CATEGORY

Production Chemicals

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Production Chemicals.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

MIBK market update

January 25, 2023PK Orlen shuts its ethylene oxide plant in Poland

January 18, 2023MIBK price update

December 09, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Production Chemicals

Schedule a DemoProduction Chemicals Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoProduction Chemicals Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Production Chemicals category is 16.40%

Payment Terms

(in days)

The industry average payment terms in Production Chemicals category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

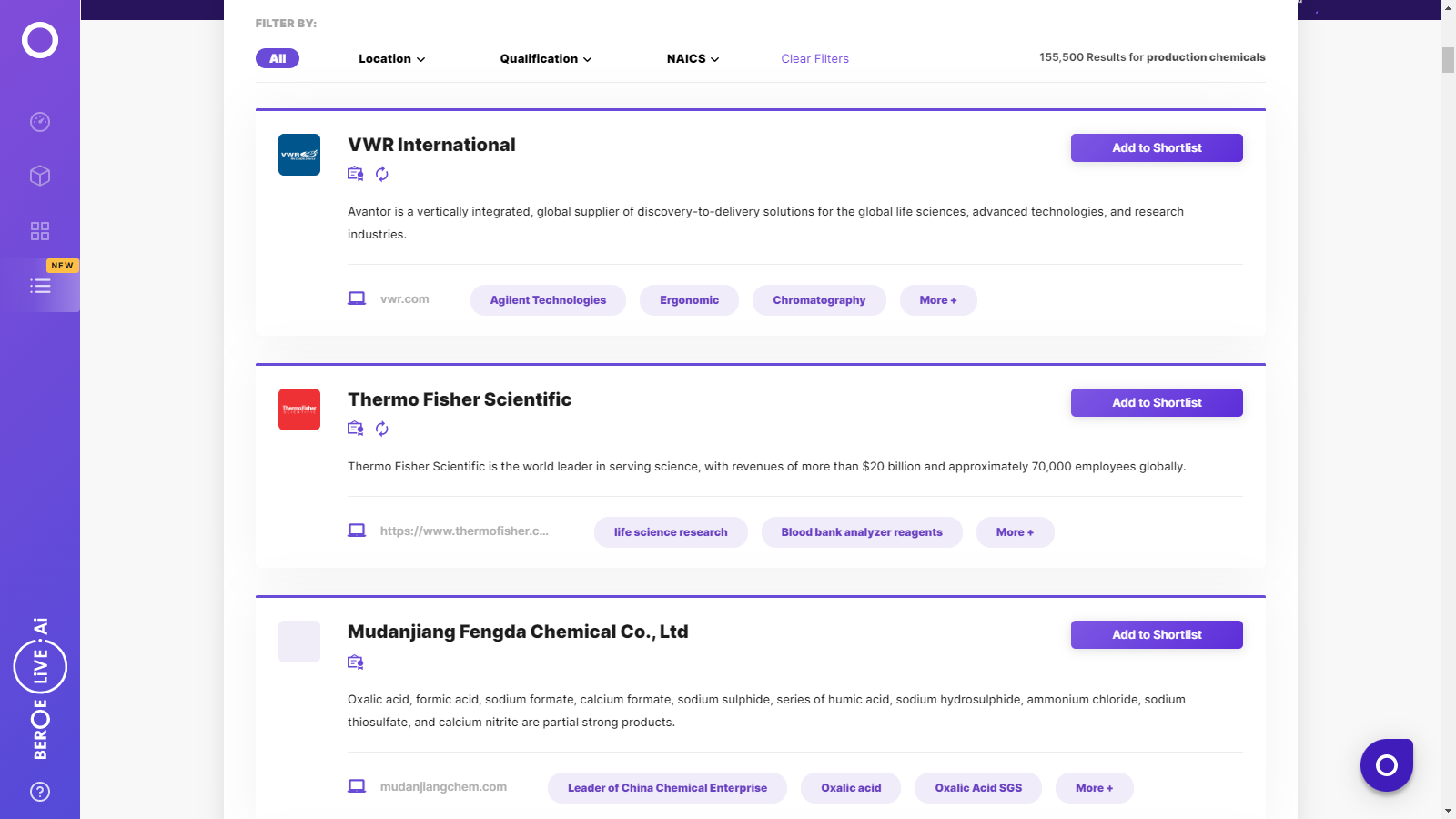

Production Chemicals Suppliers

Find the right-fit production chemicals supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Production Chemicals market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoProduction Chemicals market report transcript

