CATEGORY

Mobile Device Management

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Mobile Device Management .

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoMobile Device Management Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Mobile Device Management category is 10.10%

Payment Terms

(in days)

The industry average payment terms in Mobile Device Management category for the current quarter is 90.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

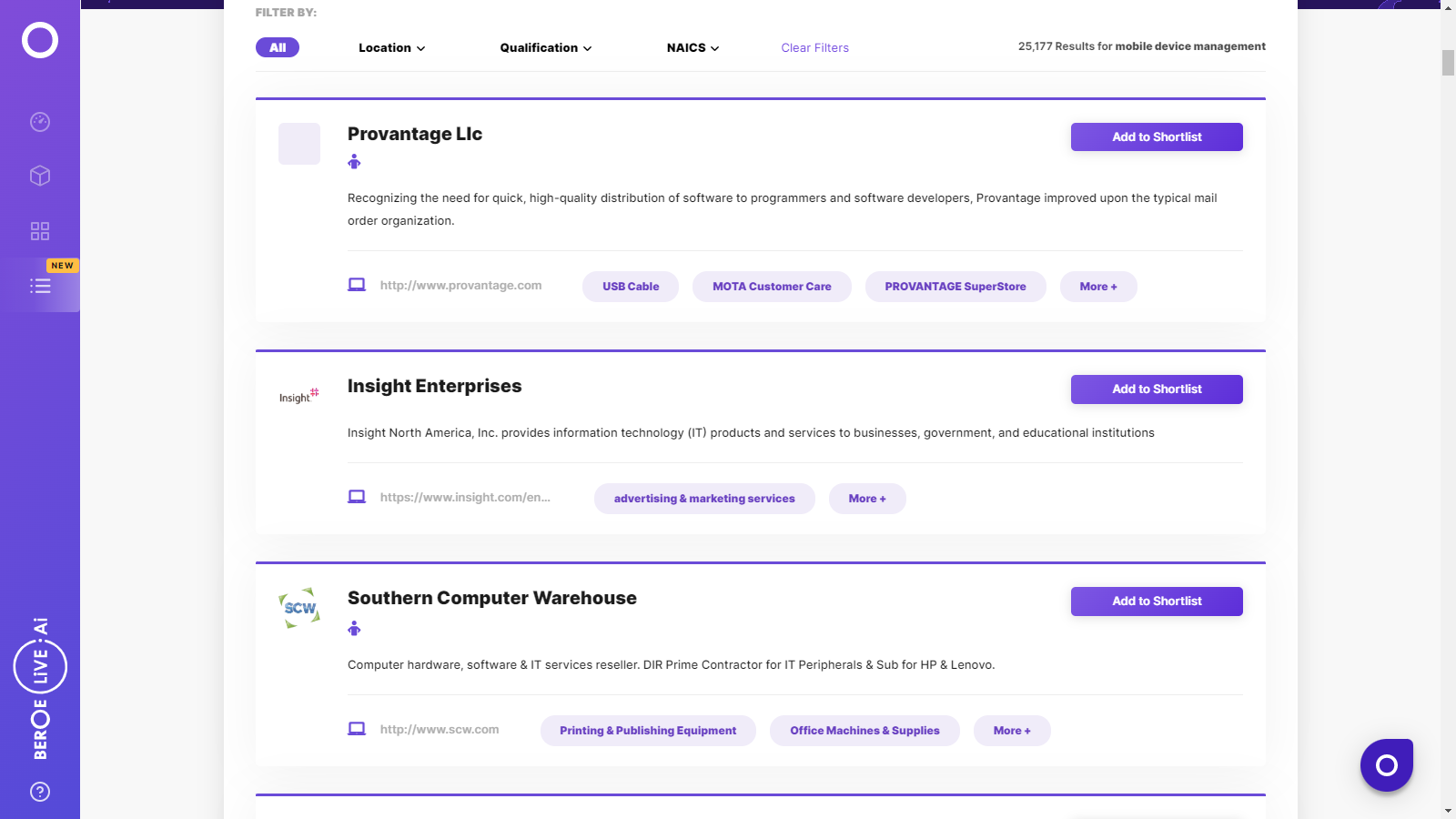

Mobile Device Management Suppliers

Find the right-fit mobile device management supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Mobile Device Management market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMobile Device Management market frequently asked questions

Leading players in the market include IBM, Microsoft, VMware, Citrix, and MobileIron. Given the rising stiffness in the competitive landscape, market players are keeping the mobility aspect at the center by building independent apps for a seamless user experience.

China is likely to remain the frontrunner in the global mobile device management market in the near future. The country is the hotbed for smartphone manufacturing, which considerably impacts the supply and demand for smartphones. Moreover, some Chinese brands are targeting the sales of mid-range and low-cost mobile devices in the Asia Pacific (APAC) and Latin America (LATAM). However, China’s mobile phone industry is witnessing low sales as customers are waiting for the cheaper 5G smartphone phones.

