CATEGORY

Signage Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Signage Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Signage Australia Suppliers

Find the right-fit signage australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Signage Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoSignage Australia market report transcript

Regional Market Outlook on Signage

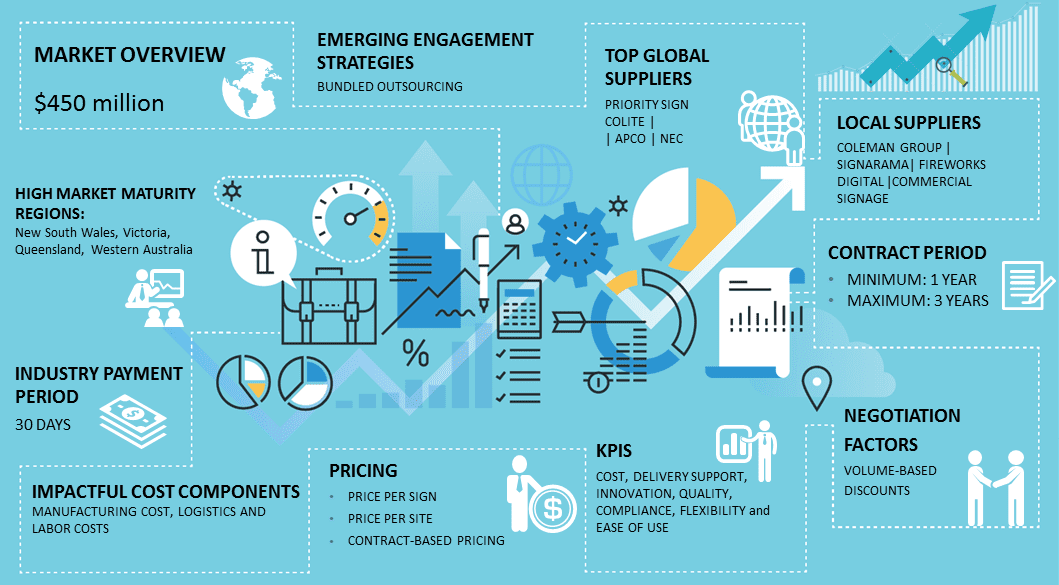

- The Australia signage industry was estimated at $410–450 million in 2018. New South Wales, Victoria has high market maturity and Queensland, South Australia has medium market maturity in Australia

- The Australian digital signage market is forecasted to reach above $130 million by 2020. Major Australian retail chains' adoption of digital signage has driven growth, along with other end-user segments, such as financial service and public transport sectors

- Industries like Retail, FMCG, and FBT are contributing significantly to the signage market revenue

Signage: Drivers and Constraints

- Growing expansion of modern retail in the developing markets of Australia is expected to drive the in-store marketing budgets and also increase the demand for both traditional (print, light box, etc.) and digital signage

- Rise in e-commerce has necessitated the need to explore options to drive walk-ins in the physical store. Digital signage is utilized by retailers to provide a better in-store experience

Drivers

Evolution of retail store formats in the emerging markets

- Development of modern retail in urban areas of Sydney, Melbourne, Adelaide, and Brisbane will increase the demand for signage. Retailers are tapping opportunities to grow in the developing markets and are investing more in these markets

Growing significance of window displays and signage

- Increasing adoption of online shopping and pre-shopping online research by customers have increased the significance of signage as one of the most powerful tools to drive walk-ins

Increase in technology adoption

- Many buyers are increasing their spend for more interactive experiences that drive the demand for digital signage, kiosks, touch screens, etc., in Australia

Constraints

Rise in e-commerce retail

- E-commerce in Australia is strongly driven by fashion industry, which can impact the physical retail growth, which also impacts the signage industry

- Consumer preference for online stores may increase further in the future. The user penetration in Australia is expected to increase from 80 percent in 2019 to approximately 90 percent by 2024. This can be challenging for the brick and mortar stores to drive significant walk-ins, which affects the profitability in spending more on physical stores

Porter's Five Forces Analysis: Australia

Supplier Power

- Signage demand is mainly driven by the retail industry. Leading signage companies have developed well established client relationships and are not dependent on any single buyer

- There is also an increasing adoption of digital signage in Australia, driving the suppliers to expand portfolio to leverage the demand

- Availability of large number of lead and niche agencies in Australia, has resulted in increased competition

Barriers to New Entrants

- There is no threat of new entrants, as large network and good relationship with installers, and high manufacturing capabilities are essential to serve the growing needs of top retailers. The costs associated like labor, materials can be a huge investment for new entrants

- In case of digital signage, large companies (with high brand image) with extensive knowledge of digital technology can easily enter the market, as the huge costs would not dissuade them

Intensity of Rivalry

- There are numerous competitive global, national, local players in the signage industry, making rivalry a huge threat

- Traditional suppliers are also expanding their portfolio to stay competitive

- Market players need to gain new customers, while retaining the existing customer base

Threat of Substitutes

- Digital signage has impacted the usage of print signage, as it is used to increase interactivity and the reach of signage

- Retailers are also testing the feasibility of completely making a transition from print to digital signage, due to long-term benefits, such as sustainability, cost efficiency, and dynamic-effective content refresh

Buyer Power

- Buyers will have higher buyer power, as suppliers compete to grab a higher share of buyers' increasing spend in Australia. There is also minimal product differentiation, placing more power in the hands of the buyer

- Growing demand for digital and print signage, and the need for innovative integration to leverage existing technology may offset some buyer power in the industry

Signage Australia Market Overview

- The Signage industry in Australia is growing and is now driven by technology integration, like digital signage, self-service checkout kiosk, etc.

- Major end-users are retail, CPG and FBT companies

- With the continued growth of the retail industry, suppliers in Australia are expanding their service portfolios to provide a one-stop solution for consolidated signage demand from buyers

- Personalization is a key trend adopted by retailers in Australia to provide better customer experience. Retail marketers have adopted beacon technology in key locations like Sydney

- Beacons and digital signage together work the best, as beacon-enabled app can give valuable customer data, including buying patterns, purchase history, demographics, customer loyalty, etc.

- Many retailers have implemented self-checkout services in busy city centers in Australia. This can replace the traditional check-outs with self-service kiosks, especially in busy areas

- Currently, a combination of traditional and self-service checkout services are available predominantly in retail stores

- Touch screen kiosks have seen increasing adoption in Australia in industries, like retail, tourist areas, hospitals, schools, railway stations, and other outdoor places

- Many suppliers provide displays with in-built media player and user-friendly deployment and usage

- According to digital signage procurement intelligence, retailers are increasingly adopting preventive maintenance to reduce the sudden breakdown of signage components, interrupting the flow of communication to end consumers. A service plan is implemented with SLA on response time. Maintenance of screens and players can include cleaning, rebooting them remotely, or even replacement of the hardware.

Why You Should Buy This Report

- Information on the Australian signage market outlook, maturity, drivers and constraints, etc.

- Porter’s five forces analysis of the Australian signage industry

- Innovations, supply trends and insights, profiles and SWOT analysis of key players like Priority sign, Colite, APCO, etc.

- Sourcing, pricing and engagement models, cost-saving opportunities, KPIs, SLAs, etc.

- Digital signage procurement intelligence, supplier landscape analysis, best practices, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now