CATEGORY

Public Relations Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Public Relations Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Public Relations Australia Suppliers

Find the right-fit public relations australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Public Relations Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPublic Relations Australia market report transcript

Regional Market Outlook on Public Relations

- The industry's geographic spread largely reflects the relative size of the states and territories, in terms of population and economic activity

- Population and business numbers also influence the industry's geographic distribution

- Large PR agencies tend to be located close to major advertising agencies in the cities

- This is because many advertising agencies own PR firms, as well as the close association required for integrated marketing and promotional campaigns

- The industry is mainly concentrated in New South Wales, with an estimated 34.2 percent of enterprises and 33.9 percent of industry revenue in 2020–2021, while Victoria accounts for an additional 25.9 percent of enterprises and 26.1 percent of industry revenue

Industry Outlook: Opportunities and Challenges in the Canadian Advertising Industry

Opportunities

- Industry profit has steadily increased over the past five years, due to strong demand

- Activities, such as viral video production, have blurred the line between PR and advertising

- Larger suppliers are forecast to gain greater economies of scale through mergers and acquisitions

Challenges

- One of the biggest issues the PR and communications industry has been grappling with for the last few years is talent, from recruiting juniors to retaining highly skilled and well trained employees

Drivers and Constraints

Demand from advertising agencies

- In Australia, a considerable amount of PR spend comes from advertising agencies. This is because many advertising agencies own PR firms, as well as the close association required for integrated marketing and promotional campaigns

Demand from internet publishing and broadcasting

- The industry is expected to grow significantly over the next five years, with increased internet connectivity and speeds and growth in online news content and PR

Total business profit

- Corporate profits in Australia rose by 0.8 percent to an all-time high of A$ 90.06 billion in Q42020

Constraints

Talent crunch

- One of the biggest issues the PR and communications industry has been grappling with for the last few years is talent, from recruiting juniors to retaining highly skilled and well trained employees.

- Agencies are recruiting from competitors, due to lack of skilled resources in the industry. Mid-level talent is cited as a major concern in North American agencies

Constrained PR budgets

- Client-side budgets increased by an average of just 3–5 percent in 2017, and budgets are expected to increase even more slowly during the next five years, by roughly 2–3 percent per year. This is mainly due to the difficulties in measuring and evaluating the results of any of the PR campaigns

Porter's Five Forces Analysis: Australia

Agencies are trying to improve their service capabilities (especially digital services such as social media and digital content creation) to offer a holistic service portfolio to buyers. This would further create competition among PR agencies, which would increase the buyer power

Supplier Power

- Fragmented Supply Base:The PR firms industry is highly fragmented, with the majority of companies operating on a local or regional basis, to cater to local businesses that require PR services.

- Low Market Share Concentration: The top four companies are expected to make up just under 30 percent of total revenue.

Barriers to New Entrants

The PR Firms in Australia have low level of barriers to entry. Among the 1,000+ PR agencies 82.9 percent of employ one to nine workers.

- Competition - High

- Concentration - Low

- Life Cycle Stage - Mature

- Capital Intensity - Low

- Technology Change - Medium

- Regulation & Policy - Low

- Industry Assistance - Low

Intensity of Rivalry

- Number of Agencies: The industry has a high level of internal competition, due to the large number of PR agencies– 1000+

- Cross Domain Relations: There is high competition among the agencies. PR firms have links with advertising agencies in developing integrated promotional solutions for their clients.

- Basis of Competition: PR Agencies in Australia primarily compete on the basis of client service, overall quality of the work, ability to meet deadlines, stability of staff, attention to detail, quality of writing and creativity.

Threat of Substitutes

Cross Domain competition: Companies in the industry compete against marketing agencies, management consultants and advertising agencies, which have increasingly diversified their service offerings. Advertising agencies have primarily acquired PR firms in growth areas of social and mobile media to offer clients integrated solution for communication needs.

Buyer Power

- New Regulations: Rolling out of new banking and finance regulation has been continuing since 2012, banking and finance firms have sought PR firms to lobby government and maintain regulatory affairs.

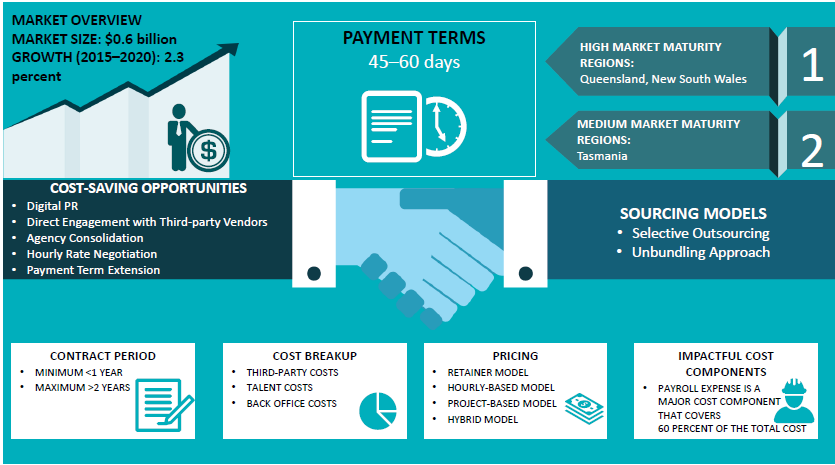

Public Relations Australia Market Overview

- A high number of specialized agencies have a presence in the public relations Australia market, and most of the agencies provide end-to-end PR services, which include digital PR. Hence, the maturity of service providers is high in these markets.

- Buyer maturity is very high in Australia. Hence, major US-based agencies are trying to open their offices in the region.

- Increasing demand from advertising agencies, internet publishing, and broadcasting & business process outsourcing in Australia are the key drivers.

- The major trends in the PR industry are rising digital spend (28–32 percent), decoupling, and increasing customization of campaigns

- Suppliers are improving their supply capability by adopting performance-based metrics for evaluation and monitoring their performance.

- Increase in M&A: The majority of M&As in the public relations Australia industry are driven by independent PR firms in order to expand their geography and service capabilities. For example, WPP merges five of its consultancy and design shops to form Superunion. It also absorbs Webling into new digital agency, Mirum, and siphons production out of major agencies and into Kantar, which increases presence in the market.

- Technological Trends: Agencies are increasingly adopting new tools and technologies, such as Toggl and Harvest. This assists the buyers in managing their PR accounts and receiving higher visibility in the hours spent by an individual on their campaigns.

- Buyers prefer engaging with global agencies that have acquired strong local agencies. In most cases, buyers do not engage with global agencies that have expanded geographically without any acquisitions or partnerships.

Why You Should Buy This Report

- Information on the public relations Australia market outlook, industry trends, drivers and constraints, etc.

- Porter’s five forces analysis of the public relations market in Australia.

- Supply trends and insights, list and profiles of key suppliers.

- Best sourcing and pricing models, cost-saving opportunities, SLAs and KPIs, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now