CATEGORY

Primary Market Research Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Primary Market Research Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Primary Market Research Australia Suppliers

Find the right-fit primary market research australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Primary Market Research Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPrimary Market Research Australia market report transcript

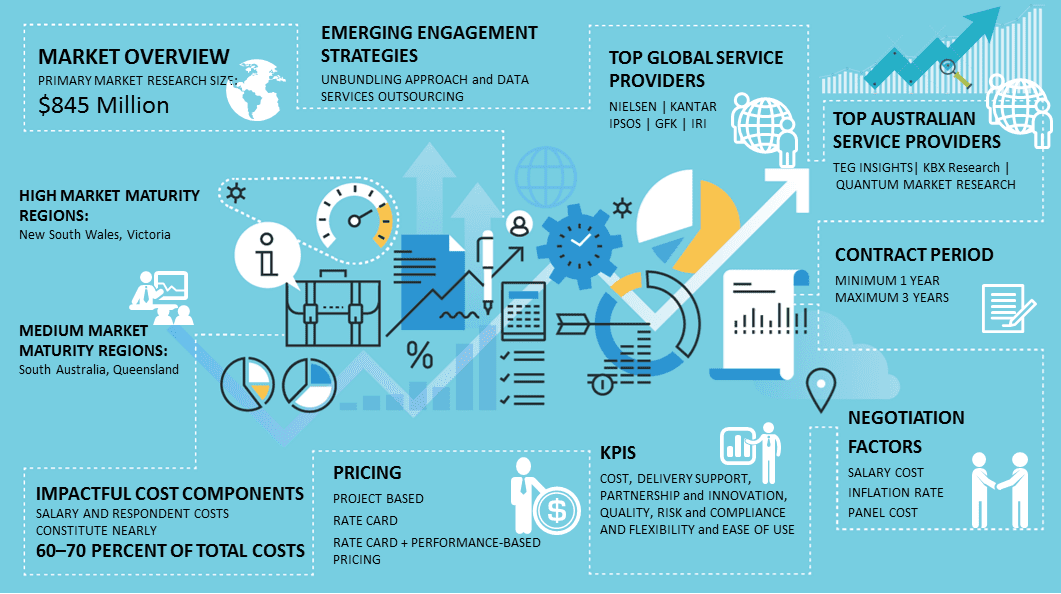

Regional Market Outlook on Primary Market Research

- The Australian primary market research industry was estimated at $845 million in 2018

- New South Wales, Victoria have high market maturity; Queensland, South Australia have medium market maturity in Australia

- New South Wales has the largest economy in Australia and contributes 30.8 percent of the national GDP followed by Victoria and Queensland

- The market research industry in Australia has been experiencing steady growth since 2017. This growth is mainly driven by consistent demand for online and mobile research from buyers and suppliers to avail actionable insights at a shorter turn around time

Drivers and Constraints - Australia

The every-expanding market research industry is shifting towards advancement in technological and analytical tools and software in Australia, also growth in the non-traditional market research studies due to the increasing adoption of technology by consumers and service providers will be a major growth driver in mature markets.

Drivers

Automation and Artificial Intelligence:

- In Australia, automation has improved significantly, showing its impact in terms of insights, data collection, forecasting and reporting

- Buyers are investing in artificial intelligence to develop in-house analytics expertise like predictive, prescriptive as an alternative to primary market research study to optimize research cost and quality of insights

Real Time Research Solution:

- In order to achieve quicker inputs or consumer feedback, the need for real-time conversational techniques (face-to-face and computer-assisted telephone interviewing) is significant among buyers

- This is likely to minimize the overall research time and enable buyers to achieve the overall result in a better turnaround time

Mobile and Online Research as Mainstream:

- Wide spread adoption of mobile and internet penetration allows suppliers and buyers to adopt mobile and online research to enhance data collection for market research studies

Constraints

Data Reliability:

- Majority of the buyers face this challenge mainly due to the lack of proper research design, unrepresentative sample selection, biased interviews, etc. This situation not only affects the buyers' spend but also forces them to check for alternate solutions or engaging with consulting companies

Porter's Five Forces Analysis

Supplier Power

- The supply market in Australia is fragmented with mature of local and global suppliers

- Supplier power depends on the ability to offer pan-Australia coverage access to technology and consultative approach

Barriers to New Entrants

- The threat of new entrants is comparatively lower since top buyers still prefer to engage with established suppliers rather than newer suppliers, especially for brand insights and benchmarking

Intensity of Rivalry

- Most buyers have consolidated their market research requirements with top suppliers like, GFK, Ipsos and Kantar. Thus, the competition in the market research space is primarily driven by smaller accounts that do not have long-term contracts with the top suppliers and are open to working with suppliers

Threat of Substitutes

- The threat is medium for primary market research due to buyers need demand for consultative approach and analytics based insights which is challenging to obtained for primary market research suppliers

Buyer Power

- Buyers power is medium due to the availability of suppliers and demand for actionable insights and market data to take inform decisions

- The demand for market research services is expected to grow strongly in Australia, with the growth of the middle class and the rapid evolution and modernization of the retail trade in the emerging markets. Clients will have higher buying power as the suppliers compete to grab a higher share of clients' spend

Market Research Australia Market Overview

- In Australia market research industry the major buyers are increasing their footprint in an attempt to tap the large consumer base

- According to the Australia market analysis, the major end-users are consumer packaged goods, government, pharmaceuticals, media, and advertising companies.

- Suppliers are investing in analytics and mature buyers are moving towards consolidation of sourcing MR services and also widening their service portfolio to offer a wide range of services and garner a bigger share of the clients’ market research spend.

- Maturity of buyers is high in the region with the presence of preferred roster of suppliers and dedicated panels for research studies

- Suppliers have access to proprietary panels, DIY solutions and also offers analytical services.

- Growth of the middle class and the rapid evolution and modernization of the retail trade in the emerging markets will increase market research Australia activities.

- Australia market research agencies rapidly develop capabilities in big data and analytics. Australia has grown into a matured market hub for establishing technological capabilities to support AI technological requirements.

- Companies are investing in technology platforms to integrate and manage panels across markets.

- Market research Australia agencies continue to expand the services portfolio to gain a fair share of buyer's spend, through outsourcing of niche services.

- To gather more focused insights, researchers use both quantitative and qualitative methods when conducting studies, than doing pure qualitative or quantitative studies.

- Agencies have stated recruiting participants through social media, online communities.

Why You Should Buy This Report

- Information on the Australia market research market, Australia market analysis, market maturity, industry trends, drivers and constraints, regional market outlook, etc.

- Porter’s five forces analysis of the market research Australia industry.

- Key research methodologies, supply trends and insights, profiles and SWOT analysis of key players like Nielsen, GfK, IRI, etc.

- Sourcing models, SLAs, KPIs, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now