CATEGORY

Wireless Communication Market in Canada

Wireless communication focusses on mobility networks, evolution and trends

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Wireless Communication Market in Canada.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Wireless Communication Market in Canada Suppliers

Find the right-fit wireless communication market in canada supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Wireless Communication Market in Canada market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoWireless Communication Market in Canada market report transcript

Wireless Communication Market in Canada

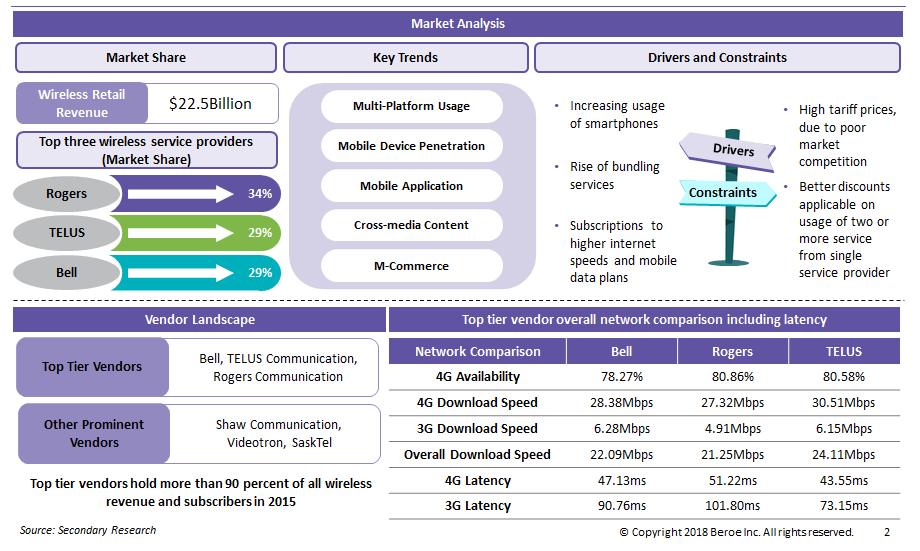

- Canada's three largest providers of wireless services: Bell, TELUS, Rogers, hold more than 90 percent of total market revenue and subscribers

- Wireless sector contributes to 51 percent of telecom retail revenue in Canada, which translates to about 7 percent increase over 2014

- Retail telecom sector services 12 million households and 1 million businesses and constitutes to 92 percent of total telecom revenue in Canada

- Wholesale services are provided by telecom service providers to internet service providers, resellers, and other telecom entities that contributes to 8 percent of the total telecom revenue

- Wireless market in Canada is dominated by three suppliers: Bell, Rogers, TELUS, which indicates that the market has not experienced any competition to benefit customers for competitive pricing

- In 2015, the Government of Canada released 50 MHz of spectrum in an auction for advanced wireless services (AWS-3) to encourage greater competition in the wireless market

- Further, in order to enable the new entrants in the wireless space, telecom regulator (CRTC) has introduced a policy to regulate rates that major telecom service providers, such as Bell, Rogers, and TELUS, charge other wireless carriers for domestic GSM-based wholesale roaming services

- These regulations are expected to facilitate sustainable competition and benefit customers by providing reasonable prices and innovative services

Enterprise Mobility - BYOD

With enterprises starting to adopt BYOD/BYOM policies, the demand and dependency on wireless services is higher than ever. In order to meet this demand, suppliers are introducing data intensive plans with a pooling features.

- Wireless data usage increased to 44 percent in 2015, due to the increase of device ownership and high data consumption

- Approximately 70 percent of wireless data subscribers utilize plans for at least 1 GB of data usage per month

- In 2015, the smartphone and tablet ownership have increased to 7 percent and 52 percent, respectively

- In 2015, 55 percent of Canadians streamed music videos on YouTube, 23 percent streamed AM/FM radio online, 20 percent streamed personalized online music, and 22 percent listened to podcasts, thus utilizing more data

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now