CATEGORY

Piston Can Systems North America

This report analyses the advancements in piston can and its comparison with conventional Aerosol cans/pumps. The report also included top supplier providing the product

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Piston Can Systems North America.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

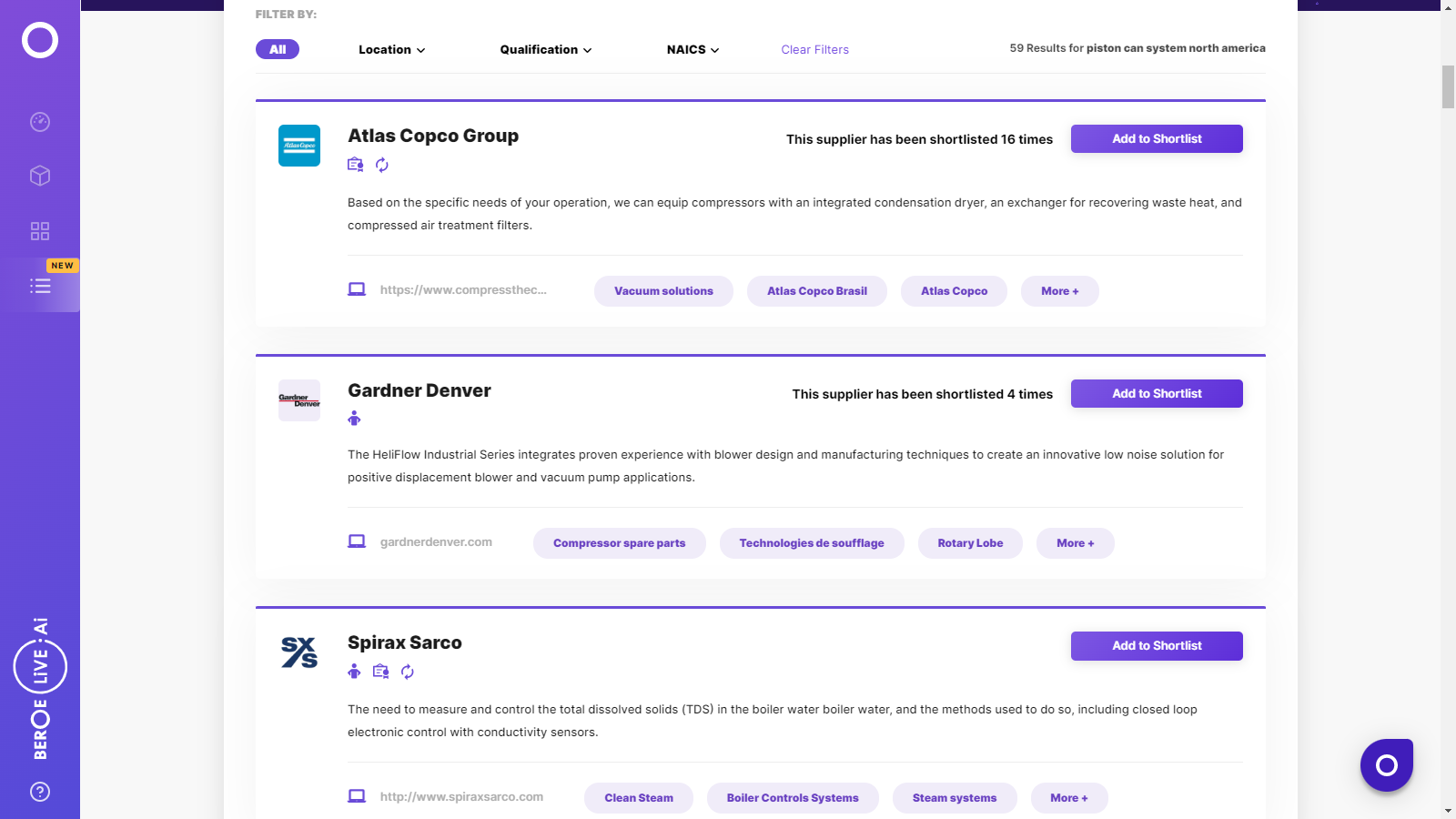

Piston Can Systems North America Suppliers

Find the right-fit piston can systems north america supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Piston Can Systems North America market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPiston Can Systems North America market report transcript

Regional Market Outlook on Piston Can Systems

- Globally, North America is the second largest producer of aerosol cans. Tinplate cans dominate the market and account for ~75% of regional demand

- Increasing demand for household products, such as insecticides and bug sprays, has led to the increased market share for household segment as compared to the personal care segment

Piston Aerosol Cans vs. BoV in North America

Can manufacturers, have ave shifted to BoV technology in North America. Buyers (Example: Gillette) are also slowly migrating to BOV technology, due to flexibility to new valve technology and elimination of piston. Additionally, supplier such as Assured Packaging offers both contract manufacturing of after-shave gels and contract filling into BoV cans, thereby providing an opportunity for reduced complexity in supply chain.

Cost Outlook of Piston Aerosol Cans in North America

- Raw Material Cost: Tin plate sheet prices in US have remained fairly stable over the past two years. Over the next year, there is expected to be price increase in the US, due to rising CRC prices, in light of higher demand and import duties.

- Overhead and Labor Cost – Most can manufacturing equipment are automated process. However, high labor cost in US significantly impacts production cost.

- Fixed Cost – High Speed Aluminium impact extrusion aerosol lines or tin plate aerosol making lines, with an annual capacity of 60 million units would require a capital of $40-50 million in US.

- Utility Cost – Utility costs in US are expected to fall in the next 6–7 months. This variation is a part of the seasonal electricity price trend.

North American Aerosol Piston Cans Supply Outlook

The consolidated supply base of tin plate suppliers and piston aerosol can suppliers in North America constraints buyer power. Migration to BoV technology, potentially in the future, according to recent trend might assist to gain buying power marginally.

Limited market for piston tin aerosol cans results in piston aerosol tin can manufacturers to mostly depend on domestic sources for their feedstock. Therefore, monitoring of domestic tin plate price fluctuations can help buyers control pricing.

Industry Best Practices

Procurement Practices Followed by Companies

- Common Contract Formats : Multi year supply contracts ranging from 2 years to 3 years, covering multi million pieces per year for multiple countries are preferred by large corporations. While small, medium buyers with production runs, as small as 5000 pieces prefer single orders for existing products.

- Sourcing of Packaging Material: Usually, the aerosol cans are purchased by the contract filler directly from the supplier. However, suppliers are willing to provide contract filling service even if the client provides the cans.

- Regulations to be Adhered to: Contract fillers are expected to work according to chemical safety and aerosol laws in order to supply to Europe, North America, and Asia. Example, Aerosol Dispensers Directive (ADD), Toxic Substances Control Act, etc. Moreover, the US Environmental Protection Agency (EPA) is proposing recycling regulations for handling hazardous waste of aerosol cans.

- Indices Used For Price Model: Can manufacturers work off of a 30-day price model, based on LME and MWP indicators. This is directly passed on to contract fillers whose prices mimic this trend.

- Pricing Model: Contracts with can manufacturers have an annual price adjustment, based on steel content. This cost is passed on to buyers by contract fillers who engage with can manufacturers.

- Migration to BoV Cans: Many aerosol contract fillers in the US, such as Chicago Aerosol, Aerosol & Liquid Packaging, have also migrated away from Piston system. Personal Care demand for shave gel products is slowly moving to BOV technology to experience lower cost for decorated or undecorated cans. Moreover, it eliminates grommet material and 3rd party production cost.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now