CATEGORY

Commercial Print Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Commercial Print Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Commercial Print Australia Suppliers

Find the right-fit commercial print australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Commercial Print Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCommercial Print Australia market report transcript

Regional Market Outook on Commercial Print Australia

-

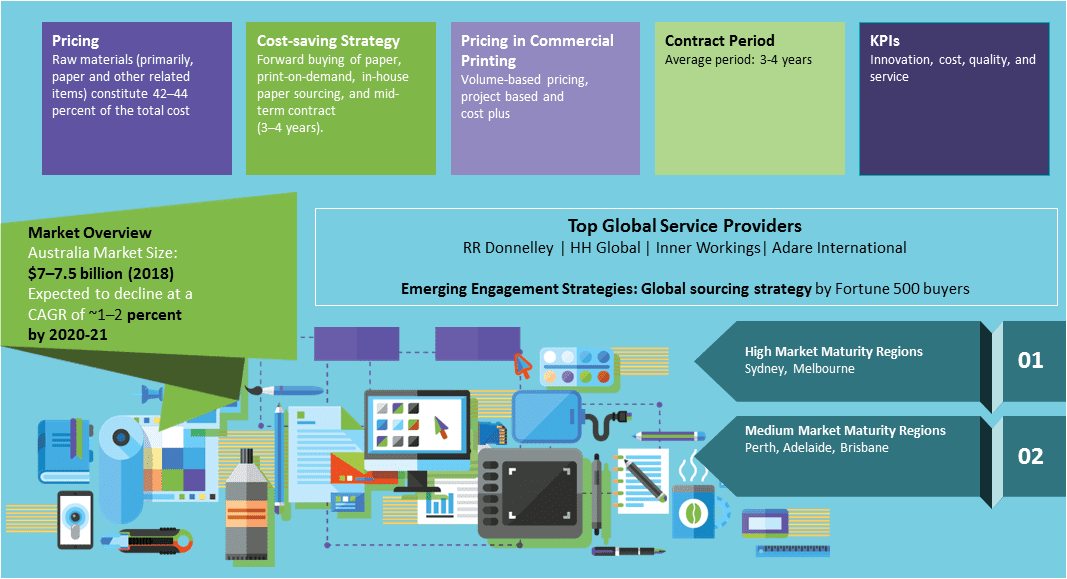

Market Size 2023 (E) - $7billion

-

Growth Rate 2023 (E) - 1.5–2.5 percent annually

-

Locations with High Maturity - Sydney, Melbourne

-

Major End-user Industries - Retail, CPG, BFSI, publishing and telecommunication

Maturity of Service Providers

- There is a scattered presence of global service providers and regional service providers. Local service providers are medium in this region.

Maturity of the Buyers

- The maturity of buyers is medium in this region. With the increase in spending driven by high market potential, the maturity of buyers is expected to rise at a fast rate.

Australian Commercial Print Industry: Market Maturity

- Commercial print penetration is medium in Australia

- Australia is a major contributor to the APAC commercial print industry

- Maturity of buyers and suppliers in Australia is lesser compared to mature markets, such as Europe, the US, and Japan

- There has been increased focus on trends, such as print-on-demand, digital printing, and value-added services by suppliers in Australia to match their client's expectations

Commercial Print Industry - Drivers and Constraints: Australia

To counter the effect of digitization of commercial print, service providers are adding value-added services, such as data management, consulting, and e-publishing to retain their clients. However, major segments, such as labels, packaging materials and books for educational institutes, still have sustained demand

Drivers

Value-added services

- A wide range of value-added services, like mailing, fulfilment, consulting, graphic design, and data management services, enables print suppliers to deliver innovative services to their buyers. Suppliers in the market are competing with each other by providing value-added services to their clients at competitive prices, and they help buyers consolidate multiple print-related activities to a single service provider

Potential industry sectors

- The demand for print services is primarily driven by the retail, financial services, publishing, and food & beverage industries. Demand for on-demand print materials, packaging, wide-format printing, digital printing, and other promotional materials by the retail, food and beverage industries is a key driver

Eco-friendly practices

- The introduction of eco-friendly practices, like soy ink, instead of the traditional petroleum-based ink, has reduced the printing industry's impact on the environment and has helped both the buyers and suppliers control their carbon footprints

Constraints

Increase in digitization

- With the increase in digitization, it is expected that buyers will adopt more electronic versions of printing materials, such as e-annual reports, e-vouchers, and e-catalogues, or use more online channels, like e-mail, the internet or websites, rather than printing materials to target consumers, which, in turn, will affect the demand for print-related items

Dependence on feedstock prices

- The print industry is dependant on feedstock prices, such as the price of paper, inks, solvents, etc. Price fluctuations for these items have an impact on the print industry. The volatility of the raw material prices poses a risk to the buyers because it has a direct impact on the final prices

Commercial Print Australia Market Overview

- The intensity of rivalry is medium, as there is a limited number of established commercial printers in Australia market

- Moreover, there are many small printers that exist in the market but do not provide end-to-end services, such as digital printing, online printing, warehousing, and fulfillment.

- As the supply base is relatively limited in Australia as compared to the developed locations, the buyer has limited bargaining power.

- The number of global commercial print service providers in Australia is considerably lower as compared to mature markets such as North America and Europe.

- Supplier maturity in the Australia markets is medium and their service capabilities are also quite limited.

- The business environment in Australia is a bit challenging; hence, entry for new players into the market isn’t that easy.

- Moreover, commercial printing is a capital-intensive market, restricting new entrants.

- Substitutes for commercially printed material, such as online media and advertising, have adversely affected the commercial print industry

- Digital publishing is the conversion of existing PDFs into the media-rich format for smartphones, and the table-compatible format is a trend that is gaining momentum.

- The growing trend of short run, on-demand work is being facilitated by advances in digital printing technology. High-volume printing will be reduced over time as more prints are produced on demand.

- Shorter runs, enhanced quality, speed to market and mass customization are key driving factors that increase the adoption of digital printing services. However, lithographic printing is still dominant

Why You Should Buy This Report

- Information on the Australian commercial print market maturity, drivers and constraints, regional outlook, innovations, etc.

- Porter’s five forces analysis of the Australian Commerical Print industry.

- Supply trends and insights, supplier profiles and SWOT analysis of key players like HH Global, Adare International, etc.

- Cost structure, price drivers, etc.

- Sourcing models, pricing models, SLAs and KPIs, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now