CATEGORY

Pulp And Paper Market Consolidation

The report summarizes the recent consolidation trend in the pulp industry globally and how market share of suppliers have changed as a result. The report also outlines the regional supply and demand numbers for pulp, growth rates and recent capacity additions

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pulp And Paper Market Consolidation.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Pulp And Paper Market Consolidation Suppliers

Find the right-fit pulp and paper market consolidation supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pulp And Paper Market Consolidation market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPulp And Paper Market Consolidation market report transcript

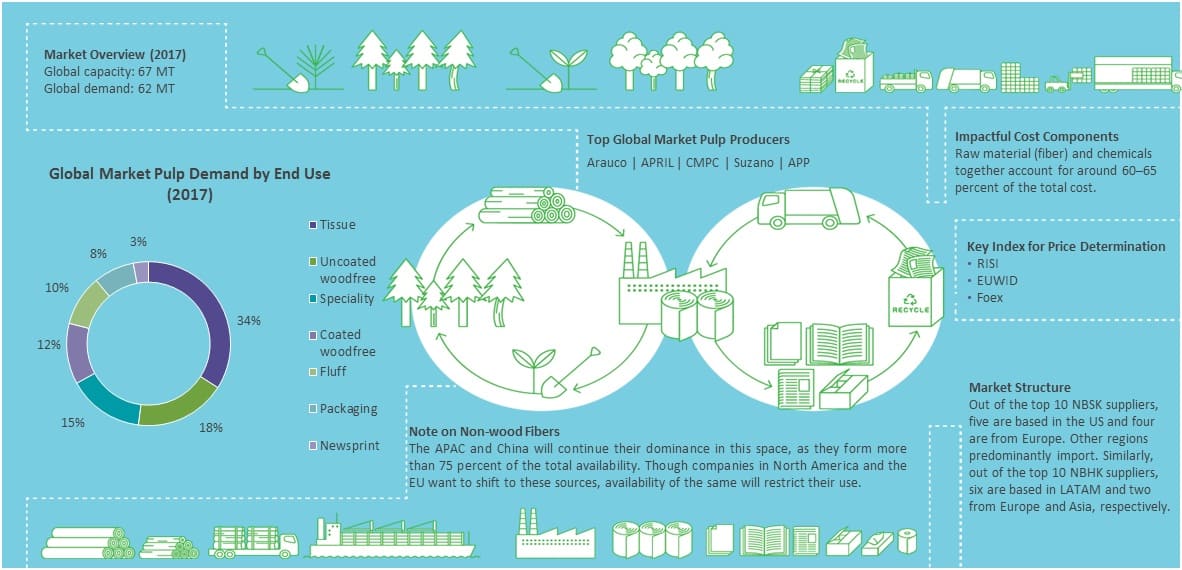

Global Market Outlook on Pulp And Paper Market Consolidation

- All the three regions, Europe, North America, and Asia, have newer capacity coming up in 2018, owing to the positive demand from the market. Tissue demand is estimated to grow by 3.7 percent in 2018

- The hardwood market is expected to be firmer than softwood from 2016 to 2020. Due to significant capacity additions in the latter and a diminishing demand, hardwood is expected to gain a lot of traction in the coming years

Major Trends and Innovations- Global Pulp Industry

Major Product Trends & Innovations

3D Printing for pulp mills

- Valmet to adopt 3D printing tech in its manufacturing processes

- The benefits of 3D printing for pulp and paper mills lie in shorter lead times when a new mold is needed for a customer-specific pattern

- This new production method means being able to produce patterns and parts regardless of shape

Alternative Fibre Plant

- Columbia Pulp in plans to start off a $145 million project that is said to be the first alternative fiber market pulp plant in North America. The pulp line is to start up in the fall of 2018

- It aims to revolutionize pulp production by using wheat straw to produce sustainable paper-making pulp to manufacture paper towels, facial tissue, packaging, molded fiber for single-use plates, cups, de-icing and dust abatement agents, and more

New trend embraced by European mills

- European mills are seeking low effluent volumes, high levels of energy efficiency, effective material use (high pulping yield), and no reliance on fossil fuels

- New Mills have begun reducing steam consumption by 30 percent

Impact on Global Pulp Market

The acquisition of Fibria by Suzano is set to create a pulp giant with 14 percent market share and a capacity of `11 million tonnes/year in 2018. This gives Suzano the pricing power advantage and also guarantees decrease in volatility of pulp prices

Impact of Suzano- Fibria Merger on Global Pulp Market

- The conglomerate will be able to produce ~11 million tonnes/yr of BEK and will have a share of over 14 percent of global market pulp

- Taking into account only BHK pulp, the firm's share will potentially hit 30 percent of the global market. The new firm will cover sales to more than 90 countries, with 34 percent of exports going to Asia, 27 percent to Europe, 16 percent to North America. The remaining amount will be traded in Latin America, including Brazil

- In 2017 Fibria was the largest market pulp producer in the world, with 6.4 million tonnes and an 8.8 percent share, Suzano came in fifth, with 3.5 million tonnes and a 4.9 percent share last year. Fibria's figures are set to grow in 2018 due to the ramp up of its new line in Três Lagoas

- Considering only BEK pulp, Suzano and Fibria occupied the first two places in 2017's ranking and led this market by far, with a combined 27.6 percent market share. CMPC came in third with 3.1 million tonnes and a participation of 8.6 percent

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now