CATEGORY

Mobility - Voice and Data

Mobility - Voice and Data market includes wireless data and voice markets. It outlines Subscription penetration,data/network coverage, trends and technolgies of leading telecom operators

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Mobility - Voice and Data.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Optus faces court proceedings by law firms

April 21, 2023Cyberattack at T-Mobile US

January 26, 2023Cyber attack happens at T- Mobile

January 04, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Mobility - Voice and Data

Schedule a DemoMobility - Voice and Data Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Mobility - Voice and Data category is 13.50%

Payment Terms

(in days)

The industry average payment terms in Mobility - Voice and Data category for the current quarter is 48.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

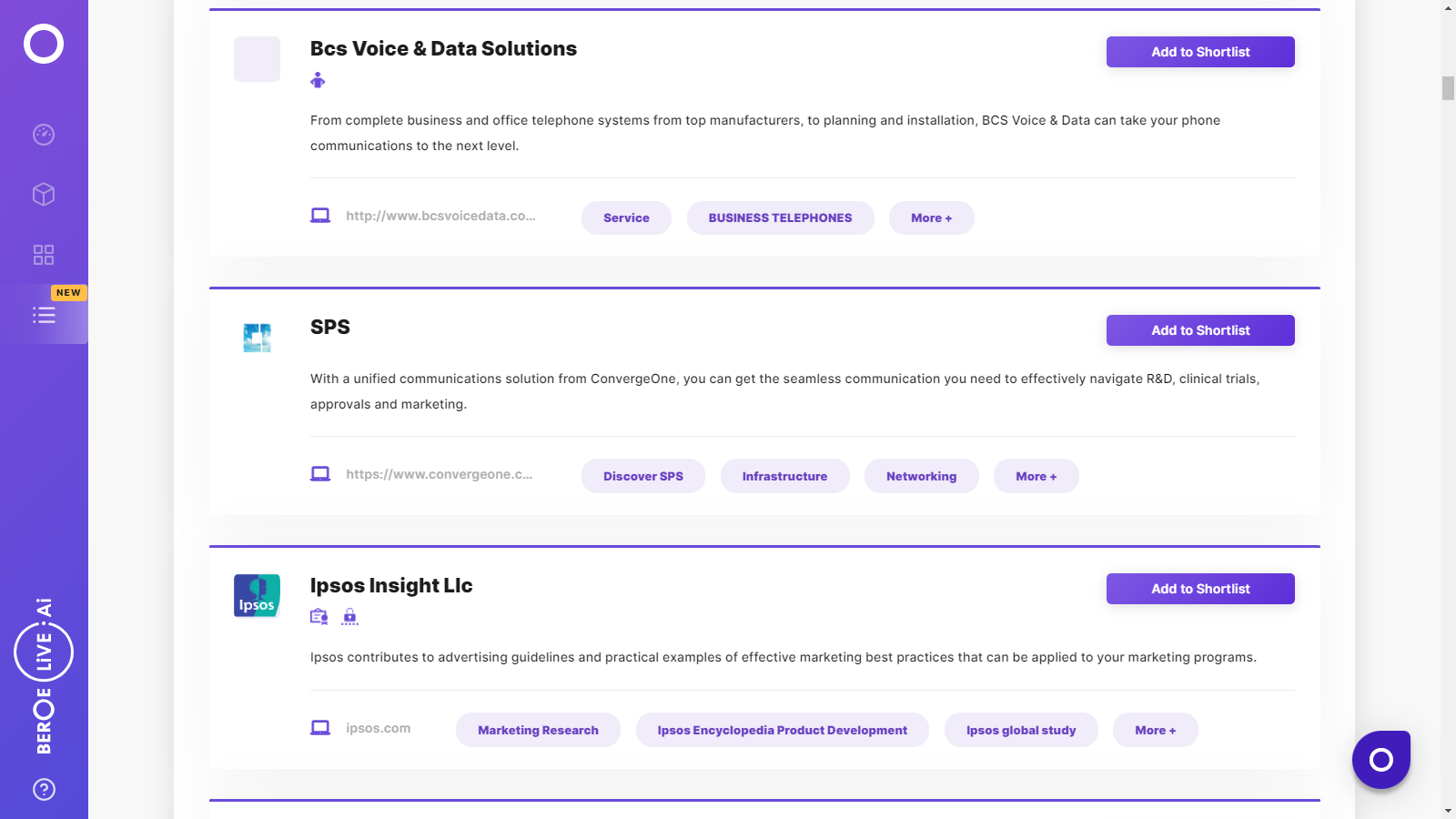

Mobility - Voice and Data Suppliers

Find the right-fit mobility - voice and data supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Mobility - Voice and Data market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMobility - Voice and Data market report transcript

