CATEGORY

Mobility Voice and Data Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Mobility Voice and Data Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Mobility Voice and Data Australia Suppliers

Find the right-fit mobility voice and data australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Mobility Voice and Data Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMobility Voice and Data Australia market report transcript

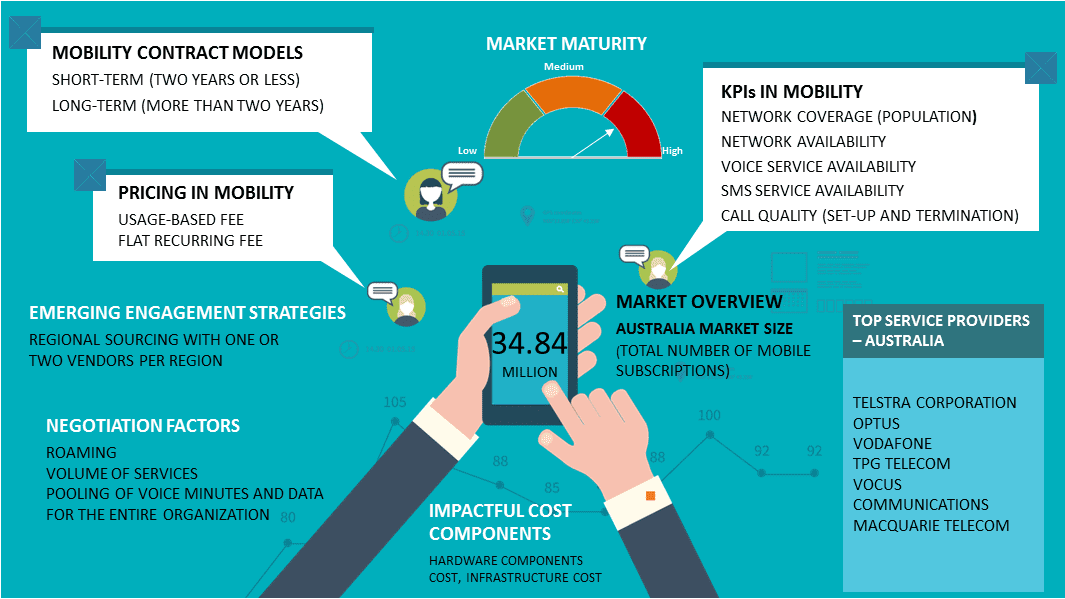

Regional Market Outlook on Mobility Voice and Data

The Australian market size for mobility services, in terms of the total number of subscriptions, was 34.84 million in 2018

- The market is expected to witness further growth in the next three to four years to reach 40 million mobile subscriptions, and the mobile penetration rate is also expected to witness growth from 70 percent to 75 percent

- As far as technology adoption is concerned, 4G and LTE coverage have crossed 95 percent and 55 percent, respectively

Australia Mobility – Drivers and Constraints

Drivers

Demand for OTT applications and BYOD

- Consumers switching to OTT applications, such as Skype, Viber, WhatsApp, Facebook Messenger, Google voiceover calls and SMS, are driving the mobility data market

- All these enterprises focus on high operational efficiency and would like to enhance workforce productivity. This shift in the market is driving enterprise mobility

- Increasing adoption of enterprise mobility in the massive banking and financial sectors is driving the mobility market

Increase in demand for cloud-based solutions

- The rapid adoption of enterprise trends, such as cloud-based solutions, Big Data, and the emergence of data-intensive IoTs, are driving mobility services, such as VoIP and SIP trunking services

Constraints

Industry regulations

- The Australian telecom industry is highly regulated, with regulations governing M&A activity, data, and price

- These regulatory regimes frequently restrict the company's ability to operate in or provide specified products or services in designated areas and require the company to maintain licenses for its operations

Increase in capital/operational expenditure

- Operational and deployment activities for 4G and 5G from the suppliers side have become a huge challenge. For instance, Telstra had spent around AUD 5 billion (USD 3.9 billion) to upgrade and expand its mobile infrastructure and lay foundation for 5G

- By the time suppliers receive returns on investment on a particular technology, they are forced to invest on deploying a newer technology, in order to maintain a competitive edge

Porter's Five Forces Analysis

Entry barriers and the intensity of rivalry are high in the Australian mobility market. Overall, the network carriers earn comparatively higher revenue from individual customers than the enterprises. Therefore, buyer and supplier power is medium in this market space.

Supplier Power

- The limited number of vendors in Australia telecom makes it consolidated. It allows them to secure competitive pricing for network equipment

- Oversight of government regulators and power/utility consumption is high

- Carriers have high bargaining power with most device manufacturers, except Apple

Barriers to New Entrants

- The industry has high barriers to entry, due to significant capital (high fixed costs) and infrastructure (technology standards) investments required

- There are a number of government regulatory requirements that carriers must adhere to

- Strong brand equity exists, especially among the top providers, such as Telstra, Optus, Vodafone

Intensity of Rivalry

- Industry appears to be competitive, as enterprises seek consolidation

- The introduction of 5G technology and NBN broadband rollout has created competition among carriers

- High competition around network coverage (i.e., avoiding dropped calls and improving connectivity speed) and customer service

Threat of Substitutes

- Currently, there are limited products available (data-only devices, pay-as-you-go phones), which do not meet enterprise-specific mobility requirements

- Technology developments could increase threat of substitution (Wi-Fi and OTT providers), but are presently not predominant

Buyer Power

- Enterprises' accounts are a major focus for carriers, as they reduce the carrier's strain on sales and marketing expenses

- Overall, telecom carriers earn comparatively higher revenue from individual users than enterprises

- The proportion of revenue that a particular enterprise provides compared to the overall enterprise revenue of a carrier drives the power

Mobility Voice And Data Australia Market Overview

- In Australia, internet connectivity has continued to intensify the growth of data services. Shift to ‘4G and 5G’ for communication has significantly increased the demand for advancements in wireless technologies

- 2G: ACMA has planned to reform the 900 MHZ frequency band to optimize for 4G mobile broadband services

- 3G: Mobile network operators continue to expand their network coverage in the coming years. With the 3G phase-out scheduled to begin in a few years, the 3G and 4G network reached around 99.4 per cent of the Australian population

- 4G: To support the increasing volume of data usage, the government has announced over $2 billion of investment in improvement to 4G networks as a precursor to support the unprecedented level of connectivity arising from the IoT Therefore, service providers are continuously focused in conducting technology trials on 5G and exploring emerging mobile technologies, like Voice over Wi-Fi (VoWiFi) and LTE broadcast (LTE-B) technology.

- IoT technology has provided the launchpad for new technologies in M2M communications.

- Additionally, the IoT specialist companies, such as Thinxtra and Semtech, are partnering with private enterprises to establish extensive IoT networks

Why You Should Buy This Report

- Information about the Australian mobility voice and data market, maturity, events, industry trends and drivers and constraints.

- Porter’s five forces analysis on the mobile voice and data Australia market

- Vendor landscape, regional regulations, supply trends and insights, profiles and SWOT analysis of major players like Vodafone, Optus and TPG Telecom, etc.

- Cost structure analysis, cost-saving opportunities, pricing models, etc.

- Sourcing models, contract models, SLAs and KPIs

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now