CATEGORY

Visual Merchandizing, Fixtures, and Furnishings (VMFF)

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Visual Merchandizing, Fixtures, and Furnishings (VMFF).

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Broad international attendance for Euroshop 2023

March 20, 2023Alpha Nero to open a new production facility in Riyadh

March 16, 2023Umdasch presents forward looking shopfitting ideas in EuroShop in D?sseldorf from 26 February to 2 March 2023

March 02, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Visual Merchandizing, Fixtures, and Furnishings (VMFF)

Schedule a DemoVisual Merchandizing, Fixtures, and Furnishings (VMFF) Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoVisual Merchandizing, Fixtures, and Furnishings (VMFF) Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Visual Merchandizing, Fixtures, and Furnishings (VMFF) category is 8.00%

Payment Terms

(in days)

The industry average payment terms in Visual Merchandizing, Fixtures, and Furnishings (VMFF) category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Visual Merchandizing, Fixtures, and Furnishings (VMFF) Suppliers

Find the right-fit visual merchandizing, fixtures, and furnishings (vmff) supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Visual Merchandizing, Fixtures, and Furnishings (VMFF) Market Intelligence

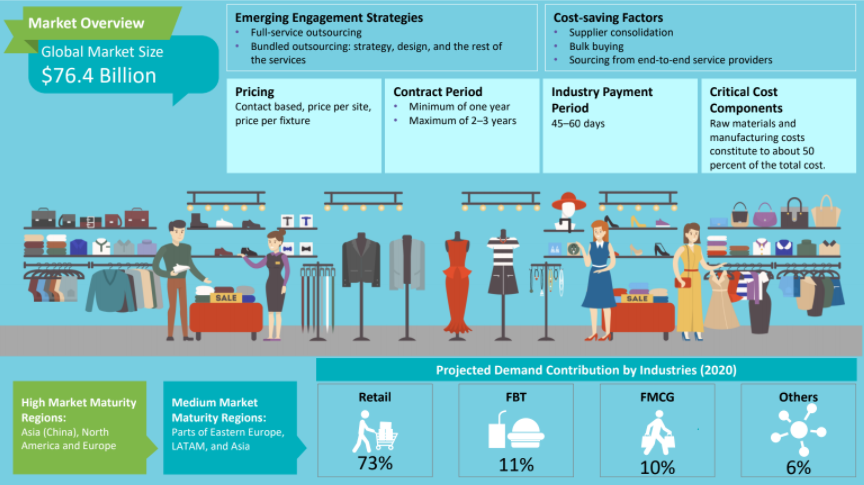

global market outlook

- The global VMFF market is estimated to be 87-89 billion USD in 2022. Market size in North America is the highest at 31Billion, followed by Asia with a market size of 22.6-24 Billion. Europe is estimated to have a market size of 22.4-22.8 Billion.

- Global players in the VMFF industry includes Idx Corporation, RTC, Triad, Caps Group, ARNO, Ganter Interior, Array Marketing, Diam.

- According to industry experts, the global demand is expected to grow at around 10% CAGR (2021-2026F).

- The top three industries that contribute to the VMFF market are retail, CPG, and FBT.

- In case of visual merchandizing displays, there is an increasing demand for sustainable materials, such as bio resin and biomaterials that include polyethylene regular new granules: 100 percent from renewable source, easy to reuse, regranulated plastics, non-toxic poly propylene, etc.

Use the Visual Merchandizing, Fixtures, and Furnishings (VMFF) market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoVisual Merchandizing, Fixtures, and Furnishings (VMFF) market report transcript

Global VMFF Industry Outlook

-

The global demand is expected to grow at approx. 3 percent CAGR through 2023–2025 (F)

-

The global VMFF market is estimated to be $84–89 billion in 2023 (E)

-

Asia, North America, and Europe are high maturity markets, with China, India, the US, and the UK being the key demand countries.

