CATEGORY

Pressure Sensitive Label Western Europe

Pressure Sensitive Labels report covers both label face stock and printers markets. Key areas of coverage include product innovations and demand trends

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pressure Sensitive Label Western Europe.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Pressure Sensitive Label Western Europe Suppliers

Find the right-fit pressure sensitive label western europe supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pressure Sensitive Label Western Europe market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPressure Sensitive Label Western Europe market report transcript

Regional Market Outlook on Pressure Sensitive Label

PSL products in Western Europe are evolving to advanced smart labels and interactive labels. Buyers can engage with some of the leading players like Avery, Inland labels etc. to be an innovation leader in beverage segments.Western Europe PSL market is expected a slower volume growth owing to the mature food and beverage consumption in the market, which dominates PSL end use. However, growing e commerce, product aesthetic requirements are likely to drive value growth by product innovations

Western Europe Demand Growth of Pressure Sensitive Labels

- Major demand region: Western Europe contributes to ~75 percent of the European labels market, making it the major demand region. Germany alone contributes to more than 25 percent of Western European labels demand, of which, more than 55 percent are PSL

- Western European countries of Germany, France, the UK, and Italy contribute to more than 50 percent of the retail sales of cosmetic and personal care market, thereby driving the labels market.

Pressure Sensitive Labels Drivers and Constrains

Drivers

Innovation

Smart technologies, such as NFC, are being included in PSL as an anti-tampering mechanism. This trend of continuous innovations is expected to drive the demand for self-adhesive labels in all the industries

Sustainability

The rising e-commerce activity has led to the need for more effective and sustainable packaging. This has prompted consumers to look toward attractive and sustainable options, like liner-less labels, recyclable adhesives, and clear film labels on clear substrates

Downstream Demand

Increasing demand from major end-use segments, such as F&B and Pharma, drive the demand for labels

Increasing Transportation and Logistics

Western Europe has witnessed a sharp rise in transportation and logistics. This is expected to drive the tracking, tracing and device authentication PSL demand in the coming years

Constriants

Recycling

- Labelstock material can be made from recycled, but the adhesive used on them acts as a constraint during recyclability

- New chemical compounds to make 100 percent recyclable adhesives are being gradually introduced to overcome this constraint

Product Substitution

Alternative packaging options, such as sleeves and pouches, are expected to grow at 5 percent and 8 percent until 2019,respectivey, and see increased applications in personal care and food sectors. They minimize packaging cost and also increase the aesthetic value of the product

