CATEGORY

Contact Centers

Contact center, also referred to as a customer interaction center. And the e-contact center is a central point from which all customer contacts are managed. These calls include inbound calls, outbound calls, technical support etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Contact Centers.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Difficulties in moving promotional items production out of China

April 12, 2023Indian call center survey results predict the intensification of voice technology

February 17, 2023Avaya, a US-based contact center technology company has filed for bankruptcy

February 16, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Contact Centers

Schedule a DemoContact Centers Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoContact Centers Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Contact Centers category is 2.80%

Payment Terms

(in days)

The industry average payment terms in Contact Centers category for the current quarter is 54.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

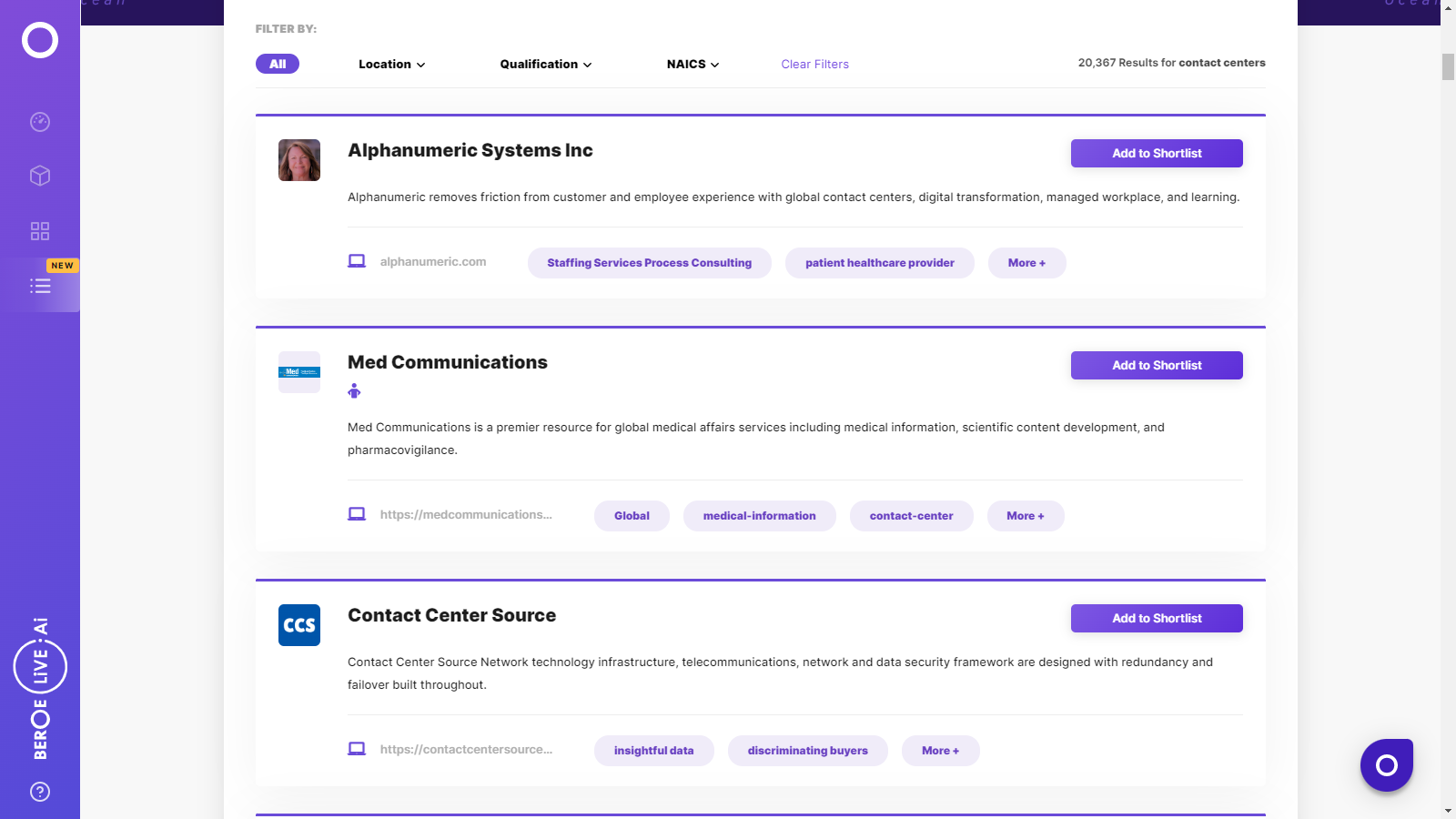

Contact Centers Suppliers

Find the right-fit contact centers supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Contact Centers Market Intelligence

global market outlook

- The global Contact Centers market is estimated to be 380 billion USD in 2022. Market size in North America is the highest at $145 Billion, followed by Europe with a market size of $125 Billion. APAC is estimated to have a market size of $45 Billion.

- Global players in the contact centers industry includes Teleperformance, Concentrix, Sitel, TTEC, Webhelp.

According to industry experts, the global demand is expected to grow at around 3-4% CAGR (2022-2026F). - The top three industries that contribute to the Contact Center market are Telecom, BFSI, CPG and Healthcare.

- Contact Center companies have begun to employ new technologies like conversational AI, which is a technology which enables users to interact like humans, and Cloud Contact Centers, which is a virtual contact center workplace enabling call center agents to work from multiple sites and the server is built on a cloud platform.

Use the Contact Centers market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoContact Centers market report transcript

Global Contact Centers Market Analysis and Global Outlook

-