Global Mobility - Voice and Data Industry Outlook

-

The global market size for mobility services, in terms of the total number of unique subscribers, was estimated at 5.48+ billion in 2023*

By 2025:

-

The global mobile penetration rate is also expected to witness growth from 67 percent to 70 percent

-

As far as technology adoption is concerned, most of the telecom operators are gradually shutting down 2G to concentrate their revenue stream on 4G and 5G technology. It is estimated that the global percentage of 4G connections has crossed above 56 percent, and the percentage of smartphone connectivity has reached 68 percent

Global Mobility - Voice and Data Market Maturity

-

The North American and European mobile markets are highly matured, and mobile penetration is nearing saturation levels. Subscriber growth and penetration are expected to be increase over the years. In APAC, mobile markets in Australia, Japan and South Korea are categorized as developed markets, whereas China, India, Indonesia, Bangladesh, Myanmar and Vietnam are categorized as developing markets.

Global Mobility - Voice and Data Market Trends

-

The North American mobile market is highly matured, and mobile penetration is nearing saturation levels. However decline in mobile voice revenue is compensated by data traffic/consumption

-

The European mobile market has been witnessing a trend of M&As in the past five to six years, which has led to increases in competition. The market is expected to witness the same for the next two to three years

-

Compared to the European and North American markets, M&A activities are low in the APAC as well as MEA markets. As far as new technological advancements are considered, these markets have potential to grow

-

4G developments have already commenced in developed markets, and the licensing of 4G spectrum is expected to be completed in developing markets

Global Mobility Market Overview

-

The subscriber penetration rates are slowing down globally and is expected to reach 70 percent of the global population in the next five years. The market is expected to be driven by Latin America and developing countries in APAC, namely India, Indonesia, China, Pakistan, and Bangladesh. A segment with opportunity for growth is mobile internet.

Global Mobility –Drivers and Constraints

Drivers

Demand for OTT applications and BYOD

-

Consumers switching to OTT applications such as Skype, WhatsApp, Facebook Messenger, Google voiceover calls and SMS are driving the mobility market

-

All these enterprises focus on high operational efficiency and would like to enhance workforce productivity. This shift in the market is driving enterprise mobility

-

Increasing adoption of enterprise mobility in the massive banking and financial sectors is driving the mobility market

Increase in demand for cloud-based solutions

-

The rapid adoption of enterprise trends, such as cloud-based solutions, Big Data and the emergence of data-intensive IoTs are driving mobility services such as VoIP and SIP trunking services

Demand for mobile data traffic

-

Demand for the share of video traffic, file sharing and audio on smartphones and tablets has increased rapidly, which in turn is resulting in demand for high-speed internet

Constraints

Industry regulations

-

The telecom industry is highly regulated, with regulations governing M&A activity, data and price.

-

These regulatory regimes frequently restrict the company's ability to operate in or provide specified products or services in designated areas and require the company to maintain licenses for its operations

Decline in ARPU & Churn rate

-

Customers are becoming highly sensitive to any negative experience and tend to switch from one operator to other. Hence, giving a tough time to service operators to retain their customer

-

With customer attrition, service providers not only lose customer acquisition cost but also lose revenue for a year

Increase in Capital expenditure/Operational Expenditure

-

Operational and deployment activities from the supplier’s side has become a huge challenge. By the time suppliers receive returns on investment on a particular technology, they are forced to invest on deploying a newer technology in order to maintain a competitive edge

Pricing Models

Usage-based Fee

-

This model is also referred as the ‘Pay as you Go’ model.

-

In this model, the user purchases a certain amount of credit before the phone is used

-

The phone can be used until the credit expires or runs out

Flat Recurring Fee

-

This is a contract-based model

-

In this model, the buyer pays a fixed fee on monthly or annual subscription basis

-

The flat recurring fee model can either be limited or unlimited, based on the buyer’s requirements

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now