CATEGORY

Wireline Data Market Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Wireline Data Market Australia .

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Wireline Data Market Australia Suppliers

Find the right-fit wireline data market australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Wireline Data Market Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoWireline Data Market Australia market report transcript

Regional Market Outlook on Wireline Data Market

- National Broadband Network (NBN): NBN has planned to deploy FTTP network that can reach more than 90 percent of Australian premises. A change in government brought a different approach to fiber connectivity called “ Multi-technology Mix”. Following which fiber-to-the-node (FTTN), fiber-to-the building (FTTB) and hybrid fiber coaxial (HFC) networks were taking its place

- MPLS based solutions has been the most preferred WAN connectivity model for enterprises in the Australian market thus far, and are the default transport mode for business critical applications

- Australian enterprises are preparing for IoT by transitioning their network into a software defined hybrid network

Wireline Services—Drivers and Constraints

Drivers

Increase in data consumption and infrastructure investments

- The rapid adoption of enterprise trends, such as cloud computing, Big Data, HD collaboration services and the emergence of the data-intensive Internet of Things, are the key factors driving the wireline data services market

- The increase in fixed broadband infrastructure investment by telecommunications service providers across the world in the next generation broadband technologies and fibre deployment in order to support the increase in data traffic is driving the wireline data services market

Demand for better customer experience and connectivity speed

- Fixed broadband speeds are expected to reach at a global average of 48 Mbps by 2020 from 25 Mbps in 2015. Connectivity speed and customer experience are closely associated, as higher speeds are necessary to deliver a better customer experience. For instance, in the case of HD collaboration solutions, higher speeds are essential to deliver lag free communication, and thereby better experience

Constraints

Cannibalisation by the mobile broadband market

- The increase in smartphone and tablet adoption has directly contributed to the rapid growth of mobile broadband service, and this has been a strong deterrent to the growth of the fixed/wireline data service market

Industry regulations

- The telecommunications industry is a highly regulated industry, with regulations governing M&A activity, data and price. In some scenarios, these stringent regulations act as key constraints on the development and growth of the wireline data services market

OTT players sharing on telecom operators margin

- OTT players has grown its share to reach 10 percent globally in few years, which indicates that a significant percent of global operator voice minutes is lost to OTT players

Porter's Five Forces Analysis

The buyer's power is medium to high, owing to the commoditised nature of the offerings from service providers. The intensity of rivalry and barriers to entry are high in this market space.

Supplier Power

- The suppliers make significant investments on building up their network infrastructure to be on par with the growing technology transformation

- In Australia, in the wireline data segment there are only four major players in the market who can cater to large enterprises, which in turn makes the supplier power medium to high.

Barriers to New Entrants

- High capital requirements for infrastructure investments are the biggest barrier

- Ownership of a telecommunications license pertaining to that specific nation is often time-consuming

- Scarce skill availability with respect to management and operating skills

Intensity of Rivalry

- With the penetration of services almost saturated, operators are willing to be cost-competitive by bundling services, such as triple play, in order to gain and retain a client base

- The commoditised market further brings down differentiation between suppliers, with cost and coverage being the only unique parameters between operators

Threat of Substitutes

- For regional coverage of traditional services, there are no substitutes for the procurement of wireline data services, though wireless services may replace wirelines in short distance communication

- However, for services like unified communications, telecom hardware/software vendors, like Polycom, Cisco, Microsoft, have established themselves as leaders and enterprises procure UC from them

Buyer Power

- Enterprise customers adopt to the changing technology trends and are focusing on the suppliers for new technologies integration and maintenance as fiber connectivity deployments being the most recent upgrades prevailing in Australia

- Switching costs of customised services and products for enterprises keeps the buyer power moderate

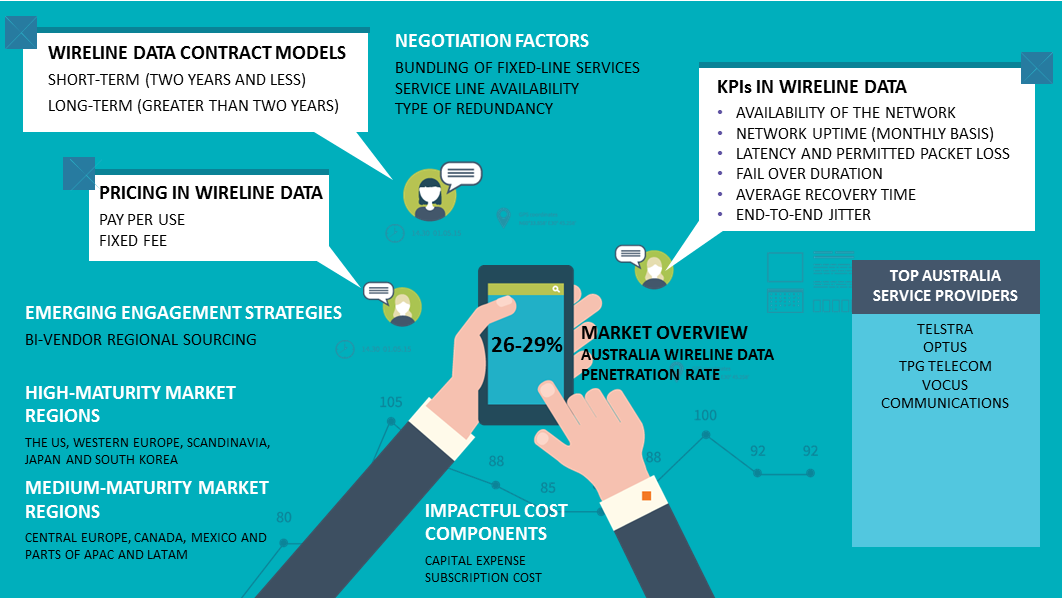

Wireline Data Australia Market Overview

- As far as fixed broadband subscriptions are concerned, Australia is ranked 26thglobally, whereas they are ranked seventh in case of mobile broadband penetration

- The four key players in the wireline data market in Australia are Telstra, Optus, TPG Telecom and Vocus Communications

- In terms of fixed internet subscriptions, Telstra and Optus recorded a growth of 11.5 percent and 6.4 percent respectively in 2018 compared to 2017; whereas TPG Telecom and Vocus experienced a decline in their subscriptions

- NBN has planned to deploy FTTP network that can reach more than 90 percent of Australian premises

- Though NBN is focusing on expanding its network connectivity, the major issue is with the higher price offered for the telecom services.

- Adoption of software-based infrastructure: All major telecommunications service providers are driving the adoption of NFV among OEM vendors, as they continue to roll out proof of concept projects. Through the implementation of NFV, service providers are able to reduce costs and are also able to engage with smaller players, which was not feasible earlier.

- Increased emphasis on data, content and other value-added services: Owing to the decline in wireline voice penetration and revenue, service providers are focusing on wireline data services (broadband Internet and private line MPLS) for increasing their revenue

- The Australian wireline data market has been experiencing numerous M&As, where service providers are acquiring content providers, security service providers, and smaller service providers

Why You Should Buy This Report

- Information on the Australian wireline data market growth, key regulations, emerging trends, cost comparison, drivers and constraints, etc.

- Porter’s five forces analysis of the Australian wireline data industry.

- Supply trends and insights, profiles and SWOT analysis of key players like Telstra Corp. Ltd., Optus, TPG Telecom Ltd., etc.

- Pricing analysis, cost-saving opportunities, etc.

- Sourcing models, SLAs, KPIs, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now