Global Market Outlook on Production Chemicals

-

The global production chemicals market is estimated to reach $4.44 billion in 2023, and it is expected to reach $5.36 billion by the end of 2026, with a CAGR of 8.2 percent

-

Despite ongoing global economic uncertainty amid high inflation levels, threat of recession, interest rate hikes by central bank, the global average oil demand forecast for 2023 is set to increase by 2.4%. OECD countries set to register higher demand growth by 3.1%.

-

North American supply is expected to increase by 1.15 million bpd in 2023 and set to account for 40% of total supply growth in 2023. Russian supply is expected to dip by an average 0.85 million bpd. Norway is set to register the second-highest growth rate in 2023, as the country has planned to maintain current high production levels for the upcoming two years.

Production Chemicals Demand Market Outlook

-

Market participants to register a price hike, due to input cost hikes. Demand for products also set to register an strong growth due to anticipated rise in oil & gas activities. Key high value chemicals prices in the market were determined on current spot prices in the market. Oil production for the year is expected to grow by 2.4%.

Regional Market Overview for Production Chemicals

-

North America is expected to hold the major share of the production chemicals market in 2023, the trend is likely to continue throughout the forecast period, the US production output is consistently on the increase and Permian basin is expected to be the most active region

-

The market is matured in the North American region. Average US production in 2023 will near pre-pandemic levels. Operators will be exposed to cost inflation due to price hikes amid high demand

-

MEA market, which contains the major OPEC members, have announced to continue its current production till end of 2023 to maintain global oil prices in the market. African production will improve strongly with major new development on the cards for 2023.

-

European production will rise in 2023 due to Russian import ban by February 2023. Norway set to lead the new production growth. New projects especially in North Sea are being licensed and explored by UK, Germany, Netherlands, Norway to boost production

-

LATAM production set to grow by 5.2% in 2023. Brazil and Guyana are set to lead the growth, whereas Mexico output set to decline

-

In Asia, Indian output set to grow by 1.2% increased. China’s output to increase strongly in following years form offshore shale projects

Global Production Chemicals: Market Drivers and Constraints

Drivers

-

Production chemicals are a mandatory requirement during crude oil production and separation process post-production in oilfield. Increasing in number of drilling wells globally will increase demand for production chemicals

-

Ban on Russian imports by major economies, like US and EU, operators are pushing to increase production and investing in new operations to replace the Russian supply.

-

New oil and gas development projects have increased in Europe, especially gas projects to improve the supply despite long term goal of clean energy transition. North Sea is registering majority of new development and expansion programs. Norway set to become the region with second highest production output hike in 2023.

-

The global oil demand for the year is forecasted to increase, coupling with ban on Russian output will drive the oil production in the year

Constraints

-

Due to the war, price of key chemicals have soared, due to supply chain disruptions, high input costs for manufacturers, putting string on operators, in terms of high upstream costs. Price of key chemical products surged ranging from 7 percent to 15 percent. For 2023, around 6-9 percent cost inflation is expected for upstream industry

-

High inflation in major economies across the globe is looming potential threat to the oil and gas industry, which could significantly impact the demand for oil products

-

Labor shortage in the oil industry, especially in US, is stinging the industry with high costs. The companies are finding it difficult to hire labor impacting the operations. This factor coupled with the fear of recession poses a significant threat to the industry, which could erode the demand and destabilize the industry

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now