CATEGORY

Fixed Line Services

Fixed Line Services market comprises fixed line connectivity options such as MPLS (multi-protocol label switching), business internet

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Fixed Line Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoFixed Line Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoFixed Line Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Fixed Line Services category is 10.10%

Payment Terms

(in days)

The industry average payment terms in Fixed Line Services category for the current quarter is 30.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

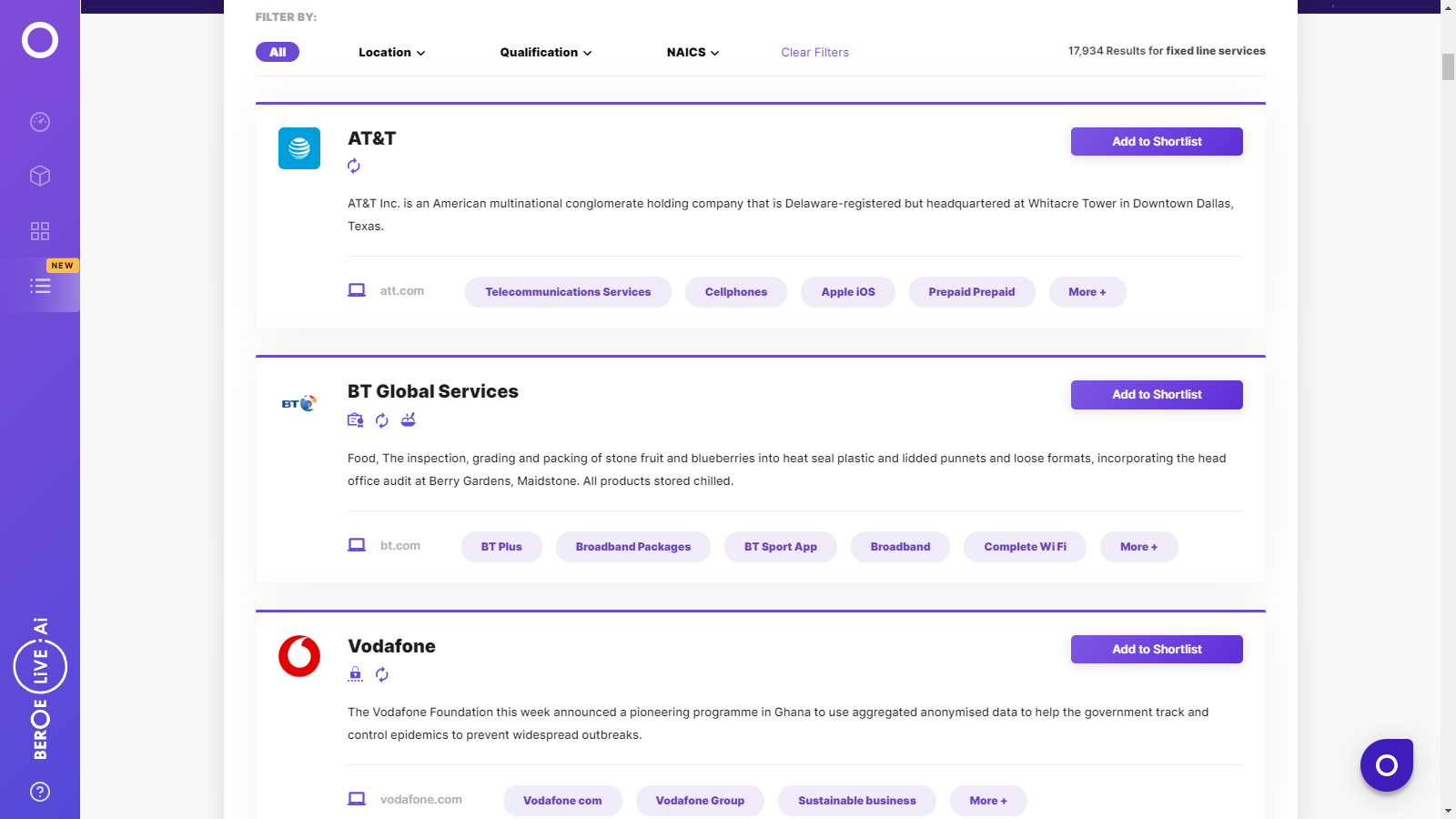

Fixed Line Services Suppliers

Find the right-fit fixed line services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Fixed Line Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoFixed Line Services market report transcript

