CATEGORY

Personal Computing

Personal Computing covers desktops, laptops, tablets, smartphones and thin clients which are essentially computing devices

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Personal Computing.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

APAC sees dip in business deals amid economic crisis

April 25, 2023China to probe Micron over cybersecurity, in chip war?s latest battle

April 10, 2023HP releases Wolf Connect solution for secure remote PC management

April 03, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Personal Computing

Schedule a DemoPersonal Computing Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Personal Computing category is 10.80%

Payment Terms

(in days)

The industry average payment terms in Personal Computing category for the current quarter is 81.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Personal Computing Suppliers

Find the right-fit personal computing supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Personal Computing market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPersonal Computing market report transcript

Global Personal Computing Market Outlook

-

By volume, In Q4, 2022, worldwide PC shipments reached 65.29 million units, a 28.5 percent decline from Q4 2021

-

Worldwide PC Shipments experienced the sharpest decline in ever. The decline that’s witnessed in Q3, 2022 has extended in Q4, 2022

-

The anticipation of a global recession, increased inflation, and higher interest rates have had a major impact on PC demand

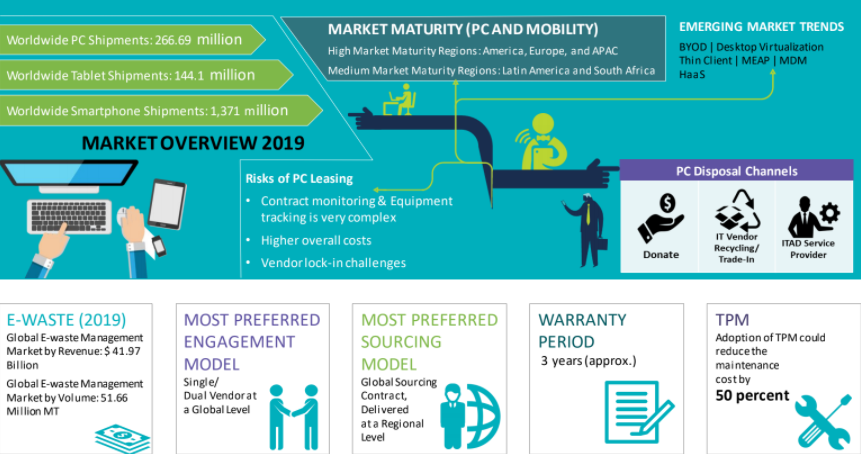

PC Market Overview - Global

Market Trends:

BYOD

-

Enterprises have started adopting BYOD as a game-changer for better employee satisfaction and increased productivity. The initiative has replaced notebooks with mobility devices

-

The trend is highly prevalent in China. The U.S. and is expected to exploit the market opportunity in APAC region

Desktop Virtualization

-

The penetration of desktop virtualization in large enterprises has increased exponentially with the priority to optimize cost

-

Increased productivity, reduction in CAPEX and OPEX costs, higher security and work-from-home options for employees are some of the major advantages, which have led large enterprises to embrace desktop virtualization

Thin Client

-

A thin client, also referred to as a lean client, is a stateless desktop terminal that has no hard drive. When using a thin client, all features like applications, sensitive data and memory are stored back in the data center. It is used as a replacement of PC technology to access any virtualized application

-

A thin client is used in various industries and enterprises worldwide. IT personnel are exploring and switching to thin client due to cost effectiveness and security

Mobility Market Overview - Global

Market Trends:

MDM

-

MDM is a security software used to deploy, monitor, manage and secure employees’ mobile devices, such as smartphones, tablets, and laptops in the workplace

-

It is often combined with mobile application management to provide complete enterprise mobility management

-

Popular MDM solutions available in the market are those from Ivanti, Microsoft, Citrix, IBM, VMware, Blackberry, etc.

Custom Apps

-

Companies are paying great attention to the mobility factor by developing individual apps for smoother work, due to increase in competition

-

The adoption of custom applications is increasing in vertical market industries

Detachable Tablets

-

Detachable tablets are associated with laptops and tablets and are full-featured tablets, which are connected to a docking device to provide a full keyboard

-

The tablet market is expected to bolster in forth coming years, due to high prominence of work from home and growth in EdTech industry

Adoption Trends Worldwide - PC, Tablets, and Smartphones

The most-adopted technology trends are server virtualization, mobility/BYOD, advanced security solutions, Software as a Service (SaaS), application virtualization/hosted shared desktop and virtual desktop infrastructure

PC

-

BYOD and desktop virtualization are merely the ‘tip of the iceberg' when it comes to gaining the full benefits of mobility

-

PC adoption also remains high because of the spread of Covid pandemic encouraging work from home activity in the enterprises

-

PC market witnessed decline in fourth quarter of 2021. This is attributed to supply-chain issues and semiconductor shortage. The demand factors are PC amongst enterprises for work from home and increasing prevalence of remote education

Tablet

-

Need for enterprise portability/real-time access to on-the-go work (regardless of physical location)

-

The introduction of more neural net processors to tablets, stronger adherence to cloud computing and convenience will make the tablet even more integrated into the work environment

-

Consumers and enterprises want to replace their aging PCs with detachable ones, with the support of touch technology and styluses

-

Dynamic tablets and 2-in-1 markets with the software and services are driving the adoption

Smartphone

-

Mobility level is high which makes the employee use a wide variety of mobile-first apps for business, away from their desk

-

Mobile devices have become essential business tools. There are many customized apps enabling office work to be done anywhere. The most emerging technology used to secure the data is enterprise mobility management

-

Ready access to the internet and the large number of web- and cloud-based applications make employees opt for business smartphones

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now