CATEGORY

Enterprise Routers and Switches

A router is a physical device that is used to connect multiple networks (at the enterprise premises) i.e. it act as a dispatcher selecting best route for the information transmission Switches focuses on channeling incoming information or data from multiple inputs to specific output ports.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Enterprise Routers and Switches.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoEnterprise Routers and Switches Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Enterprise Routers and Switches category is 10.60%

Payment Terms

(in days)

The industry average payment terms in Enterprise Routers and Switches category for the current quarter is 127.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Enterprise Routers and Switches Suppliers

Find the right-fit enterprise routers and switches supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Enterprise Routers and Switches market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEnterprise Routers and Switches market report transcript

Enterprise Routers and Switches Market Analysis and Global Outlook

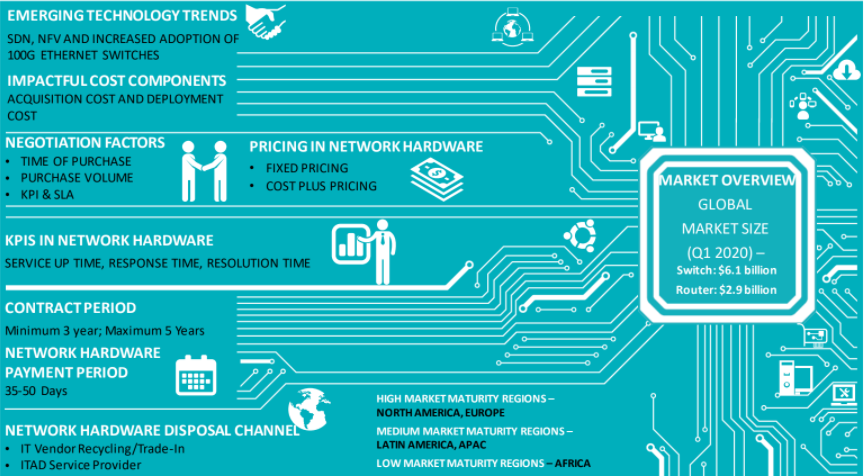

MARKET OVERVIEW

GLOBAL MARKET SIZE (Q4 2022) –

-

Switch: $10.3 billion

-

Router: $4.6 billion

-

HIGH MARKET MATURITY REGIONS – NORTH AMERICA, EUROPE

-

MEDIUM MARKET MATURITY REGIONS – LATIN AMERICA, APAC

-

LOW MARKET MATURITY REGIONS – AFRICA

Key Insight

-

The transition towards remote working culture has resulted in network equipment demand reduction from the enterprise segment. Despite this, enterprise demand continues to be high and supply chain issues being exacerbated by the semiconductor shortage issue. In order to circumvent the effects of logistics cost increase, enterprises can evaluate options to extend lifecycle of existing equipment through third-party repair and refurbishment service

Key Network Hardware Components

Switch

-

In an Ethernet LAN, a switch determines the destination, where a message has to be sent based on the MAC address in the message

-

Switches initially performed only the data link layer function (layer 2), whereas the newer version of switches perform routing functions (layer 3) and are also called IP switches

-

Switches are classified based on their speed, form factor and operating layer

Router

-

A router controls the flow of information within a network

-

A router also acts as a hardware firewall for systems connected to high-speed internet connections such as cable, satellite or DSL

-

A router operates in layer three of the open systems interconnection model

SDN – Cost Breakup

-

SDN can offer immediate costs savings of about 50 percent for large data centers when compared to the existing hardware

-

The savings potential over the years may decrease with the size of the network, however, savings in the range of 30 to 50 percent can be achieved over a course of 5 years

Cost Breakup: Typical Hardware vs. SDN Hardware

-

SDN facilities implementation of multi-brand equipment in the same architecture, which leads to reduction of acquisition cost

-

The efficiency of the network is increased through automation, leading to reduction in maintenance and administrative costs

Drivers and Constraints : Enterprise Routers and Switches

-

Increase in growth of internet-enabled devices and growing demand for hyperscale datacenters are the key factors steering the growth for network hardware industry

-

Major factors hindering growth for network hardware industry include the risk of information theft and increasing adoption of low-cost alternatives such as Skype and Google Hangouts

Drivers

Growth in the Usage of Internet-Enabled Devices:

-

To support the rapid increase in an adoption of internet-enabled devices and trends such as BYOD, new network infrastructure is required, which in turn is fueling the growth of the network hardware market.

Growing demand for hyperscale datacenters

-

Enterprises and service providers are opting for hyperscale datacenters (because of the growing IP traffic) that are built with multistage circuit switching networks. Such datacenters require deployment of several routers and switches, and the required amount of server capacity for bandwidth and pipes to cross-connect would be more than 100,000.

Constraints

Safety of Cloud Usage and Security of Information:

-

Though network security features have advanced in recent years, there still exist concerns regarding the security of information in the cloud by some verticals, such as pharmaceutical and BFSI.

Semi-conductor Shortage:

-

The global semiconductor shortage has caused delays in supplies of key components by as much as 100 percent forcing big names, like Cisco, to evaluate other sourcing locations and also looking at acquisitions backwards in supply chain.

Procurement Practices: Sourcing Models for Network Hardware

-

Enterprises generally prefer a multi-vendor model when procuring network hardware

-

The multi-vendor sourcing model offers better cost- saving opportunities

-

Most Fortune-500 firms prefer the bi-vendor regional sourcing model to reduce risks and to encourage competition.

-

The typical contract duration ranges from a period of three to five years depending on the maintenance contract, depreciation of the equipment and technological advancements.

-

When procuring multiple network hardware products from a single supplier, buyers prefer having individual contracts for various services (bundled under the same deal), rather than bundle all service offerings under a single contract. This enables flexibility, as termination of one contract will not impact the other.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now