The global contact centers market is estimated at $390 billion in 2023E, of which 75 -70 percent of contact center services are kept in-house and the remaining 25-30 percent are outsourced to third parties. The overall contact centers market is forecasted to grow at a CAGR of nearly 3-4 percent to reach $385–395 billion by 2023(F)

-

The industry is dominated by in-house contact centers. However, in upcoming years outsourced contact center market will continue to extract more chunk of the overall pie of a contact center.

-

Demand perspective: North America, Europe, UK, Australia and Japan are the leading buyer of customer care outsourcing services but share of these region remains stable in upcoming years. Some parts of APAC drive the outsourcing demand due to rising domestic demand

-

Supply perspective: India and the Philippines are the foremost countries in managing contact center outsourcing demand, and they will continue to maintain their top positions in the near future. However, a moderate number of contracts are expected to move toward nearshore locations, such as LATAM, and emerging destinations like the Caribbean, Central America and Eastern Europe

Global Contact Centers Market Maturity

-

Contact center outsourcing penetration is still low outside of North America, the UK, Europe, and Australia

-

Developed markets constitute about 70–75 percent of the overall outsourced contact center contracts

-

Few destinations in APAC and LATAM are witnessing increasing adoption due to rising domestic and near-shore demand

Industry Trends

-

Buyers are shifting their focus from cost saving to value-added services to create strategic relationships where-in both parties contribute to each other’s success

-

Service providers are also improving their supply capability by expanding delivery locations and adding customer analytics and omni-channel solutions in their portfolios to offer better value to buyers over long-term contracts

-

Contact center buyers are focusing on providing a better customer experience rather than considering it as only a cost-saving opportunity. Buyers expect the service providers to successfully manage changing customer needs.

Drivers and Constraints

Rising customer focus and complexity to provide a better customer experience will encourage buyers to outsource contact center services to third parties. Therefore, it has been noticed that outsourcing spending has grown between 5-6 percent annually, while in-house spending has been relatively flat.