Samsung, Apple, and Huawei are the top smartphone brands, which hold over half of the overall smartphone market. While Samsung and Huawei witnessed a substantial decline in global shipments amid the COVID-19 pandemic, Apple remained relatively resilient with only a 5% Y-o-Y drop during Q1 2020.

Among various mobile device segments, detachables continued to flourish with a 57% Y-o-Y growth, primarily driven by the iOS devices.

The global tablet shipments stand around 144.1 million units, a 1.5% drop from the previous year. Moreover, the COVID-19 crisis led to a further reduction in the global shipments by more than 18% Y-o-Y, reaching 24.6 million units in Q1 2020.

Huawei’s worldwide smartphone shipments fell by 22% Y-o-Y to 51.9 million units in Q3 2020 due to the COVID-19 impacts and the geo-political situations.

Mobile Device Management market report transcript

Global Mobile Device Management Market Outlook

-

The global mobile device management market is valued at approximately $17 billion in 2023, and it is expected to experience further growth at a CAGR of around 25–30 percent

-

Currently, North America accounts for the largest share of the global market, followed by Europe. Asia Pacific is expected to exhibit the highest growth in the next 3-4 years

-

Among the two prevalent deployment models, cloud is expected to grow at a higher rate. Cloud based MDM solutions offer flexibility, scalability, affordability, operational efficiency, and cost benefits; as the users can access MDM solutions virtually through the internet

-

Among the industry verticals, BFSI vertical is expected to hold a larger market size as the rising BYOD implementations have made BFSI organizations adopt MDM solutions

Mobile Devices –Global Market Analysis

-

Mobile penetration and the number of mobile devices are increasing across the globe, even in the developing counties and low- & middle-income countries, primarily driven by mobile internet.

-

The market is consolidated with five leading players (Samsung, Apple, Xiaomi, OPPO and vivo) holding more than 70 percent of the market share.

-

The global smartphone market declined by 10–12 percent year-on-year, as a result of the pandemic-induced supply chain disruptions, semiconductor shortage in combination with other unfavorable economic and political scenarios

-

The market is consolidated with five leading players (Samsung, Apple, Xiaomi, OPPO and vivo), holding more than 70 percent of the market share

-

Around 250 million units were shipped in Q2 of 2022, Samsung led the market with around 62 million units and Apple was the second highest contributor to the market with around 45 million units

-

In Q4 2021, though the entire world and industry verticals are struggling, owing to the COVID-19 pandemic, tablets and Chromebooks shipments registered a tremendous growth of over 55 percent Y-o-Y

-

In Q12022, the market experienced a decline of approximately 4 percent Y-o-Y, with the global shipments registering 38.4 million units

Mobile Devices –Major Trends and Regional Analysis

Market Trends:

MDM

-

MDM is a security software used to deploy, monitor, manage, and secure employees’ mobile devices, such as smartphones, tablets, and laptops, in the workplace. It is often combined with mobile application management to provide complete EMM

-

Popular MDM solutions available in the market are Microsoft, IBM, VMware, MobileIron, Citrix, etc.

UEM

-

UEM is an endpoint management platform used for managing desktop computers and mobile devices, like smartphones, tablets, laptops

-

UEM can be used to update all devices at the same time and can also be used to manage IoT devices and printers

Custom Apps

-

Companies are paying great attention to the mobility factor by developing individual apps for smoother work, due to an increase in competition

-

The adoption of custom applications is increasing in vertical market industries

Detachable Tablets

-

Detachable tablets are associated with laptops and tablets and are full-featured tablets, which are connected to a docking device to provide a full keyboard

Mobile Devices – Recent Sourcing Trends

Sourcing Model

-

Large corporations, global enterprises, and government organizations in Europe typically procure devices from resellers and value-added resellers

-

Sourcing from carriers and telecom service providers has been losing favor with enterprises, though carriers still sell a lot of devices and can offer devices at a discounted cost, the lack of customization to the devices has made them less attractive compared to the previous years

-

Enterprises typically establish organizational standards regarding mobile devices and run a RFP with resellers, it is observed that the involvement of the manufacturer in this process increases, and they guide the customers to resellers that have a better relationship, and who adhere more to the manufacturers sales plan

OS Adoption

-

The preference toward android has significantly increased over the past couple of years, and enterprises aim to achieve a healthy balance between iOS and Android, predominantly Apple and Samsung devices, however, based on the organizational culture, some prefer to adopt a single OS

-

Both Apple and Samsung supporting leasing of their devices, over a two-year period, which would be refreshed with new devices at the end of the tenure. Apple also supports an inventory buy-back model through which they reclaim older a higher price, which are refurbished and sold to enterprise customers or carriers

-

Enterprises, who tend to emphasize more on security, tend to refrain from sourcing refurbished devices, as they are more willing to prevent any threat to enterprise data

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now