CATEGORY

Brand Management Services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Brand Management Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoBrand Management Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Brand Management Services category is 7.90%

Payment Terms

(in days)

The industry average payment terms in Brand Management Services category for the current quarter is 58.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

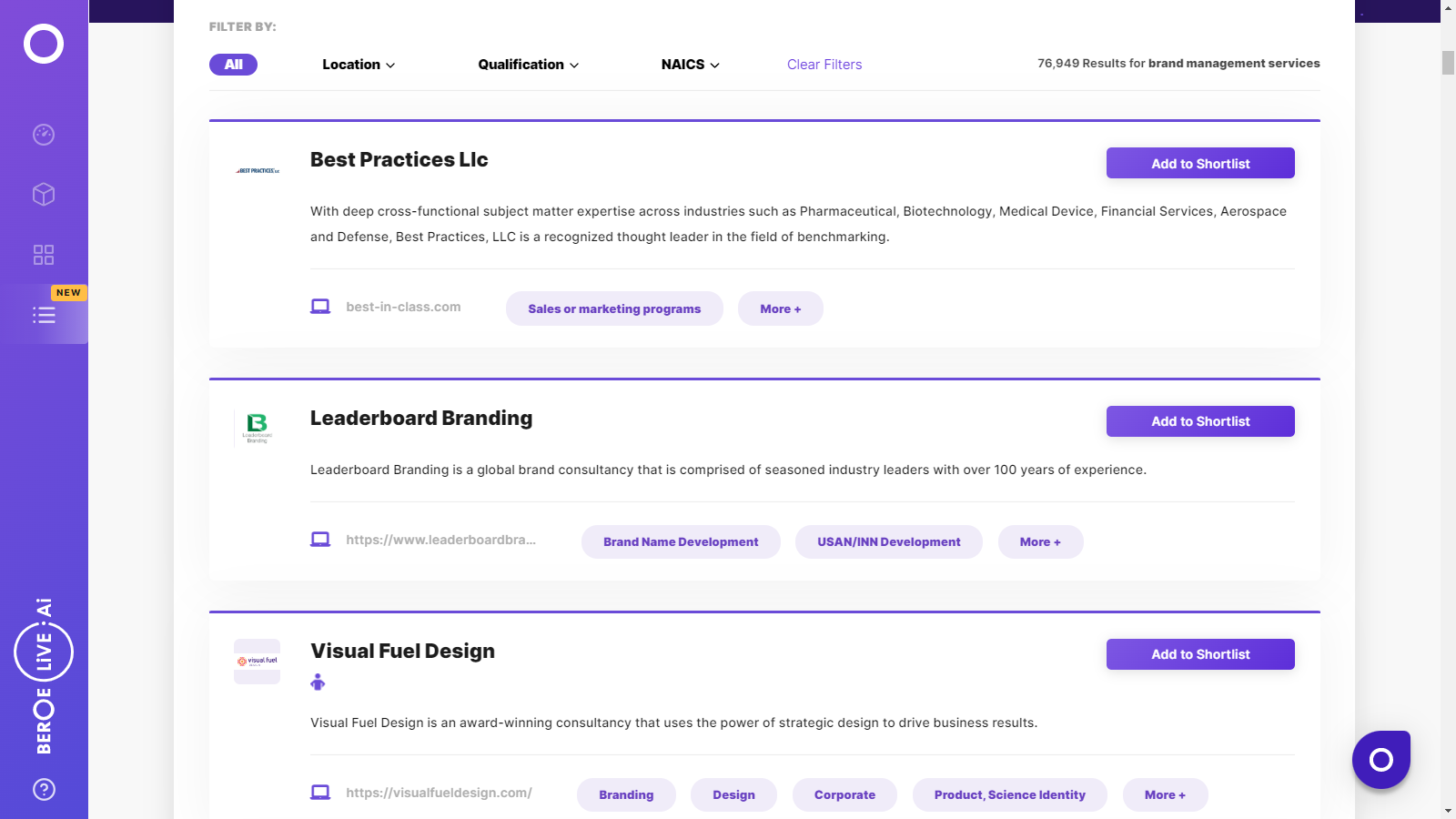

Brand Management Services Suppliers

Find the right-fit brand management services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Brand Management Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBrand Management Services market report transcript

Brand Management Services Global Market Outlook

-

The global branding market is expected to grow to $5-7 billion in 2021 at a CAGR of 5-6 percent.

-

The independent firms continuing to outperform their publicly-held peers although publicly-held firms account for around 30-40 percent of the overall global market

-

This growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges

Impact of COVID-19 on Brand Management Services Industry

-

Technology, sensitivity and local awareness are seen as essential tools to navigate a sense of ongoing crisis as business reopens in 2021. The biggest communications challenge as companies enter the recovery phase is earnings and customer disruption.

-

As businesses are faced with unexpected closures and demand uncertainties, the demand for Branding services has decreased significantly

-

Many sectors will increase budgets to recover

-

The HCP and technology sector will continue to have a high demand for Branding.

-

Coordinating between global, regional and local offices, has been a complex challenge that may lead to minor changes in corporate structure

Global Brand Management Services Market: Drivers and Constraints

Buyers are looking to work with their incumbents to create measurable Key Performance Indicators (KPIs), which consider both quantitative and qualitative variables. However, the difficulties in measuring and evaluating agencies would remain a major constraint for the industry

Industry Drivers

-

Rapid Use of Social Media: Increased adoption of social media is leading to increased spend in digital, with earned media being the dominant revenue driver

-

Growth Driven by Content: A majority of the top buyers estimate that future growth is mainly derived from creating relevant content on traditional and digital mediums with an objective of building reputation among various stakeholders

-

Rise in Technology Adoption: The industry is experiencing changes in response to new technology, expansion of new communication channels and greater use of data analytics

Constraints

-

Talent Crunch: In North America, agencies are recruiting from rival firms, due to the lack of skilled resources in the industry. Mid-level talent is cited as a major concern in North American agencies

-

Constrained Branding Budgets: Client-side budgets decreased by an average of just 3–5 percent in 2020, and budgets are expected to increase even more slowly during the next five years, by roughly 1–2 percent per year. This is mainly due to the difficulties in measuring and evaluating the results of any of the Branding campaigns

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now