CATEGORY

Primary Market Research

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Primary Market Research.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

QUMIND releases Customer Sentiment Analysis Tool

April 13, 2023NIELSEN launches comparable reporting of local television?s OTT streaming apps.

April 10, 2023STRAT7 ACQUIRES RAINMAKERS CSI

April 08, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Primary Market Research

Schedule a DemoPrimary Market Research Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPrimary Market Research Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Primary Market Research category is 7.00%

Payment Terms

(in days)

The industry average payment terms in Primary Market Research category for the current quarter is 52.1 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Primary Market Research Suppliers

Find the right-fit primary market research supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Primary Market Research Market Intelligence

global market outlook

- The global primary market research industry was valued at $67.1 billion during 2021.

- The estimated market research industry to be valued at $69.5 billion for 2022.

- North America, Western Europe, and several markets in Asia Pacific (APAC), such as China, Japan, and Australia, have high market maturity

- The top global players in the primary market research categories are Neilsen, Ipsos, Kantar, GfK and IRI

Use the Primary Market Research market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPrimary Market Research market frequently asked questions

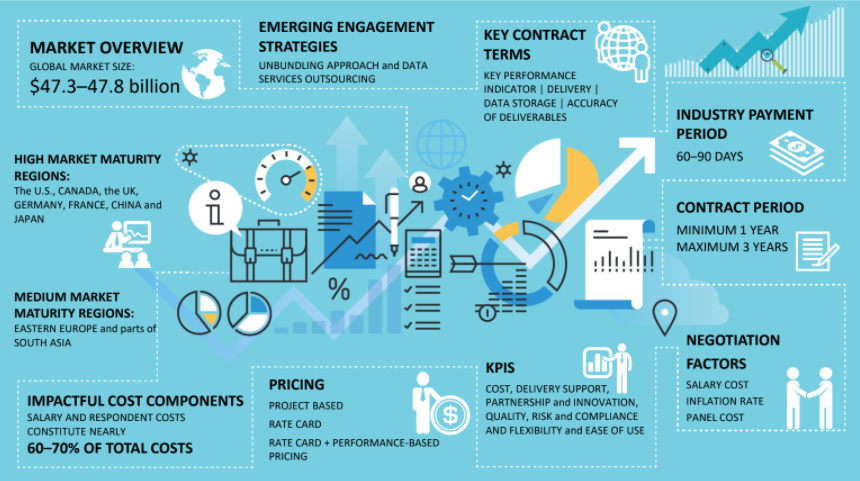

As per the primary market research report generated by Beroe, the highest market size is being captured by North America with the size ranging between $19.2 - $20.2 Bn. Europe falls in second place with size ranging between $18 - $19 Bn. The Asia Pacific with $6.3 - $7.3 and Latin America with $1.3 - $2.3 values have the least market size.

The report generated by Beroe Inc. not only helps you learn what is primary market research but gives you a detailed overview of the market. Apart from covering the definition of primary market research, it shares valuable insights around the market w.r.t its engagement strategies, maturity regions, and much more.

According to the market research industry trends, the average industry payment period falls within the range of 60-90 days, while the contract period is usually between 1 ' 3 years.

The growth of APAC and the Middle East region is higher compared to that of Latin America because of two parameters namely ' the exchange rates and inflation that affected the average performance of the region.

Following the insights shared by Beroe market research, the top global service providers include: Nielsen Kantaripsos GfK IRI

Beroe's report on primary market research includes extensive data that highlights the average spend of buyers. As per the report, buyers in Africa, parts of South America, and Asian markets spend only 2-4 percent of their marketing spend on market research activities. On the contrary, in developed markets, the buyers easily spend 10-20 percent of their marketing services budgets.

The major KPIs are: Cost Delivery support Partnership and innovation Risk and compliance Flexibility and ease of use

As per Beroe's report, salary and respondent costs constitute nearly 60 ' 70 percent of the total costs.

