CATEGORY

Commercial and Reminder Items Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Commercial and Reminder Items Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Commercial and Reminder Items Australia Suppliers

Find the right-fit commercial and reminder items australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Commercial and Reminder Items Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCommercial and Reminder Items Australia market report transcript

Regional Market Outlook On Commercial and Reminder Items

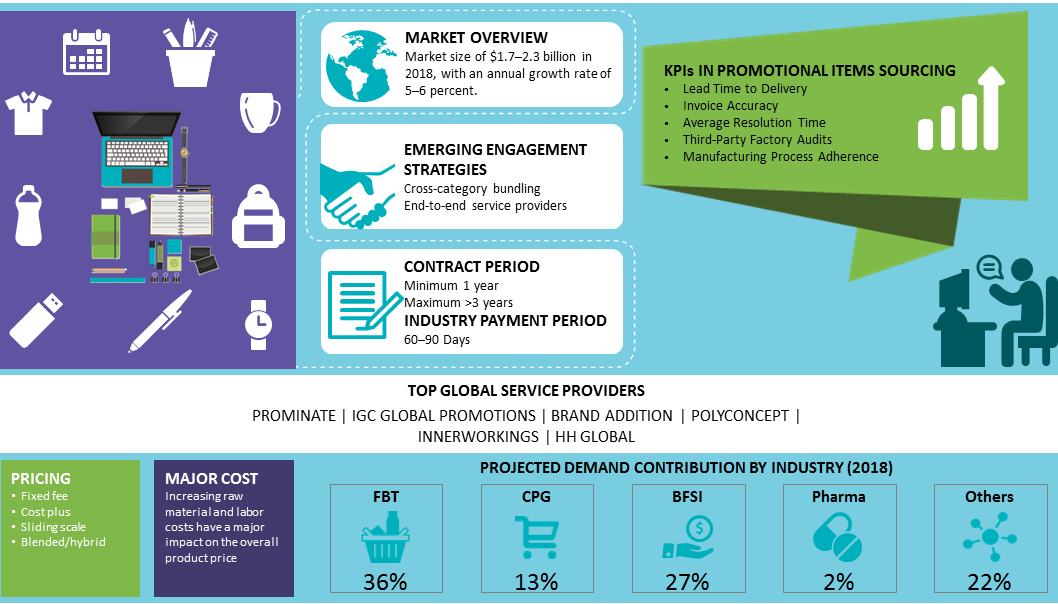

- The Australian reminder items market is valued at $1.7–2.3 billion in 2018, and it is growing at ~5–6 percent Y-o-Y

- The total Australian spend for promotional items is forecasted to be $2.7 billion by 2020

- The growth will be driven by the increasing focus of key end-user industries, like BFSI, food, beverages, and CPG

- Most of the growth in demand will be from the markets in South and Australia, in addition to the high maturity regions, like New South Wales and Victoria

Global Reminder Items: Drivers and Constraints

Drivers

- One of the most important growth drivers is the increase in value-added services, like design inputs, relevant market inputs, and value engineering, and spend/cost structure visibility provided by suppliers, which enables buyers to gain assurance and try new initiatives with regard to promotional/reminder items

- Buyers are working toward reducing their environmental footprint; hence, the demand for green/eco-promotional products is also on the rise, as buyers attempt to attain a better brand value and image

- According to recent studies, electronic gadgets are gaining more prominence and have become one of the important drivers of the promotional items industry. Hence, buyers are procuring gadgets, like power banks, earphones, wearable technology, and most importantly, wireless accessories

- The Australian marketers spend $1.7–2.3 billion a year on promotional products. Studies indicate that 91 percent of people have at least one promotional product in their kitchen and 74 percent in their offices

- Rise in the demand for retail brand products being used as promotional merchandize, since it deeply resonates with the younger target audience

Constraints

- Experts suggest that there is a lack of innovation in the industry. For example, polypropylene tote bags became a sensation eight years ago, and there has nothing been noteworthy since.

- It is also believed that one of the critical reasons for sluggish innovation is pricing pressure among the suppliers and manufacturers

- Many countries are starting to ban plastics, which will become a major constraint, in terms of sustainable raw material substitutes, resulting in increased overall costs

- The pharmaceutical industry is strictly governed by codices and regulations, with respect to issuing promotional items to patients, healthcare professionals, etc. Therefore, the spend for the promotional items industry with regard to the pharmaceutical companies is slowly decreasing with just 2–3 percent of the total global spend

Porter's Five Forces Analysis: Australia Reminder Items Industry

Supplier Power

- Supplier power in the Australian markets ranges from low to medium, owing to the fragmented supply base, which results in the buyers, having enormous number of options to choose from

- Suppliers find it challenging to win and sustain a customer/buyer for a significant period

Barriers to New Entrants

- Australia encourages new businesses for various economic reasons, like job creation and FDI. Thus, they impose limited restrictions on the setting up of businesses

- However, the basic guidelines, with respect to emissions and carbon footprints, are expected to be monitored

Intensity of Rivalry

- Intensity of rivalry is extremely high in the emerging markets, owing to various new entrants and their boutique or diverse service capabilities

- Suppliers are expected to be well equipped with innovative service capabilities, in order to remain attractive to the buyer

Threat of Substitutes

- The threat of substitutes is considerably high, as the promotional items can also be substituted with digital incentives, like discount coupons, free passes, and online rewards

- These substitutes might also open up the possibility of reducing overall costs for the company

Buyer Power

- Buyers have a significant power over vendors, due to availability of a large number of vendors, offering highly varied type of reminder items with no compromise on quality and service

- Moreover, the switching costs for buyers are low, making them even powerful

Commercial and Reminder Items Australia Market Overview

- Australia is one of the largest adopters of reminder items, with approximately 1.7–2.3 billion overall spend, which is around 14 percent of the total APAC spend

- The maturity of both buyers and suppliers in these regions is medium, due to limited adoption of the latest technologies and trends

- The increasing need for supply chain transparency constantly demands that suppliers modify the services that they offer to buyers.

- Most Australian buyers predominantly adopt a local strategy, due to limited spend in reminder items

- Global players are starting to show a gradual increase in sourcing maturity by entering into regional contracts and limiting their overall supply base.

- Medium technology adoption and other trends by the suppliers. They also focus on increasing the service capabilities with respect to deep integration into the buyers’ ERP

- Spend and cost structure visibility to stakeholders.

- Major global buyers are consolidating their procurement strategies to a more limited and centralized engagement approach.

- Fitness-related products are gaining more and more prominence in the Australian market, due to increasing health awareness and concerns among the end consumers.

- Green promotional items see a low adoption, due to increased landed costs. However, global high spend players see green items as a tool to increase brand value.

- The majority of global suppliers have in-house design capabilities, along with relevant market insights, which help their buyers meet their business requirements in a more efficient and effective manner.

Why You Should Buy This Report

- Information on the commercial and reminder items Australia market maturity, drivers and constraints, regional market outlook, etc.

- Porter’s five forces analysis of the Australian commercial and reminder items industry.

- Supply trends and insights, profiles and SWOT analysis of key players like Prominate, IGC Global Promotions, Brand Addition, etc.

- Sourcing models, case studies, engagement models, pricing models, KPIs, SLAs, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now