CATEGORY

Enterprise Routers, Switches, and Security Services Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Enterprise Routers, Switches, and Security Services Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Enterprise Routers, Switches, and Security Services Australia Suppliers

Find the right-fit enterprise routers, switches, and security services australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Enterprise Routers, Switches, and Security Services Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEnterprise Routers, Switches, and Security Services Australia market report transcript

Regional Market Outlook on Enterprise Routers, Switches, and Security Services

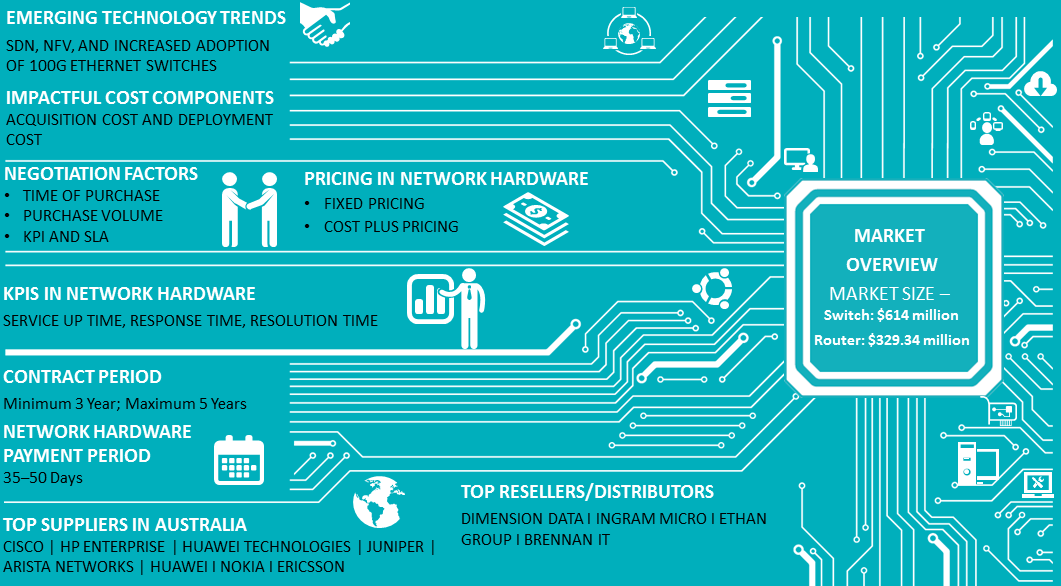

Australian Enterprise Switches Market

- The Australian enterprise and service provider switch market was valued at USD 614 million in FY 2018, an increase of 10% from FY 2017. The high growth rate in the last five years is due to the increased shipment of high speed ports (25 Gbps, 50 Gbps, and 100 Gbps)

- The another key growth driver is the increase in enterprises spend on private and public cloud services, which, in turn, increase demand for switches

- Cisco holds 65% of the Australian Ethernet switch market, followed by HPE Networks (9.5%) and Juniper Networks (3.8%)

Australian Enterprise Router Market

- The Australian Enterprise and Service Provider router market was valued at USD 329.34 million in 2018, a decrease of 6.2% from FY 2017

- The major reason for the decrease in market value is the reduction of router spending by service providers. This is because most of the service providers are looking to upgrade to 5G technology

- Cisco holds 71.6% of the Australian router market, followed by Juniper (11.8%) and Nokia (7.2%)

Drivers and Constraints

- Increase in growth of internet-enabled devices and growing demand for hyperscale datacenters are the key factors steering the growth for network hardware industry

- Major factors hindering growth for network hardware industry include the risk of information theft and increasing adoption of low-cost alternatives, such as Skype and Google Hangouts

Drivers

Growth in the usage of internet-enabled devices

To support the rapid increase in an adoption of internet-enabled devices and trends, such as BYOD, new network infrastructure is required, which, in turn, is fueling the growth of the network hardware market.

Growing demand for hyperscale datacenters

Enterprises and service providers are opting for hyperscale datacenters (because of the growing IP traffic) that are built with multistage circuit switching networks. Such datacenters require deployment of several routers and switches, and the required amount of server capacity for bandwidth and pipes to cross-connect would be more than 100,000.

Constraints

Safety of cloud usage and security of information

Though network security features have advanced in recent years, there still exist concerns regarding the security of information in the cloud by some verticals, such as pharmaceutical and BFSI.

Low cost alternates to telepresence

Enterprises are opting for alternatives, such as Google Hangouts, Skype, Apple Facetime, and other such applications as low-cost alternatives, to established telepresence solutions.

Porter's Five Forces Analysis - Global

Supplier Power

- Consolidated Market: The supplier market is highly consolidated and almost monopolistic, with Cisco holding 50 percent of the enterprise switch markets and majority of the router markets. The scenario is expected to continue, as a change in market dynamics is expected in the short run

Barriers to New Entrants

- High Capital and Technical Expertise: The barriers to new entrants are high because of high capital investments and technical expertise requirements

- New players entering the market may get acquired by larger players in order to expand their product portfolio and geographical reach

Intensity of Rivalry

- Competition for Innovation: The market is witnessing high competition, allowing peers to compete on factors, such as technology and product innovation (adoption of 100 G switches)

- Rivalry is expected to intensify with mainstream adoption of trends, such as SDN, leading toward feasible and simpler interoperability, resulting in a level playing field

Threat of Substitutes

- Converging of Device Functionalities: At a category level, there are no substitutes to the network hardware. On a sub-category level, layer-3 switches are capable of performing the functions of a router and can replace branch office routers to a certain extent

- Layer-3 switches have not yet replaced the routers in most of the IT architectures globally

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now