CATEGORY

Public Relations

Involves both internal communication (communication to shareholders and employees) and external communication. PR encompasses sub-categories or service lines like media montioring, crisis communication, public affairs, etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Public Relations.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

APCO Worldwide has acquired Camarco.

March 29, 2023Weber Shandwick Collective (TWSC) acquired Diverse Interactive

March 21, 2023Revenue increase in SEC Newgate

April 10, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Public Relations

Schedule a DemoPublic Relations Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPublic Relations Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Public Relations category is 10.00%

Payment Terms

(in days)

The industry average payment terms in Public Relations category for the current quarter is 71.3 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Public Relations Suppliers

Find the right-fit public relations supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Public Relations Market Intelligence

global market outlook

- The global public relations market is expected to grow from $88.13 billion in 2020 to $97.13 billion in 2021 at a CAGR of 10.2 percent.

- Markets such as North America, Europe - UK, Germany, France and markets in APAC, such as Japan, have high market maturity.

- This growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact, war in Europe, Great Resignation and ongoing Inflation which resulted in various operational challenges

- The top global players in the PR are Edelman, Weber Shandwick, BCW, FleishmanHillard and Ketchum.

Use the Public Relations market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPublic Relations market frequently asked questions

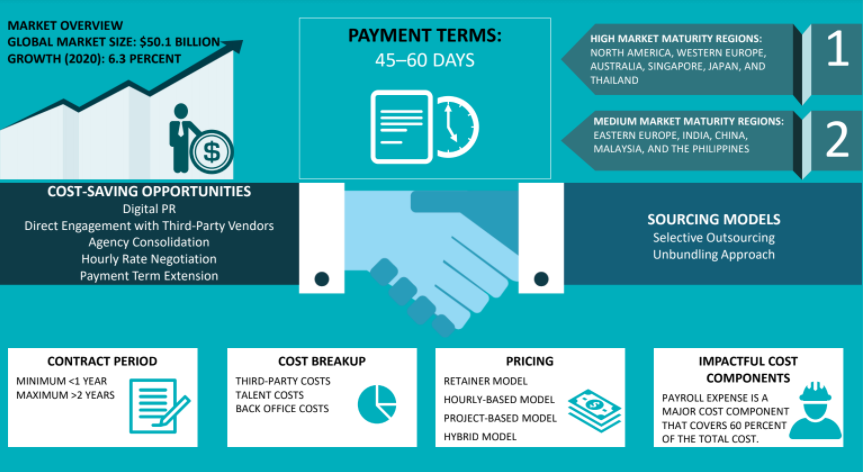

According to the global PR analysis, the market size is over $50 billion. The public relations intelligence states that there is expected to be a growth of 6.3 percent. As per Beroe's PR market research, the market size of Europe is the biggest as it has a market value of $17 billion to $18 billion. The market size of the US comes next as it is valued at $16.2 billion. The Asia-Pacific region is next with market size of $8 billion to $9 billion.

In the public relations industry, the high market maturity regions include Japan, North America, Thailand, Australia, Western Europe, and Singapore. The medium market maturity regions include the Philippines, eastern Europe, Malaysia, India, and China.

According to Beroe's public relations analysis, the top suppliers include Ketchum, Edelman, FleishmanHillard, and Weber Shandwick.

As per the Beroe industry insights, the public relations market has four opportunities to save on costs. The first is payment term extension and the second is digital PR. Other ways to cut costs include hourly rate negotiation, direct engagement with third-party vendors, and agency consolidation.

The major cost component that has a direct impact includes the payroll expense. The payroll expense accounts for 60 percent of the total cost according to the marketing services market. If the cost breakup is delved into, then they can be divided into talent costs, third-party costs, and back-office costs.

There are mainly two sourcing models used in PR marketing; unbundling approach and selective outsourcing.

The communication services, marketing, public affairs, promotions, and Corporate Communications will contribute to the growth of the PR market. The growth drivers include increased digital spending, BFSI, healthcare, increase in adoption of technology, and increase in the use of social media.

Public Relations market report transcript

Public Relations Market Analysis and Global Outlook

-

The global public relations market size will grow from $100.39 billion in 2022 to $107.05 billion in 2023 at a CAGR of 6.6%.

-

The independent firms continuing to outperform their publicly-held peers although publicly-held firms account for more than 40 percent of the overall global market.

-

This growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact and Russia-Ukraine war. Other key factors influencing market growth include cost reduction initiatives by companies and workforce planning along with introduction of digital transformation strategies to navigate the technology advancements.

Public Relations Global Market Maturity

-

The public affairs agency and specialty market (agencies specialized in a particular PR service area or business sector) in Latin America is still in the evolution phase, with the presence of very few specialized PR agencies

-

The major challenge in European and North American markets is to find and retain critical talent at a time when the need for talent to manage specialized areas, like digital PR, is increasing

Public Relations Industry Trends

-

The North American and European markets for PR are mature, with ongoing mergers and acquisitions to increase geographic reach, industry-specific expertise and service execution expertise in areas such as media relations and digital and social media

-

As expectations increase for demonstration of return on investment for all communications spending, there has been (and will continue to be) an increased focus on measurement and evaluation, where most of the buyers are investing 5–7 percent of their PR budgets in measurement. However, measurement and evaluation remains a weakness of the industry overall, and buyers are looking for improved methods for PR to be viewed credibly by other functional departments, such as marketing, sales and financial

-

Acquisitions or new strategic alliances and partnerships have been robust in the Latin America and Asia Pacific regions, The PR industry has been growing significantly, especially as consumer buying power has been rising in developing markets

-

Recent geographical expansions of PR agencies reflect a trend that indicates that buyers are looking at reducing roster size and want to have global contracts with incumbents

Public Relations Industry Drivers and Constraints

Buyers are looking to work with their incumbents to create measurable Key Performance Indicators (KPIs), which take into account both quantitative and qualitative variables. However, the difficulties in measuring and evaluating agencies would remain a major constraint for the PR industry

Drivers

Rapid Use of Social Media:

-

Increased adoption of social media is leading to increased spend in digital PR, with earned media being the dominant revenue driver

Increase In-house PR teams:

-

A few of the top Brands are building PR teams internally that address most of the requirements of the Brand via traditional and digital mediums with an objective of building reputation among various stakeholders

Rise in Technology Adoption:

-

The PR industry is experiencing changes in response to new technology, expansion of new communication channels and greater use of data analytics

Constraints

Talent Crunch: PR Firms are not Mastering Digital and Other New Technologies

-

There is a growing need for diverse talent among resources to meet the PR agencies’ demand for skilled resources in digital mediums

-

Digital agencies are increasingly preferred over PR agencies for any of the digital PR requirements, due to the PR agencies’ lack of digital expertise

-

In North America, agencies are recruiting from rival firms, due to the lack of skilled resources in the industry. Mid-level talent is cited as a major concern in North American agencies

Constrained PR Budgets

-

Client-side budgets are expected to decreased by an average of just 3–5 percent in 2023, and budgets are expected to decrease even more significantly during the next five years, by roughly 1–2 percent per year. This is mainly due to the ongoing inflations as well as difficulties in measuring and evaluating the results of any of the PR campaigns

Sourcing Models: Comparative Analysis

-

The sourcing model would differ based on the type of PR service and the objectives of the PR campaign. For certain specialized services, such as digital PR and public affairs, buyers look at following the unbundling approach

-

Adopting a selective sourcing and unbundling approach provides the buyers with maximum cost-saving opportunities with no execution risk and higher quality

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now