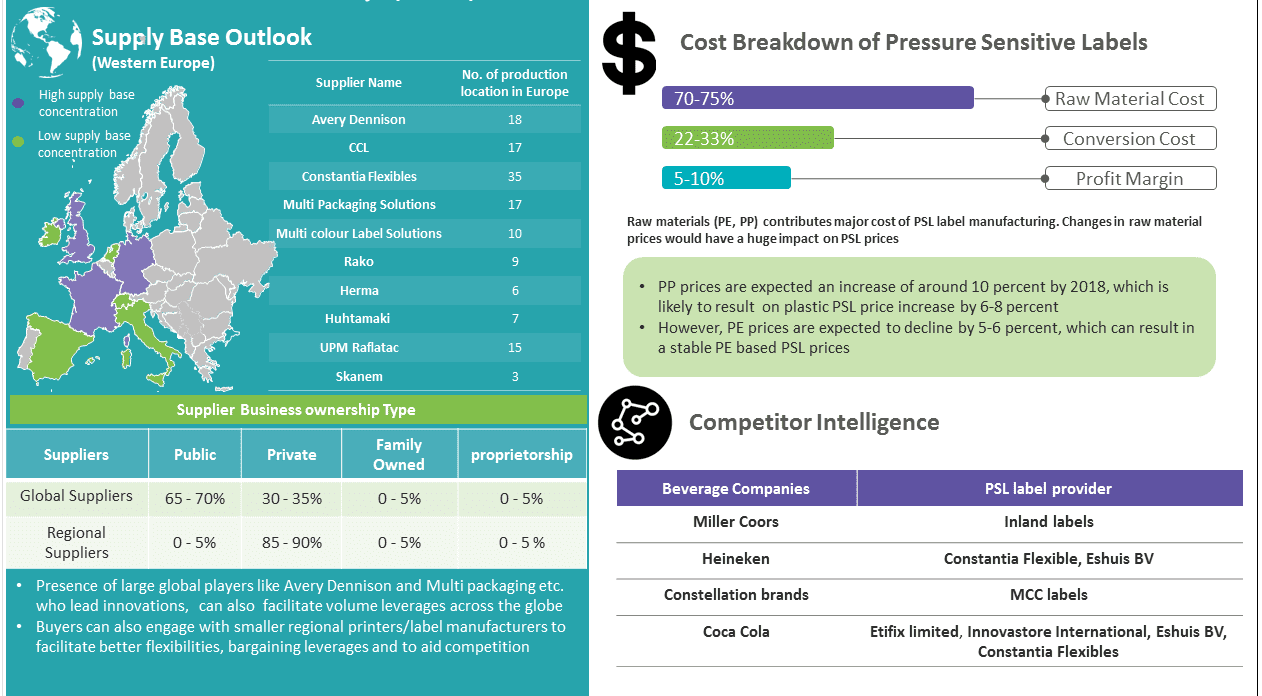

Western Europe PSL market is considerably fragmented, with the presence of multiple global players and a large pool of domestic suppliers. However, suppliers like Avery, Constantia might have a leverage in certain innovative and customized SKUs

Supplier Power

- Though fragmented, the major upstream industries (label stock producers) in western Europe, like Avery Dennison, UPM Raflatac, etc., hold 15 percent of the global market share

- Most converters are not backward integrated into label stock production, which limits the supply chain transparency, thereby decreasing their power over facestock suppliers

Barriers to New Entrants

- Low capital investment, in terms of printing equipment (flexo machines range from $10,000–25,000), decreases the barrier for new entrants

- Digital printing is a rising trend in this region, with an initial investment of $45,000 and enhanced printing speeds. Newer machines with better quality and higher speed are being introduced by companies, such as Gallus.

Intensity of Rivalry

- Western Europe labels market is fragmented, thereby increasing the rivalry among suppliers

- To increase their market share, major suppliers are involved in M&As

- Suppliers are also actively investing in product differentiations through innovations to stay competitive in the market

Threat of Substitutes

- In-mold labels, which is witnessing a tremendous growth of around 6–7 percent in Europe and 5–6 percent in North America, is a possible substitute for PSL in plastic containers

Buyer Power

- In spite of several M&As, the supply base in Western Europe remains highly fragmented

- This directly translates into low switching cost for buyers, thereby enhancing the buyer power further

There is no immediate threat of price increase in PE based plastic PSLs. However, with the expected surge in PP prices, PP based label prices might go up by up to 10 percent

Major cost saving Arena

- For large volumes (>20,000 m2), rotogravure would be the economical option. For smaller volumes (<3,000 m2), offset would be economical. However, digital printing is slowly replacing offset printing for short runs

- Companies offer auctions or bids to the industry to determine a cost efficient supplier. In case of secondary level buying, companies can leverage the prices offered by the current supplier with another face stock supplier to get a better price quote

- Production setup cost per unit can be reduced by printing at least 5000 units of label, in a single production run

Pressure Sensitive Label Market Trends

Sustainability and product interactiveness is expected to be the focus of innovations in PSL in the next 2-3 years. Smart features in packaging across food and beverages segment is likely to penetrate labels, especially around temperature alerts, personalized designs etc

Smart Labels

- Smart PSL has gained the market interest of Food and Beverage industry. Interactive labels keeps the customer engaged to the brand and also helps in product reorders

- Labels with NFC technology and special designs are being incorporated into beverage bottles to improve customer reception and loyalty

With increasing regulations from FDA requiring more detailing on labels, companies are looking to adopt new technologies to incorporate extra detail, while keeping the packaging attractive.

Sustainability

- Recyclable adhesives have been widely adopted by companies to improve the recyclability of the product

- They use the same chemical components, hence, the cost remains the same. However, the blend is different compared to normal adhesives, making them recyclable

- Polymer based RCA (Recycling Compatible Adhesive) pressure sensitive labels has superior recycling capability, when compared to paper made PSLs

PURE 100 percent compostable PSL, with eco-friendly adhesives, were showcased in Labelexpo Americas 2016. It is the first certified compostable, tree-free label compliant, with food grade regulations.

Digital Printing

- For high-quality printing, companies often look for rotogravure, followed by flexographic technology. When the companies are willing to compromise on quality, offset technology is considered to be the cheaper option

- Digital technology is being widely adopted for short runs or immediate requirement, due to low investment and high-print speeds

Digital Printing is increasing print-on demand, thereby discouraging long term contracts with labeling converters

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now