATEGORY

Pharmaceutical Contract Packaging North America

Contract packaging market is anlysed for both demand trends and regualtions. Key suppliers catering to the market is alos covered

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pharmaceutical Contract Packaging North America.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

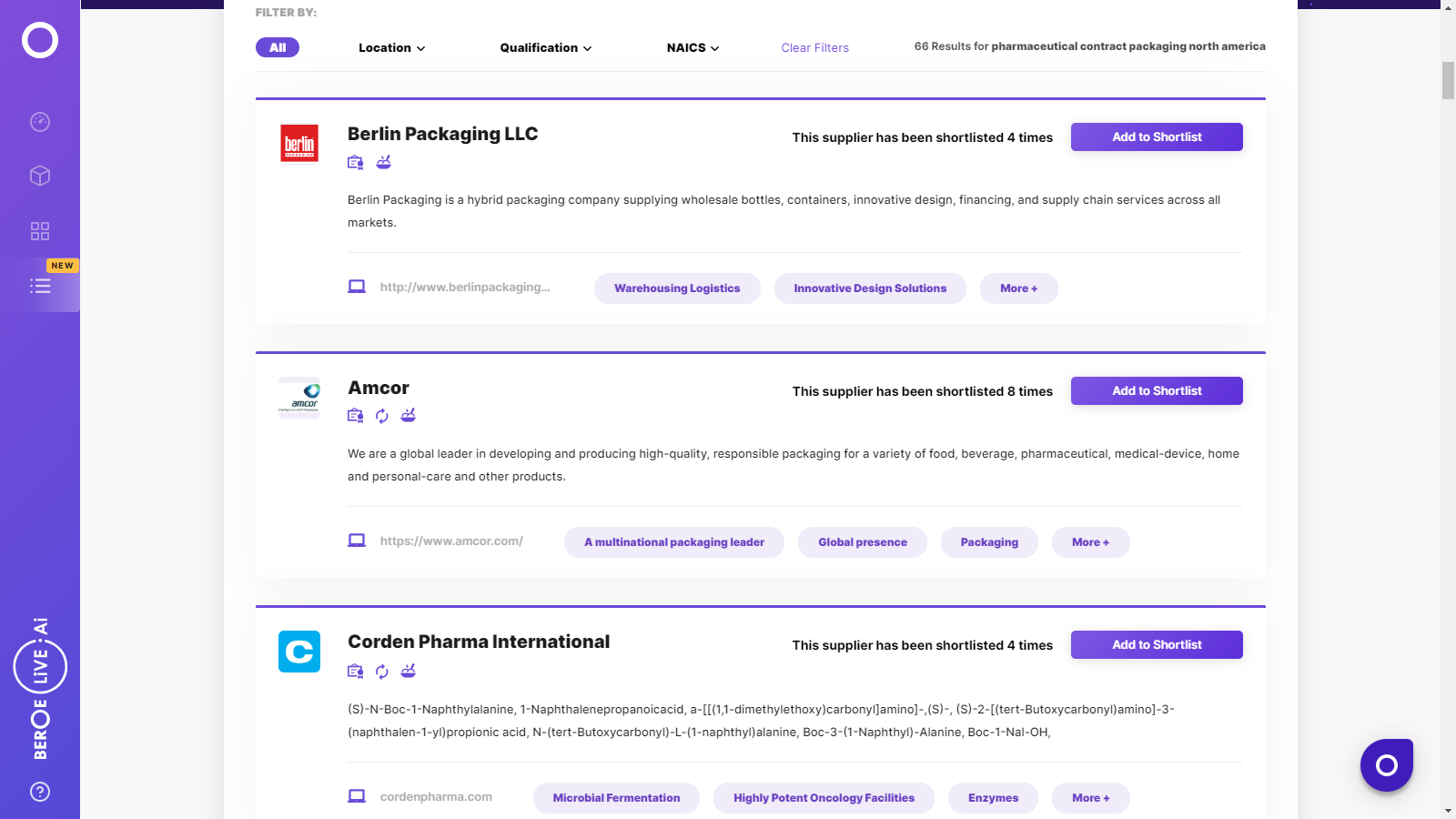

Pharmaceutical Contract Packaging North America Suppliers

Find the right-fit pharmaceutical contract packaging north america supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pharmaceutical Contract Packaging North America market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPharmaceutical Contract Packaging North America market report transcript

Regional Market Outlook on Pharmaceutical Contract Packaging

- North America holds around 40% of the global CRO market, which drives the demand for different packaging formats both for critical and normal drugs. Hence, pharma companies are increasingly outsourcing their non-critical activities in packaging, like bulk breaking, primary packaging, secondary packaging, kitting, compliance, and serialization

- North America holds around 41% of total global pharmaceutical market, which proves to be an opportunity for expansion in the contract packaging market. The changing regulatory environment in packaging, like child resistance, serialization, etc., is also likely to drive growth in the near future, as the contract packagers increase their capabilities in these areas

- There is a considerable growth in pharma imports to North America, with y-o-y growth at around 18.8% in 2014-15. This is also likely to foster the growth in third-party bulk breaking and kitting in pharmaceutical industry

Pharmaceutical Contract Packaging – Supply Chain Analysis

- The major cost component in Pharmaceutical contract packaging supply chain is the capital investment required to set up the filling/packaging line

- Packaging raw material occupies a major chunk of the contract packaging cost (around 40-45%), followed by labor and utilities, which together contribute to around 35% of the cost

- In case of critical drugs, pharma brand owners provide the packaging materials to the contract packagers to reduce packaging complexity

- Warehousing and logistics is either done by the contract packagers themselves or through partnerships with 3PLS

Current Trends in Pharmaceutical Contract Packaging - North America

Sterilization

- The regulatory pressure on pharma companies to bring serialization in to effect has provided an added leverage for the contract packagers. The top contract packagers have made significant investments in this front to provide serialization support to the customers

- Major players, like Sharp, PCI, ReedLane, Almac, have built their in-house software architecture for serialization with the help of software partners. For example, Apac Pak made advancement in their serialization process through Optel Vision

-

This trend will gradually shift the industry toward large contract packagers, and many small to medium firms, who cannot make investments on serialization service front might lose their business.

Technological Advancements

- The top contract packagers, like Sharp, Reed Lane, PCI, and Almac Group, have gone through several technological innovations in the recent past, majorly towards strengthening their filling, counting, and blister lines

- Contract packagers are also investing on expanding their lines, so that they can adapt to the evolving package formats. E.g., Sharp Packaging Solutions have recently standardized their tablet counting & filling line in PA, US

Quality Concerns

Supplier selection plays a vital role in the contract packaging industry to deliver quality products. Some of the recent examples where contract packaging engagements suffered product recalls, due to poor quality are below:

- In August 2015, FDA issued a warning letter to Ohio based Genpack Solutions for violating CGMP regulations on repacking and relabeling of unapproved drugs

- In October 2014, Contract Packaging Resources Inc., USA had to recall 11,640 boxes of Naproxen Sodium tablets, due to packaging mix up

- On the other hand, even despite few quality concerns, contract manufacturing and packaging still remains to be the most necessary option by major pharmaceutical companies for drug development and packaging. For example, In December 2015, Pfizer formulated and manufactured its leading over the counter heartburn treatment, Nexium 24HR from Catalents Winchester facility

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now