CATEGORY

Visual Merchandizing, Fixtures, and Furnishings (VMFF) Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Visual Merchandizing, Fixtures, and Furnishings (VMFF) Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Visual Merchandizing, Fixtures, and Furnishings (VMFF) Australia Suppliers

Find the right-fit visual merchandizing, fixtures, and furnishings (vmff) australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Visual Merchandizing, Fixtures, and Furnishings (VMFF) Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoVisual Merchandizing, Fixtures, and Furnishings (VMFF) Australia market report transcript

Regional Market Outlook on Visual Merchandizing, Fixtures, and Furnishings (VMFF)

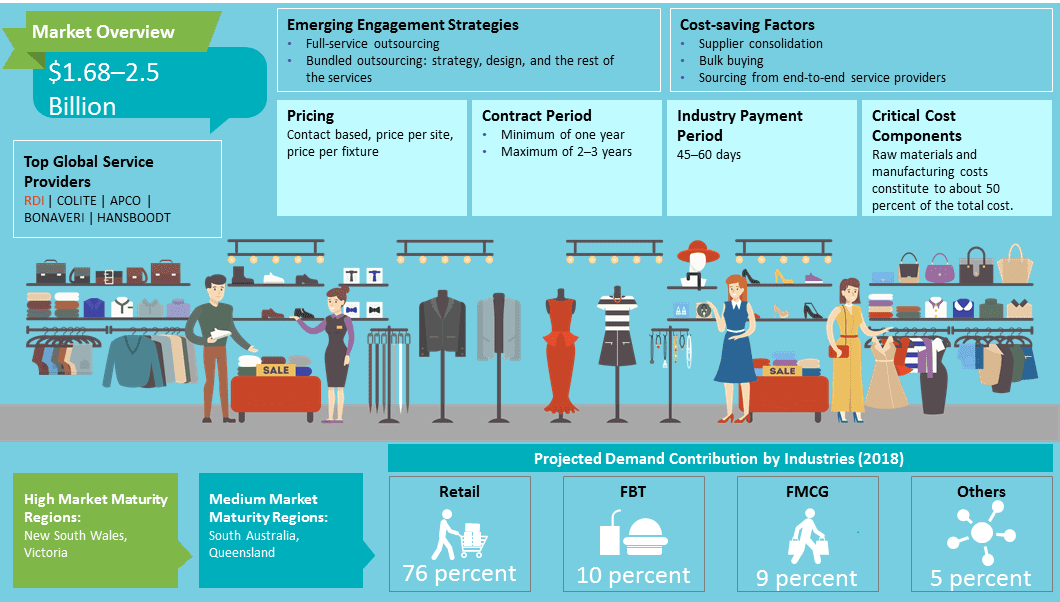

- The Australia fixture industry was estimated at $1.68 -2.5 Billion in 2018. New South Wales, Victoria have high market maturity and Queensland, South Australia have medium market maturity in for the retail market in Australia

- The rapid growth of retail industry is driving suppliers in Australia to diversify their product portfolio and venture into eco-friendly and high quality in-store fixtures

Australia VMFF: Drivers and Constraints

- Rising adoption of technological tools by Australian retailers to enhance the instore consumer experience is driving investments in VMFF

- Growing retail outlets especially in the beauty, fashion & luxury segments in Australia bodes well for the VMFF industry in Australia

Drivers

Growth of Beauty & Fashion Retail in Australia

- Rapid growth of retail in beauty & fashion sector in Australia and its focus on enhancing customer experience is driving the scope for shop fittings & fixtures

Omni Channel Retail Strategy

- Retailers are attempting to integrate al channels including in-store, mobile, social media, websites, e-commerce etc. Omni channel strategy is considered vital to keep the customer engaged from first impression till the point of sale

Growing Adoption of Technological Tools in Stores

- Retailers are focusing on personalizing the instore experience by developing technological tools supported by Internet of Things, Artificial Intelligence, Virtual & Augmented Reality

Constraints

Rise in e-commerce retail in Australia

- Increasing growth of online commerce is expected to slow down the growth of physical retail sector in the long run.

Impact of Retail Spending Nature of Consumers

- Growth in retail store fixtures industry is driven directly by retail sales. Consumer buying habits & changes in per capita disposable income impacts the retail industry growth & investments in store fixtures.

Porter's Five Forces Analysis: Australia

Supplier Power

- The supply market in Australia is fragmented with high presence of local players and limited coverage of global suppliers

- Supplier power depends on the ability to offer pan Australia coverage & sustainable manufacturing capabilities

Barriers to New Entrants

- Barriers to new entrants are low, as the demand is growing, and the supply base in these markets is not fully evolved

Intensity of Rivalry

- The intensity of rivalry is medium, since there are few full-service providers in the market, and most of them are local players

Threat of Substitutes

- The threat of substitutes is moderate, as there are suppliers, offering POSM might expand their product portfolio to cover complete retail environment solutions

Buyer Power

- With the rapidly growing retail industry in Australia, there is a steady demand for the VMFF suppliers

- Buyers will have moderate power, due to the moderate availability of supply base in Australia

VMFF Australia Market Overview

- The growing retail industry is driving the demand for VMFF in Australia. Companies could use their buying power to negotiate for better cost savings since the supplier landscape is matured and competitive

- In Australia, the VMFF market is fragmented, with multiple local players and growing presence of global players. Bringing about cost savings by consolidation will be an issue due to the fragmented nature of the supply base.

- In Australia, companies are focusing on incorporating sustainable products in their businesses

- There is also an increase in demand for modular and flexible solutions as well as refurbishing services to transform existing stores instantaneously with instore shelving

- store interiors to enhance the in-store customer experience in order to combat the competition from online retailers. This approach is driving the demand for VMFF.

- Engaging with preferred suppliers is mostly sort by leading global retailers to bring consistency in brand communication, look and feel of the stores

- VMFF is rapidly gaining prominence in Australia, due to the consistent growth in retail

- Major end-users are retail, CPG, and FBT companies

- With the continued growth of the retail industry, suppliers in Australia are improving their service offerings and expanding their product portfolio to meet buyers’ evolving needs for consolidation.

- With the growing awareness of sustainability, retailers & brands are collaborating to adopt sustainable commercial practices & designs

- In Australia, innovative design styles are being adopted to facilitate in-store marketing tactics.

- In-store technologies like beacons, digital signage, interactive technology, and smartphone applications are widely adopted in Australia

Why You Should Buy This Report

- Information on the VMFF Australia market maturity, drivers and constraints, regional outlook, major innovations, etc.

- Porter’s five forces analysis of the Australian VMFF industry.

- Supply trends and insights, profiles and SWOT analysis of the key players like Global Display, Colite, Bonaveri, etc.

- Sourcing, pricing and engagement models, KPI and SLA components, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now