Drivers

Increasing focus on customer services

-

Earlier, contact center buyers’ focus was mainly on cost saving, but now the focus has shifted to maximizing value to end-consumers due to rising customer demand and competition

-

This will lead to higher outsourcing spending in order to maximize customer experience, brand image and revenue

Need for specialized service capabilities

-

The rising demand for contact center analytics and support on different channels, such as social media and around-the-clock mobile services, requires specialized and dedicated capabilities to provide better customer experience

-

Buyers are expected to spend more on contact center outsourcing in order to partner with third-party service providers to meet these needs

Rising demand from small and medium businesses

- Small and medium players will find it increasingly difficult to compete with top players in their fields and will look to outsource processes to limit expenses and tighten budgets

Constraints

Lack of Transparency

- Buyers of contact center services are hesitant to outsource some of their strategic, high spend, high value services as they see lack of transparency in there. Service providers are working on this and coming up with new tracking mechanism to ascertain transparency in processes.

Rising quality concern and very limited cost saving

- Very frequently raising quality issues and reducing the cost difference between outsourcing and managing in-house influences the buyer’s decision of outsourcing

Regulation implications

- Various regulations, such as the Dodd-Frank Act, Basel III, MIFID II, OCC Guidelines and FRB restricts companies to keep personal, financial and confidential data within the country’s boundary. This restricts outsourcing various processes to other locations

Supply Market Outlook

Supply Trends and Insights

Global/Regional Service provider

Increasing shift towards on-shore and nearshore locations

-

Global suppliers are strengthening their footprint/coverage in on-shore locations particularly US in order to provide best in class services to their clients.

-

For example: Sitel Group has plans to hire 1,500 full-time associates to support new and existing client programs across multiple flagship contact center locations

-

TTEC would be hiring more than 3,000 customer experience associates across multiple centers such as: Arizona, Arkansas, Colorado, Florida, Georgia, Kentucky, Missouri, Montana, Nevada, North Carolina, Pennsylvania, Texas, Virginia and West Virginia.

Customized services

- Regional service providers are able to provide customer services with natural accents, which increases customer satisfaction.

Supply Trends

Global vs. regional service providers

- Global service providers are focusing on their expansion and building capabilities through M&As and partnership activities in the contact center market

Impact on profit margin

- Access to cheap labor and the presence of numerous alternate nearshore destinations in emerging countries like Colombia, the Dominican Republic, Peru, Romania and Bulgaria force service providers to cut down on their profit margin to stay attractive in these highly competitive markets.

Engagement Trends

-

Most adopted model (global): Global sourcing strategy

-

Why? To achieve spend visibility and cost savings

-

Contract length: Three to five years, with an option of contract extension, based on performance, linked with SLAs

-

Pricing strategy: Shifting from FTE-based pricing to transactional or outcome-based contracting, linked with SLAs

Contact Centers Australia Market Overview

- Supply Base: The supply base in Australia is fragmented with multiple regional and local players

- Market Trend: As the contact centers Australia industry is growing, global suppliers are looking for opportunities to expand their operations by acquiring regional and local players or by setting up their own offices.

- The contact center service provider market is highly fragmented and dominated by the global players, with the top 10-15 players accounting for 35–38 percent of the market share.

- Traditionally, offshore countries have been the key sources of revenue for the Australian contact center outsourcing market. Offshore buyers are very mature. However, the maturity of Australian buyers is increasing, therefore improving domestic sourcing.

- The contact center Australia market is a mature market, in terms of its implementation, while service providers in the Philippines are investing heavily in this solution.

- Usage of social media for customer services is mostly used in Australia, due to high internet penetration and a rising number of social media users.

- Adoption rate is pretty high, as most of the local Australian contact center agents are working from home.In Australia, service providers’ acceptance is higher for an outcome- based model, in terms of customer/buyer maturity, when compared to the FTE-based pricing model.Service providers’ maturity leads to higher implementation of analytical tools.

Why You Should Buy This Report

- Information on the contact centers Australia market maturity, drivers and constraints, local market outlook, industry outlook, etc.

- Porter’s five forces analysis of the contact centers Australia industry.

- Supply trends and insights, supplier list and service capabilities and SWOT analysis of key players like Teleperformance, Convergys, Sitel, etc.

- Cost breakup, cost savings and analysis, key cost and price drivers, etc.

- Sourcing models, pricing models, KPIs, end-user industry update, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now