Global Fixed Line Services Industry Outlook

-

The global fixed line revenues have been declining, especially fixed voice; however, fixed line data have provided service providers with an alternate source of revenue. The rapid adoption of emerging technologies around cloud computing, Big Data, and HD collaboration services and the emergence of the data-intensive Internet of Things are the key factors driving the fixed line data services market

Fixed Line Services—Market Maturity

-

The APAC and LATAM are classified as emerging markets, whereas North America and Europe are classified as developed markets

-

With respect to fixed-line penetration, the MEA region exhibits very low penetration and is observed to be one of the least developed regions

Global Fixed Line Services—Industry Trends

-

Telecommunications service providers are facing competition from OTT service providers in the mature markets and are now bundling content services, along with their traditional offerings, to increase their market attractiveness

-

Revenue from voice-based services has been declining steadily over the past four to five years; this trend is expected to continue and be more pronounced in the developing markets

-

The overarching trends have impacted few developing countries in the MEA region, the overall impact is observed to be low and is expected to start gaining prominence in the next five–six years

-

Similarly, in the APAC region, the overarching trends are more pronounced in the developed markets, such as Japan and South Korea, and are gaining market adoption in other developing countries

Global Fixed Broadband and Regulatory Impact

Global Fixed Broadband Subscriptions

-

Asia Pacific, Europe, and North America are the major drivers of growth for fixed broadband

-

Globally, the increase in share of fixed broadband is due to the Asian market growth from 49 percent to 52 percent

-

The actual global broadband subscription by the end of 2022 was around 1,279 million. East Asia provided 70 percent of additions in fixed broadband subscribers

-

The global fixed broadband subscriptions are expected to reach over 1.3 billion by 2025. Approximately, 90 percent of the total subscriptions would be contributed by the top 30 markets. The global adoption is expected to grow at 20–25 percent during 2022–2027

Major Regulatory Frameworks that Impact the Fixed Line Industry

-

Net neutrality, being the top regulatory issue, is expected to impact the telecom sector in the next couple of years

-

The growth in cloud adoption by enterprises, IoT enablement, and growing technology demand increase the regulatory intervention on data privacy and protection

-

Most of the developed markets look at data privacy and protection as the major regulatory policy risks, as implementation incurs huge cost and failure to act leads to penalties

-

Spectrum release and auction framework policies are expected to be more prevalent in the emerging markets

Global Broadband Developments

Global DSL Ports by Technology (2021)

-

Fiber deployments are growing faster in both developed and developing countries

-

Copper-based technologies (ADSL, ADSL2+, G.SHDSL) have reduced deployment, due to the increase of fiber technology

-

The deployment of fiber technology being expensive, operators are looking to incorporate fiber connected to the already existing copper deployments for faster go to market

-

G-fast a high frequency DSL protocol expected to pass more than 10 million homes by 2023

G-Fast

-

A recent technology used by operators to increase speed, service quality, reduce the deployment cost, quick go to market is expected to achieve with the mix of copper and fiber technology called G-fast

-

G-Fast reuses the traditional telephone lines in the last mile to achieve the fiber equivalent speed of 1G bps and is approved by ITU

-

Recently, G-Fast trails underwent in both developing and developed countries, like Australia, Panama, Brazil, Croatia, the Republic of Korea, Norway, the UK, and the US

Recent Developments

-

Swisscom, a operator in Switzerland, has extended G-Fast deployments to increase the speed to 500 Mbps to all FTTB and FTTS connection

-

Austria A1 has deployed a mix of VDSL2 and G-Fast to support national broadband initiative goal to reach 99 percent of home to receive broadband service at 100 Mbps, which has already completed by covering half of Austria population

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now