CATEGORY

Data Center Hosting and Storage Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Data Center Hosting and Storage Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Data Center Hosting and Storage Australia Suppliers

Find the right-fit data center hosting and storage australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Data Center Hosting and Storage Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoData Center Hosting and Storage Australia market report transcript

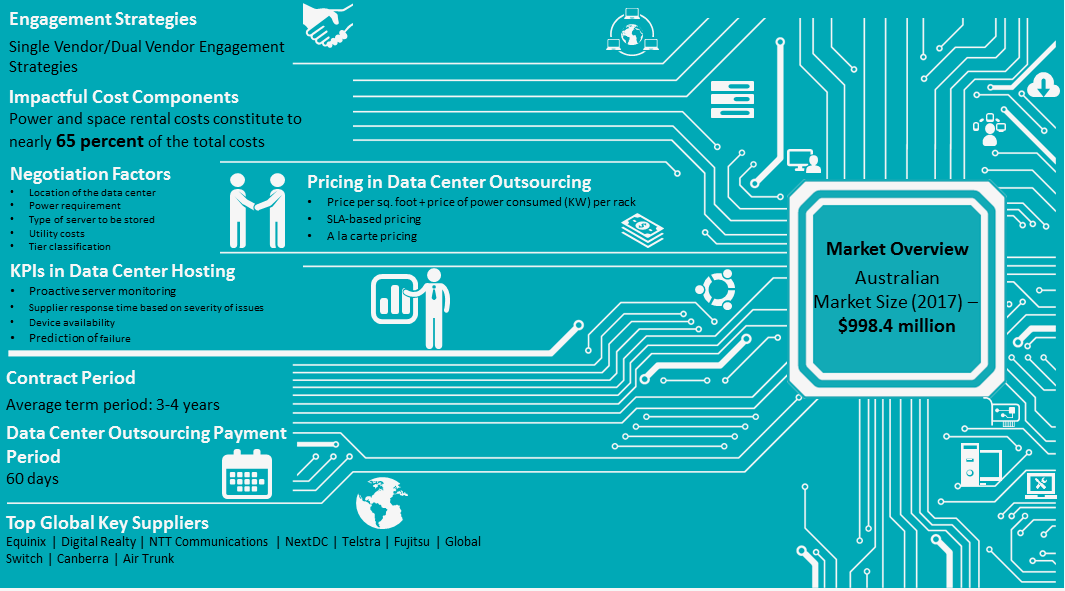

Regional Market Outlook on Data Center Hosting and Storage

The Australian data center services market is projected to grow at a CAGR of 9.8 percent from 2015 to 2023. The growing demand for reduction in IT infrastructure expenses, physical space, security, and high power requirements are the major factors driving the market.

Co-location Market

Co-location Market

- The Australian co-location services market is projected to grow at a CAGR of 9.85 percent and reach $1.1 billion by 2023

- In Australia, Melbourne remains the top area, in terms of highest installed capacity of co-location data center, followed by Brisbane and Adelaide

- During 2017, the wholesale co-location revenue grew around 20 percent Y-o-Y, higher than the growth of the retail co-location market

Managed Hosting Market

- The Australian managed hosting services market is projected to grow at a CAGR of 11.75 percent and reach $569.5 million by 2023

- The growing importance of streamlining IT costs, limited IT expertise, and improving operations are the major factors driving the market

- While managed hosting services are witnessing greater adoption, colocation services continue to dominate data center services revenue

Australian Market Outlook – Data Center Services

- The Australian data center outsourcing market is expected to grow at a near double-digit pace and reach AUD 1.7 billion by 2023, mainly driven by shrinking IT budgets, limited IT expertise, and increasing operational overhead within enterprises

- The Australian market continues face competition in the Asia Pacific region, particularly from Singapore and Malaysia.

Key Business Segments

- Data center co-location: Customers can rent/lease out data center space from third- party vendors, where options, like power, security, and bandwidth, are readily available

- Dedicated hosting: Service providers will provide the infrastructure and hardware configuration required to run a data center, with only limited services

- Managed hosting: Extension of dedicated hosting, it also includes complete end-to-end management services

Australian Landscape

- The market is fragmented in nature, and no single vendor contributes to more than 15 percent to the overall data center raised floor space in 2017

- The impetus provided by the exponential growth of hyperscale cloud vendors has made data center providers to extensively focus on attaining scale to provide network-abundant, hyperscale-ready facilities to support such requirements

Co-location and Managed Hosting – Global Drivers and Constraints

Drivers

Flexible plans

- Co-location and managed hosting vendors provide flexible payment structures, suited to every organization's needs

- Enterprises can choose the plan depending on criticality of application and technical specification of device they propose to proceed with

Minimal latency

- While the performance of devices is completely outsourced in a managed hosting model, enterprises need not worry about computing performance or the latency involved

Zero downtime

- The hosting vendors make sure that servers, platforms, and network infrastructure are constantly monitored and ensure that enterprises operate without any downtime

- Hiring and training an in-house team to manage data centers would prove to be expensive for enterprises

Backup and security

- Hosting vendors also make sure that data is backed up and safe, even in cases of technical failure or natural disasters

- Global hosting vendors are capable of securing data and ensuring they adhere to the security guidelines and regulations governing that region/industry

Constraints

High cost

- Vendors in the hosting space charge a high fee for managed hosting services, as they take care of end-to-end management activity of data center

- Organizations need to analyze the applications that should be co-located and managed in-house vs. completely outsourcing to a managed hosting vendor

Reduced flexibility

- Through managed hosting, organizations will have reduced control over the administrative access of servers

- Enterprises will have to rely on the hosting provider every time for management activities of a data center

- As enterprises have ownership only of the data and not of physical device itself, they find it difficult to terminate current agreement with the vendor

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now