CATEGORY

Stimulation Chemical

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Stimulation Chemical.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoStimulation Chemical Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Stimulation Chemical Suppliers

Find the right-fit stimulation chemical supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Stimulation Chemical market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoStimulation Chemical market report transcript

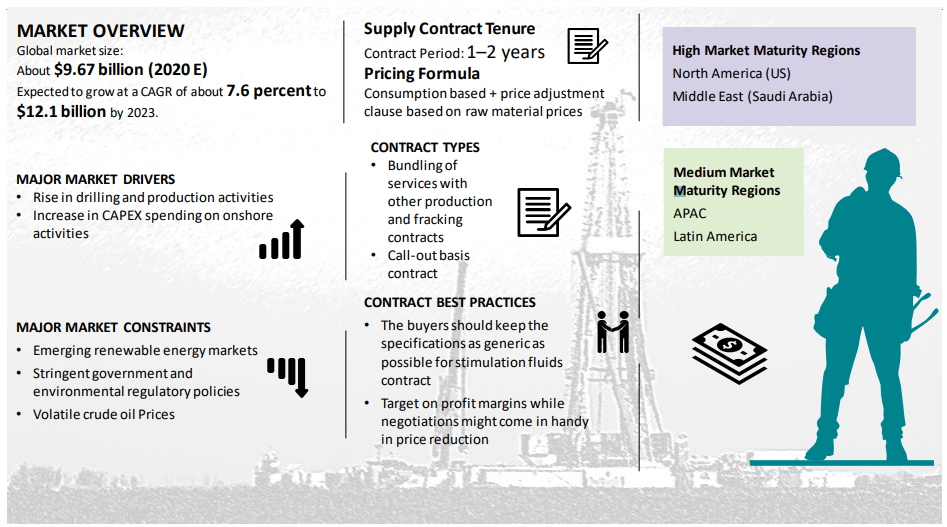

Global Market Outlook on Stimulation Chemical

-

The global stimulation chemicals market is estimated to be $15.3 billion in 2023, and it is expected to reach $18.7 billion by the end of 2026, with a CAGR of 8.2 percent. Major stimulation market, US, registered weak shale activity by the end of 2022. For 2023, the shale activity is expected to grow, but the rate is expected to slowdown due to cost inflation, amid equipment, materials & labor shortages

-

Shale investment in the US is expected to slow down in 2023, due to high capex cost inflation in the market. China is a new upcoming shale market, as the country has recently tapped shale reserves in the offshore South China sea region and is planning to ramp up output from the reserves to meet the country’s demand

-

In terms of value, the global oil & gas stimulation chemicals market is forecasted to reach $18.7 billion by the end of 2026, with a CAGR of 8.2 percent. The stimulation chemicals market is completely dependent on drilling activities and the production of crude oil. For 2023, the major stimulation chemicals market, hydraulic fracturing, is set to grow but the pace will slow down, especially due to operators in US resorting a conservative approach amid high-cost inflation and shortages

-

Price of key chemical products to increase between 3 to 8 percent, due to supply shortage, and high input costs for suppliers, amid strong demand. China is currently investing to develop major offshore shale resources in South China sea region. The offshore asset is expected to hold approximately 1.2 billion tons of prospective shale oil

Regional Market Overview for Stimulation Chemicals

-

North America is expected to lead the stimulation chemicals market in 2023, and the trend is likely to continue throughout the forecast period. The high market share is ascribed to the strong shale activity in the region; however, shale growth is expected to slow down in 2023. China is another key offshore shale market with major prospective resources, and a key stimulation chemical market during the forecasted period

-

Shale growth in the US is expected to be slower in 2023, due to cost constraints. Demand growth is certain from the Permian basin, where major production boosts are planned

-

The MEA contributed to around 5.6 percent of the overall stimulation chemicals market

-

Europe and LATAM regions collectively contributed to 7 percent of the global oil & gas stimulation chemicals market. New field development projects are coming in the North Sea and offshore in LATAM

-

China is expected to lead APAC’s stimulation market, as the country is planning to boost production output, especially with new offshore shale developments in South China sea

Global Stimulation Chemicals: Market Drivers and Constraints

Drivers

-

Stimulation chemicals are a mandatory requirement during drilling operations mixed in drilling mud to ensure smooth operators of bits and carrying cuttings to the surface. Increasing in the number of drilling wells globally will increase the demand for production chemicals

-

Ban on Russian imports by major economies, like US and EU, operators are pushing to increase production and investing in new operations to replace the Russian supply

-

New oil and gas development projects have increased in Europe, especially gas projects to improve the supply despite long term goal of clean energy transition. North Sea is registering majority of new development and expansion programs. Norway set to become the region with second highest production output hike in 2023

-

The global oil demand for the year is forecasted to increase, coupling with ban on Russian output will drive the oil production in the year

Constraints

-

Due to the war, price of key chemicals have soared, due to supply chain disruptions, high input costs for manufacturers, putting string on operators, in terms of high upstream costs. Price of key chemical products surged ranging from 7 percent to 15 percent. For 2023, around 6-9 percent cost inflation is expected for upstream industry

-

High inflation in major economies across the globe is looming potential threat to the oil and gas industry, which could significantly impact the demand for oil products

-

Labor shortage in the oil industry, especially in US, is stinging the industry with high costs. The companies are finding it difficult to hire labor impacting the operations. This factor, coupled with the fear of recession, poses a significant threat to the industry, which could erode the demand and destabilize the industry

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now