-

The top three industries that contribute to the VMFF market are retail, CPG, and FBT

Global VMFF: Market Maturity

-

VMFF is gaining prominence across markets, due to the consistent growth in retail

-

Major end-users are apparel retail, CPG retail, and FBT companies

Global VMFF: Industry Trends

-

With continued growth of the retail industry, suppliers around the globe are improving their service offerings and expanding their geographical presence to meet buyers’ evolving needs for consolidation

-

With continued growth of the retail industry, suppliers around the globe are improving their service offerings and expanding their geographical presence to meet buyers’ evolving needs for consolidation

Global VMFF: Drivers and Constraints

-

With the growth in organized retail across emerging markets and rise in technology-based innovation, there will be a rise in the investment in retail stores, which would further increase the spend on VMFF

-

Rise in the adoption of technology by suppliers and improved service portfolio & market access will be the major growth drivers in the matured markets as well as the emerging markets

Drivers

Integrating technology

-

Development of the latest technological tools to improve the store experience will drive the consumption of VMFF products and services in both the developed and emerging markets

Bundled solutions

-

Higher usage of VMFF services brings in the opportunity for bundled solutions, which are provided by suppliers in the developed markets. Using these services, buyers can save considerable costs

Declining technology costs

-

Due to the reduced costs of technology, same investment is giving better yields, and therefore, buyers and suppliers are increasingly showing interest toward technology-enabled services and products

Constraints

Rise in e-commerce retail

-

Consumers may increase their purchase online, and this may result in reduced investment in traditional retail stores, which could further impact the VMFF industry

Retail stores: Closure

-

Many of the reputed brands have closed hundreds of stores in recent years, due to unprofitability. This is expected to directly impact the demand for visual merchandizing materials and services

Supply Trends and Insights

Global/Regional Supplier

The VMFF industry is evolving and has given rise to the emergence of many store design firms. There are a few players in fixture manufacturing who have global presence, and a number of suppliers who have a presence in multiple markets.

Consolidation of suppliers across markets:

-

US: Many suppliers have expertise in manufacturing shop fitting fixtures as well as visual merchandizing fixtures. Many of the prominent shop fitting fixture manufactures and merchandizing cosmetic fixture manufacturers have a presence in the US, which makes it an attractive sourcing destination

-

China: Presence of large fixture manufacturing suppliers, who can support brands with multiple type fixture, makes China a key sourcing destination

Supply Trends

-

Global reach: Suppliers are expanding their presence into newer markets to address clients’ requirements in these markets.

-

Service expansion: Clients are increasingly looking for suppliers, who act as a one-stop-shop for all their retail environment needs, therefore suppliers are widening their service portfolio.

-

Environment friendly: Suppliers offering fixtures are focusing on environment-friendly products and processes and are trying to use innovative materials in fixtures.

-

Strategic Partnerships: Fixture manufacturers have partnered with retail Suppliers for installation, maintenance, etc., to provide one-stop solution for the client

Engagement Trends

-

Most adopted model: Engaging with few of the top nationwide/global suppliers

-

Contract length: Medium term (2–3 years)

-

Pricing strategy: Fixed based on contract is the recommended model. Once design is finalized, estimate to be obtained based on requirement and contract to be placed for “X” number of fixtures. The price is locked, no matter what volatility the manufacturer encounters before, during or after the production Demand Consolidation – Engaging with limited established preferred suppliers will enable better price negotiation. Global suppliers with manufacturing in China as well as outside China can be engaged to leverage different regional capabilities

Why You Should Buy This Report

Information about Visual Merchandizing, Fixtures, and Furnishings market size, maturity, industry trends, regional outlook, drivers and constraints, etc. Porter’s five force analysis of developed and emerging VMFF markets. Major innovations, supply trends and insights, product portfolio and SWOT analysis of major players like CAPS Group, Ganter Interior, Global Display, etc. Sourcing models, engagement models and pricing models for VMFF.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now