Primary Market Research market report transcript

Global Primary Market Research Industry

-

The global primary market research industry was valued at $69.5 billion during 2022

-

The estimated market research industry to be valued at $69.5 billion for 2022

-

North America, Western Europe, and several markets in Asia Pacific (APAC), such as China, Japan, and Australia, have high market maturity

-

The growth has been negative in the established research segment, positive in the tech-enabled research segment and neutral in the report arm of market research industry invariably across regions

Global Market Research Market Maturity

-

The penetration of market research is very low in Africa, parts of South America and Asian markets where buyers spend an average of 2–5 percent of their marketing spend on market research activities, while in developed markets the share of spend is between 25-30 percent of the marketing budgets

-

Major end-users are CPG, government, pharmaceuticals, media and advertising companies

Global Primary Market Research Industry Trends

-

Suppliers are increasing their geographic footprint as mature buyers move towards the consolidation of sourcing MR services and also widening their service portfolio to offer a wide range of client services and garner a bigger share of clients’ market research spend.

Global Drivers and Constraints : Primary Market Research

The market research industry is strongly driven by the tech-enabled segment of research. While the traditional research activities is facing a slow growth, the focus of Fortune 500 companies has moved to data mining, social listening and online communities. This change is positively impacting primary market research industry.

Drivers

Growth in Tech-Enabled Research:

-

The main growth of the market research industry was driven by the technology enabled segment of the insights sector.

Segmented Market Research:

-

The constraints posed by COVID-19 forced data collection to move online. Remote research and data companies saw a significant surge demand as it became the only way to capture data.

Understanding Consumer Behavior in Post-COVID Era:

-

Data and research is playing a crucial role in anticipating, identifying and understanding the shifts in pandemic related consumer behavior. Companies have started investing in data and data scientists to delve deeper into the insights and meaning hidden in the large array of datasets.

Constraints

Decline due to Face-to-face Research:

-

The traditional research activities suffered a decline of 4.4 percent between in 2022 due to the decrease in face-to-face research activities and the shift od budgets to other automated and technological solutions.

Data Reliability:

-

Most buyers are finding concerns about innovative approach, creating new use cases for insights and deep understanding of business needs from traditional research players. Buyers look forward to innovative ideation, full coverage of consumer touchpoints in media & consumer interaction tracking to stay relevant in era of digital/social.

Cost Structure of Primary Market Research

-

Unbundling panel requirement is the key approach that majority of buyers across industries (food and beverages, consumer packaged goods, etc.) adopt, in order to have better control over the cost and also suppliers. This is usually done after a preferred supplier is selected for undertaking major services. Ensuring visibility into each of the market research cost component is essential to achieve significant cost savings apart from negotiations with market research suppliers.

Industry Outlook Opportunities

-

With the advent of DIY technologies, online research, AI and research automation in market research services, in-house research has gained momentum among companies, especially in the US

-

Opportunity for the regionalization of sourcing exists in several markets across LATAM where top global MR companies have a significant presence.

-

Markets with a high level of maturity enable the consolidation of sourcing activities while markets with lesser maturity can be clubbed together and examined at the regional level to effectively mange the supply base.

-

The supply market is witnessing a lot of restructuring in the form of M&As and organic growth, with global suppliers set to open new research offices in this region.

-

Buyers are expected to increase their spend in market research activities, offering opportunities for market growth in the region.

Challenges

-

Lack of innovative solution in story-board format, lack of consultative approach, and demand for insights aligned to business problems are the key challenges that matured buyers are experiencing with established suppliers

-

Some countries have low supply market maturity in MR services, thereby limiting the possibilities of following a regional approach in sourcing the category. Also, higher than average inflation rates in several markets make it challenging to keep costs under control.

-

Fragmented levels of maturity in the European region make it challenging for the buyer to approach sourcing MR services using a homogenous approach.

-

The fragmented nature of the markets and presence of regional agencies that are strong in fewer markets across the region make supply base consolidation difficult to achieve.

-

The lack of presence of global suppliers will lead to service quality inconsistency.

-

The low level of technology penetration in Africa will result in decreased service quality.

Why You Should Buy This Report

This Beroe market intelligence report starts with the primary market research definition and moves ahead with the global and regional industry outlook and supply-demand trends in the market research industry. It lists out the drivers and constraints and provides Porter’s five forces analysis of emerging and developed markets. This category intelligence report lists the key suppliers and offers SWOT analysis of major players such as Nielsen, GfK, Ipsos, and IRI. It details and compares the best sourcing and pricing models and provides the key performance indicators (KPIs) and end-use industry updates.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now