CATEGORY

Audio-Visual Solutions and Devices

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Audio-Visual Solutions and Devices .

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoAudio-Visual Solutions and Devices Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Audio-Visual Solutions and Devices category is 11.00%

Payment Terms

(in days)

The industry average payment terms in Audio-Visual Solutions and Devices category for the current quarter is 72.2 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

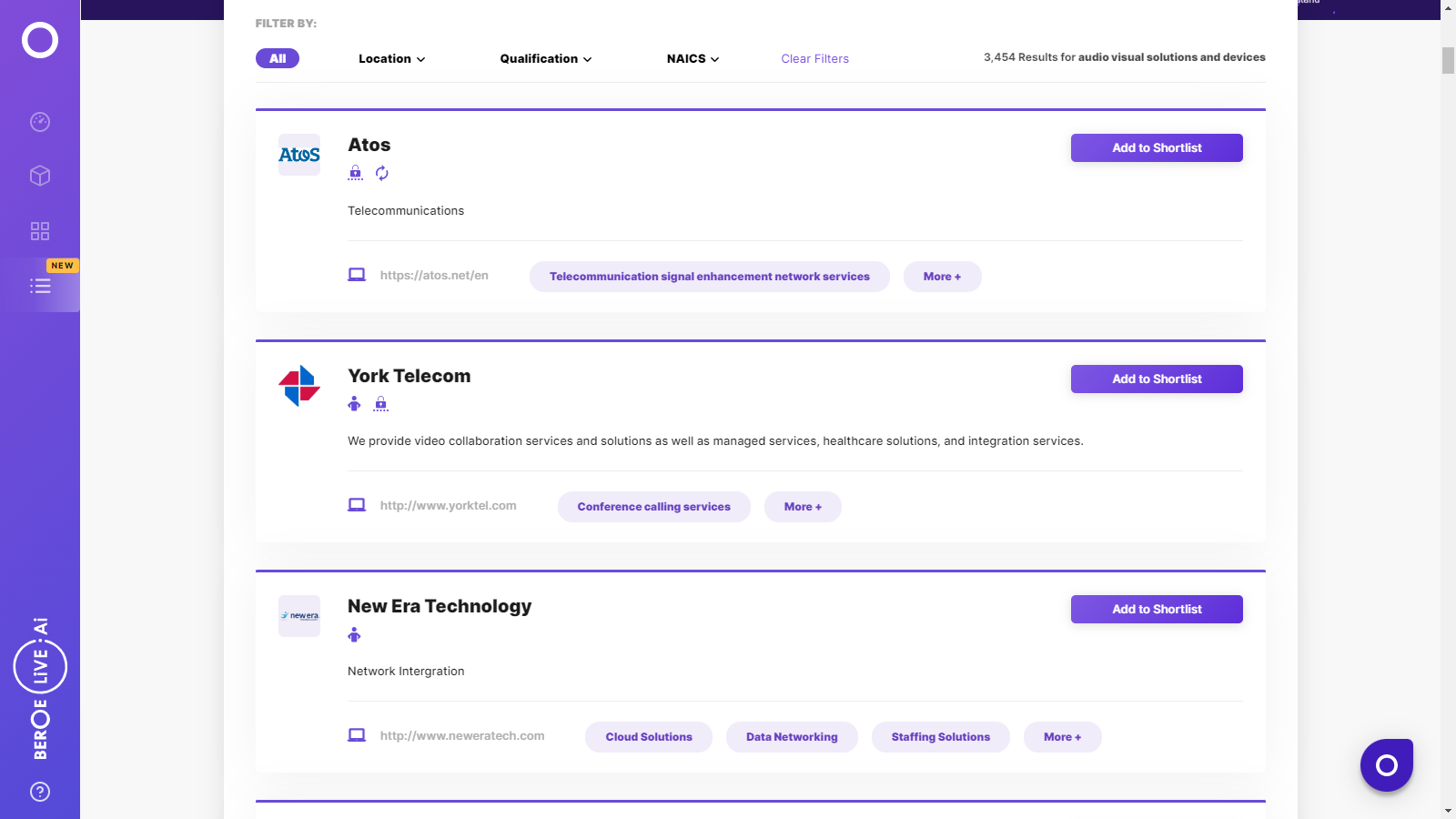

Audio-Visual Solutions and Devices Suppliers

Find the right-fit audio-visual solutions and devices supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Audio-Visual Solutions and Devices market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAudio-Visual Solutions and Devices market report transcript

Audio-Visual Solutions and Devices Global Market Outlook

-

The worldwide video conferencing industry is estimated to reach $22.5 billion by 2026, increasing at a CAGR 19.7 percent between 2021 and 2026. The video conferencing market is likely to expand in the future, as organizations embrace new technologies quickly, and the APAC is expected to expand at a faster rate than other regions, due to its developing economies. By 2026, the audio-conferencing services market will reach $38.5 billion, growing at a CAGR of 12.1 percent between 2021 and 2026

-

While North America is the greatest revenue market, the APAC is the largest unit shipping market, with much lower average selling prices, especially for USB cameras. The European region demonstrated the highest growth in 2020, followed by North America

Impact of COVID-19 on Audio-Visual Solutions and Devices Industry

-

Beginning from the initial phase of the COVID-19, the impact in the AV industry was positive, due to a rapid shift of working culture directed towards remote working location. In addition, with the multitude of waves occurring, due to the mutated version of the virus, the demand of the AV industry would continue to be sustainable in the near future.

-

Rapid digital transformation has resulted in a faster innovation engine in audio and video quality, as well as information sharing modalities, among other things

-

A rising emphasis on enhancing the user experience is leading to more extensive feature sets and more incorporation of AI. In addition, concerns about background noise, video conference fatigue, meeting room safety and usage, and meeting room utilization and security are driving innovation

Audio-Visual Solutions and Devices Market: Drivers and Constraints

Industry Drivers

-

The Revamped Workforce: COVID-19 facilitated the shift of the whole workforce to remote working, opening the path for video conferencing solutions and hardware items

-

Office Space: The shift to a hybrid office environment and the ability to work from anywhere is providing long-term growth prospects

-

Availability of Devices: The easy access of personal audio-video communication devices and all-in-one collaboration hubs by employees across industries, such as healthcare, education, retail, manufacturing, banking and financial services, has been a key driver in the space

-

Analytics: The increasing integration of analytics and Artificial Intelligence, such as facial recognition, active noise cancellation, real-time closed captioning, proximity detection provides overriding utility that often supersedes the real-time interaction, which held dominancy during the pre-pandemic world

Constraints

-

Privacy and Security: Organizations have significant reservations about the security and privacy of video material shared across various channels. Aside from that, corporations are also worried about copyright and Digital Rights Management (DRM) because of the possibility of abuse, as well as information leaks and data breaches. Therefore, prior to using video conferencing solutions, businesses must reorganize their plans for utilizing video conferencing services to overcome these limitations

-

Number of participants: In conferencing solutions, particularly for audio conferencing solutions, the limits on the number of people that could be engaged in a single meeting is often seen as a restraint for audio-only conferencing implementation

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now